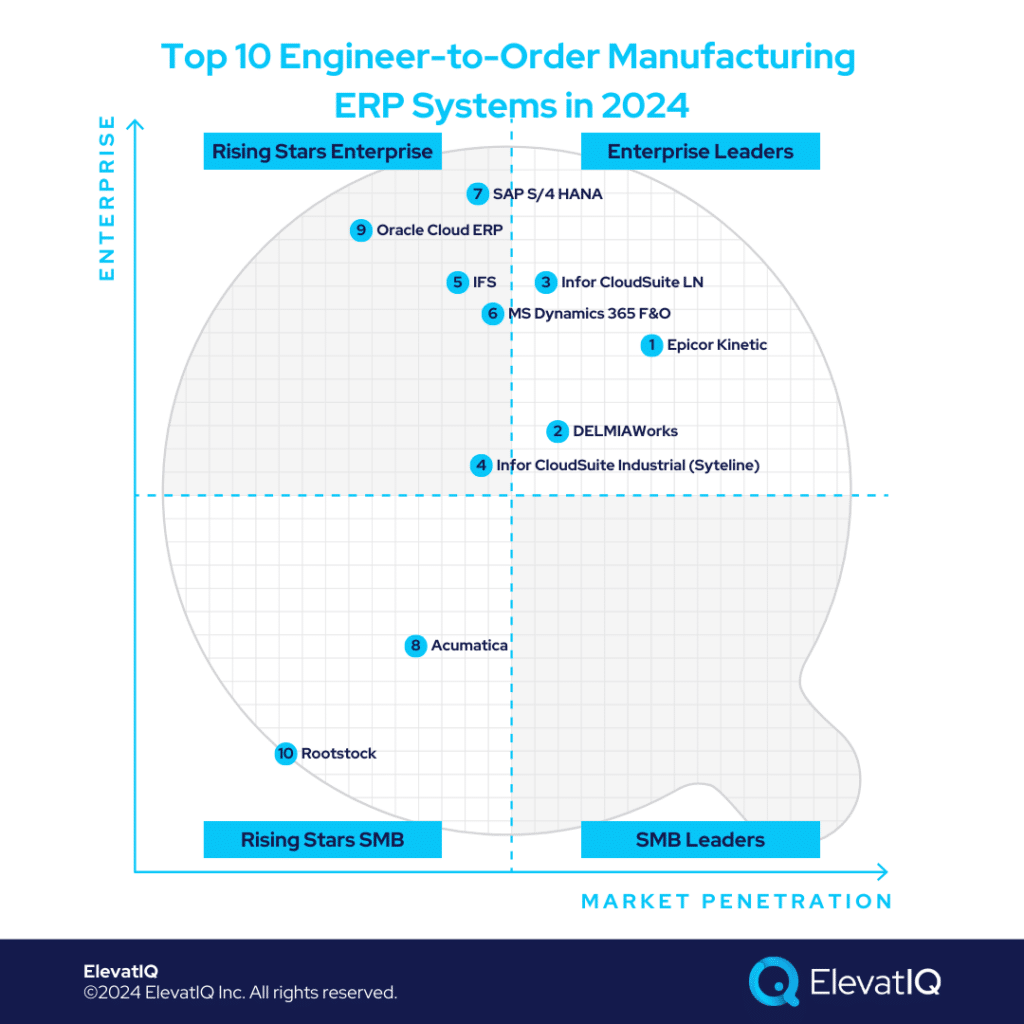

Top 10 Apparel Manufacturing ERP Systems In 2024

Apparel manufacturing companies. They specialize in producing clothing and related accessories. They encompass a range of processes, from design and fabric sourcing to production and distribution. These companies are integral to the fashion industry, catering to consumer demands for a wide variety of garments, including casual wear, formal attire, sportswear, and accessories like footwear and bags. The business model of the apparel industry could vary from design companies to brands that manufacture and distribute through several retail stores and consulting companies that might also be manufacturing their own designs. They generally consider themselves part of the apparel industry, requiring apparel manufacturing ERP capabilities.

Apparel manufacturing processes. It involves transforming raw materials into finished garments ready for sale involves several stages, including design, pattern making, fabric sourcing, cutting, sewing, assembly, quality control, and packaging. Each step requires precision and coordination to meet quality standards and market expectations. Product development involves collaboration among functions such as design, merchandising, planning, procurement, and logistics. This process requires designing and planning based on factors like size, style, and season, necessitating unique inventory supply chain capabilities and specialized ERP systems.

Apparel manufacturing ERP needs. Apparel manufacturing companies require ERP systems tailored to their specific industry needs. These ERP systems must handle complex manufacturing processes such as supply chain management, production planning, inventory management, and demand forecasting, working in conjunction with a supply chain suite. Integration with CAD software for pattern making and design is crucial for efficient production. ERP solutions for apparel manufacturing also need robust capabilities for managing diverse product lines, handling multiple sizes and color variations, and tracking raw material sourcing and utilization. Additionally, comprehensive financial management modules are essential for cost control, pricing strategies, and financial reporting.

Criteria

- Definition of an apparel manufacturing company. An apparel manufacturing company produces clothing and related accessories on a large scale, typically involving design, production, and distribution of fashion products. They operate within a complex supply chain to meet consumer demands for clothing items.

- Overall market share/# of customers. The higher market share among apparel manufacturing companies drives higher rankings on this list.

- Ownership/funding. The superior financial position of the ERP vendor leads to higher rankings on this list.

- Quality of development. How modern is the tech stack? How aggressively is the ERP vendor pushing cloud-native functionality for this product? Is the roadmap officially announced? Or uncertain?

- Community/Ecosystem. How vibrant is the community? Social media groups? In-person user groups? Forums?

- Depth of native functionality. Last-mile functionality for specific industries natively built into the product?

- Quality of publicly available product documentation. How well-documented is the product? Is the documentation available publicly? How updated is the demo content available on YouTube?

- Product share and documented commitment. Is the product share reported separately in financial statements if the ERP vendor is public?

- Ability to natively support diversified business models. How diverse is the product in supporting multiple business models in the same product?

- Acquisition strategy aligned with the product: Any recent acquisitions to fill a specific hole for apparel manufacturing industries? Any official announcements to integrate recently acquired capabilities?

- User Reviews: How specific are the reviews about this product’s capabilities? How recent and frequent are the reviews?

- Must be an ERP product: Edge products such as HCM, CRM, eCommerce, MES, or accounting solutions that are not fully integrated to support enterprise-wide capabilities are not qualified for this list.

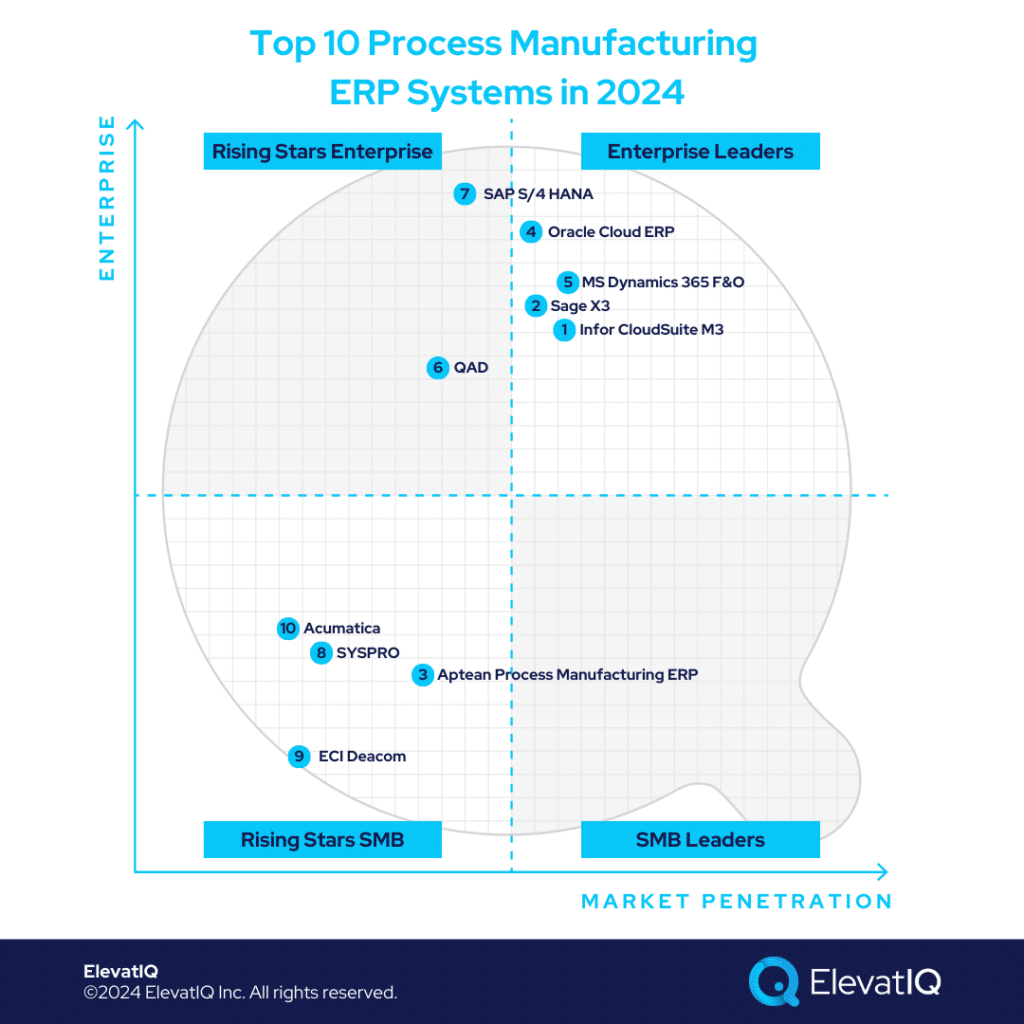

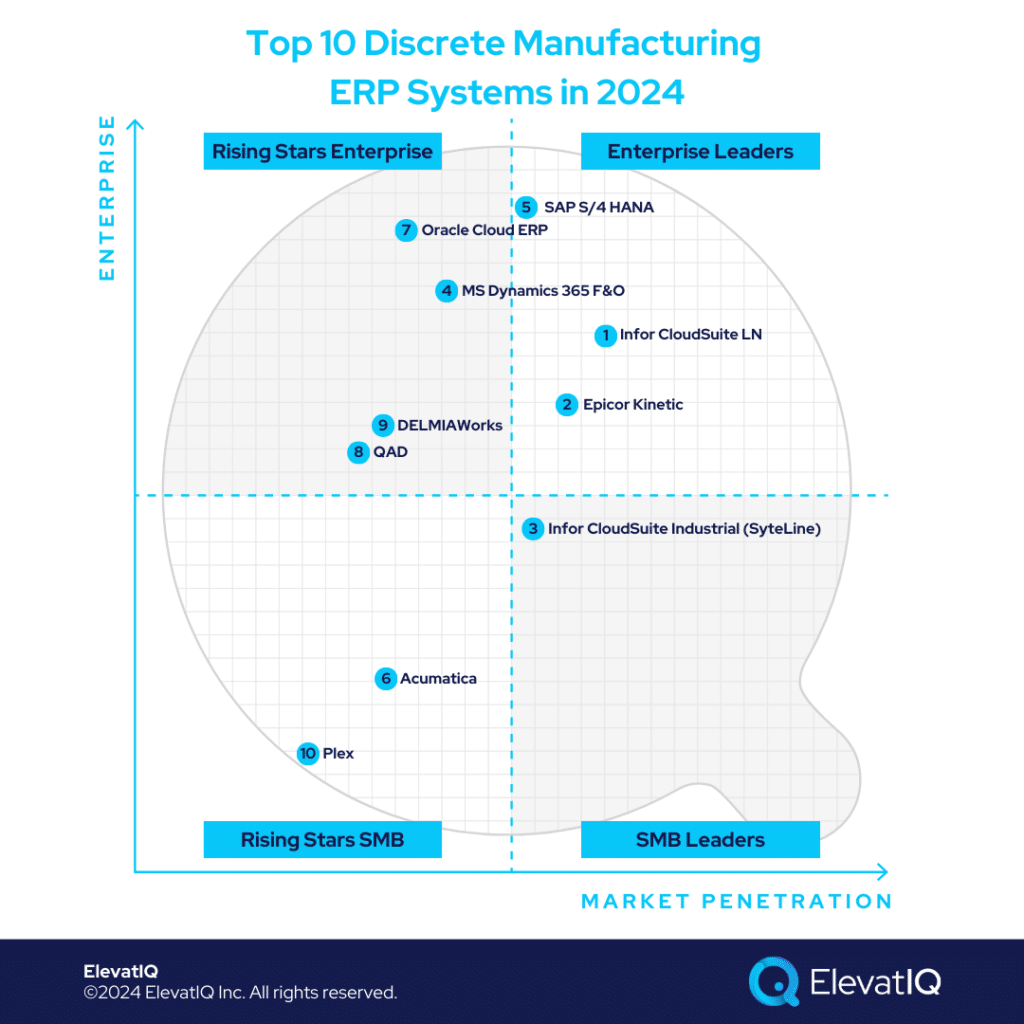

10. FDM4

FDM4 caters to apparel-centric processes and suits companies outgrowing QuickBooks. The benefit of FDM4 is that their team will be more committed to helping you with your processes. In general, you won’t require an additional consulting firm. For companies working with private equity firms or larger companies selling an ERP, they might not provide as much support as you would receive with FDM4. Hence, it acquires the #10 spot on our list of top apparel manufacturing ERP systems.

Strengths

- Matrix order entry with conversion for color, size, case. When entering specific colors or sizes in cases, these relationships might be harder to support with the core ERP data model. Additionally, you require integration with color palettes, PLM, or design tools like Adobe Photoshop or Illustrator. FDM4 often addresses these tricky integrations and challenges.

- Easier implementation. The core ERP layers are not as detailed, making the implementation easier for smaller companies.

- Cheaper. The implementation is also cheaper from the cost perspective. So, if cost is one of your biggest factors, this could be a great product.

Weaknesses

- Clucky technology. The technology is not as modern because they lack the R&D funds to innovate and catch up with larger vendors. As a result, the technology is inferior, less cloud-native, and may have limited mobile capabilities.

- Primarily a distribution software. FDM4 is primarily a distribution software, although it does have some manufacturing capabilities.The distribution category in apparel manufacturing widely adopts it. However, the supply chain collaboration required for manufacturing is different. Therefore, just because the distribution sector adopts it widely, does not mean it will fit manufacturing needs, so you may want to evaluate that.

- Scalability. If you have a very simplified business model, it might be okay. However, if your business model is complex or if you are active in M&A and acquiring various capabilities as part of your business model, you will run into issues with FDM4.

9. Microsoft Dynamics 365 Business Central

MS Dynamics 365 BC is ideal for companies in locations where prescriptive products might not be available and you need a localized and supported solution in those geographies. This can be a particular challenge in some Eastern European countries, South America, or Asian countries. In these regions, you might not find support for some prescriptive products, or you might find many small, local products available. For the most part, if you are looking for a slightly more global product supported in various geographies and offering both operational and financial consolidation within the same product, MS Dynamics 365 BC is a suitable choice. However, you will need to use a quick add-on to support your apparel assets. The success of using this product will depend on the quality, adoption, coding, and documentation of that add-on. Therefore, it secures the #9 spot on our list of top apparel manufacturing ERP systems.

Strengths

- Core ERP layers. The core ERP layers are very strong, especially for smaller companies outgrowing QuickBooks or the smaller ERP systems.

- Ecosystem. One of the most active ecosystems, offering numerous solutions to support various industries, even if those capabilities aren’t part of the core ERP layers or products.

- Well adopted among apparel brands.The add-ons in the MS Dynamics 365 ecosystem enrich its capabilities, helping apparel brands adopt it widely. This is despite the fact the core product not being as tailored layers as a prescriptive product like FDM4.

Weaknesses

- Suite capabilities through third-party vendors. If these come from a third party, you might encounter challenges, especially if the core product doesn’t expose all the necessary ERP layers. Even if the solution is a great fit, a lack of support from Microsoft can cause issues. This scenario increases vendor risk and implementation risk, as you are dealing with many different moving parts in your solution.

- Expensive implementation. The implementation may be slightly more expensive because you’re dealing with many different vendors and add-ons.

- Requires a mature internal IT team.To tailor, customize, and configure these capabilities—already included in the suite, MS Dynamics 365 BC requires a very mature internal IT team.

8. Odoo

Odoo suits companies looking for an easier-to-implement product, especially those outgrowing QuickBooks. It offers many different apps, each with its own database, so you won’t experience the same consolidation found with other ERP systems. Despite allowing communication among modules, its products are not as tightly integrated from a data model or database perspective. As a result, you won’t achieve the same traceability as with other ERP products. Additionally, this increases the implementation budget and complexity, as you need to convert siloed data models into a unified one and make your teams operate on it. This is typically a significant challenge for organizations that haven’t traditionally operated on a single data model. Therefore, it acquires the #8 spot on our list of top apparel manufacturing ERP systems.

Strengths

- Well adopted among apparel brands. This is because they excel in the e-commerce space and have a very strong CRM component included as part of Odoo.

- Diverse solutions to accommodate several business models. It can support many different business models, many different localizations, countries, etc, as part of the same product.

- Matrix functionality is built as part of the inventory core. This functionality is critical for apparel manufacturers. They would require this functionality supported throughout the phases starting from design, planning, and production.

Weaknesses

- Visual order entry with color or style might be challenging. The visual order entry required by apparel companies might be a much heavier lift to customize and build on top of Odoo. If you need an ERP add-on, choose one that is well-designed and widely adopted among apparel companies.

- Data layers not as embedded as needed for complex manufacturing companies. Odoo does not have as many users in larger apparel manufacturing companies compared to smaller apparel companies primarily in retail distribution. Adoption in the apparel manufacturing space, which is more complex, may not be as widespread.

- Requires a mature internal IT team. To tailor, customize, and configure these capabilities—already included in the suite, Odoo requires a very mature internal IT team.

7. Acumatica

Acumatica is ideal for smaller apparel companies that are outgrowing QuickBooks, Odoo, or Zoho. These companies might be looking for a single data model for all their departments to operate in a more integrated and consolidated manner. However, with Acumatica, you won’t achieve global consolidation and may not be able to explore as many global synergies. This is because Acumatica is designed for very small companies. Hence, it secures the #7 spot on our list of top apparel manufacturing ERP systems.

Strengths

- Apparel PLM, merchandizing, planning, and eCommerce brands part of the ecosystem. The ecosystem includes many apparel-centric solutions such as PLM and merchandising planning, blended with e-commerce brands in Acumatica. Sometimes, you can find pre-baked integrations that may work well for your processes. However, thorough evaluation is necessary to ensure they align with your data and processes. Nonetheless, you may find at least some solutions within their ecosystem.

- Underlying CPQ layers can allow customer and vendor and customer quoting processes. A growing CPQ layer enables both customers and vendors to engage in coding processes within the apparel space. Ensuring that the data model supports all these processes is crucial.

- Core ERP layers. The core ERP layers are robust, supporting processes like warehouse management, even when using specialized WMS systems. All required data models must be supported to ensure seamless communication with the ERP layers.

Weaknesses

- Color and style based order entry not as intuitive. It might often require an add-on, which may not be intuitive if the core data model doesn’t support those integrations. However, in the Acumatica ecosystem, you will likely find some ERP add-ons that can handle this functionality.

- Expensive implementation with too many add-ons. In general, dealing with many different add-ons and vendors makes your implementation expensive and potentially very risky.

- Limited global consolidation capabilities. The global instances would need to be disconnected, preventing you from exploring synergies among different countries.

6. Microsoft Dynamics 365 F&O

Microsoft Dynamics 365 F&O is a very generalized product, designed for companies in regions where prescriptive products might not be available. For industries seeking global operational consolidation of various business models and processes, Microsoft Dynamics 365 F&O fits well. Therefore, it secures the #6 spot on our list of top apparel manufacturing ERP systems.

Strengths

- Well adopted apparel add-ons as part of the ecosystem. They are widely adopted and have as many installations as some apparel-centric products. For example, products within the Aptean portfolio might have 1,000 installations, and this add-on also has 1,000 installations. So, this is likely as good as the product from your OEM or software publisher.

- Core ERP layers to support diverse business model. The underlying ERP layers are designed to support various business models, so you are unlikely to encounter many challenges.

- Comprehensive localization across the globe. It has natively built capabilities for global synergies, in countries and geographies where prescriptive solutions might not be present.

Weaknesses

- Last mile capabilities through third-party vendors. The last mile or industry-specific capabilities you acquire will be through third-party vendors. This approach increases vendor risk when utilizing these capabilities.

- Expensive implementation. The ERP implementation may be slightly more expensive because you’re dealing with many different vendors and many different add-ons.

- Requires mature internal IT team. In tailoring, customizing, and configuring these capabilities, the same capabilities that are already included as part of the suite, MS Dynamics 365 F&O also requires a very mature internal IT team.

5. SAP S/4 HANA

It is similar to MS Dynamics 365 F&O, both designed for generalized use cases supporting various business models globally. SAP excels in the large enterprise space, while F&O, though less proven with large enterprises, offers deeper operational capabilities in its cloud version. SAP S/4HANA‘s cloud version lags behind but has significantly improved, with its on-prem version being more mature. The cloud ecosystem differs, as some rich add-ons for on-prem might not be upgraded for the cloud. Therefore, it’s crucial to understand what kind of demo you are seeing and where those capabilities are supported. Thus, placing this product at #5 on our top apparel manufacturing ERP systems list.

Strengths

- ERP layers for complex organizations. This ERP is designed for complex organizations, offering excellent suite capabilities for best-of-breed architecture. However, it may not be as tailored for apparel-centric organizations, which may still need to rely on third-party vendors and solutions to complete the system.

- Diversity of the solution supporting discrete and process manufacturing. A variety of solutions are present to support different discrete and process manufacturing processes. Most apparel manufacturers are in the textile business, but they may also need process manufacturing capabilities, especially if they incorporate chemical processes. They might acquire these capabilities to meet their requirements.

- Global compliance and localization. The solutions natively support dozens of countries in geographies where prescriptive products might not be present.

Weaknesses

- Last mile capabilities through third-party vendors. The last mile or industry-specific capabilities you acquire will be through third-party vendors. This approach increases vendor risk when utilizing these capabilities.

- Expensive implementation. The ERP implementation may be slightly more expensive because you’re dealing with many different vendors and many different add-ons.

- Requires mature internal IT team. In tailoring, customizing, and configuring these capabilities, the same capabilities that are already included as part of the suite, SAP S/4 HANA also requires a very mature internal IT team.

4. Oracle Cloud ERP

It is similar to SAP S/4HANA, designed for a global install base and suited for publicly traded companies needing deep financial compliance and traceability. Oracle Cloud ERP offers comprehensive retail components, including apparel manufacturing, where processes are intertwined with merchandising, planning, warehouse, procurement, and design. Solutions like Blue Yonder and Manhattan are well-suited for these areas, while ERP primarily handles financial reporting. For manufacturing, which requires cost accounting and MRP, a robust ERP solution is essential. Apparel business models are complex, involving retail distribution and physical stores, making their supply chain planning intricate. Thus, Oracle Cloud ERP secures the #4 spot on our list of apparel manufacturing ERP systems.

Strengths

- Retail focused solution and CX solutions friendlier for B2C orgs. It is designed for a retail-focused architecture. The CX and supply chain solutions also take a very different perspective, tailored to retail needs.

- Diversity of the solution. It can accommodate several different business models, making it ideally suitable for holding companies or companies owned by private equity.

- Workforce scheduling provided as part of HCM solution for companies with physical locations. Features such as workforce scheduling which are typically included in the HCM portfolio, are also present as part of the ERP system. Scheduling and compensation planning are very different in apparel-centric industries. This is where it excels.

Weaknesses

- Last mile capabilities through third-party vendors. The last mile or industry-specific capabilities you acquire will be through third-party vendors. This approach increases vendor risk when utilizing these capabilities.

- Expensive implementation. The ERP implementation may be slightly more expensive because you’re dealing with many different vendors and many different add-ons.

- Requires mature internal IT team. In tailoring, customizing, and configuring these capabilities, the same capabilities that are already included as part of the suite, it also requires a very mature internal IT team.

3. Aptean Apparel ERP

Aptean apparel ERP is designed for very small apparel manufacturing companies with a limited budget. These companies seek a tailored suite with pre-integrated solutions, so they don’t have to handle the integration themselves. Thus, acquiring the #3 spot on our list of top apparel manufacturing ERP systems.

Strengths

- Full suite pre-integrated. A tailored suite with pre-baked integrations includes solutions required by apparel manufacturing companies, reducing the need for them to develop these integrations themselves.

- Intuitive experience tailored to apparel workflows. Very customized order entry and learning processes specifically designed and labeled for apparel-centric business.

- Tight integration of merchandizing, planning, WMS, TMS, and PLM. PLM, merchandising, planning, WMS, and TMS processes, all of which are highly specialized in the apparel-centric industry. You’ll find all of these pre-configured as part of your Aptean Apparel ERP.

Weaknesses

- Expensive with partial implementation. Sometimes, these partial scenarios can be more expensive than opting for something like NetSuite or other ERP systems if your preference is to incorporate all those best-of-breed components and integrate them.

- Not as diverse. It’s not as versatile to support a diverse range of business models. Typically, apparel business models are focused within the apparel category, often launching many new products but maintaining a consistent business model. They typically do not venture into selling apparel machinery. If you have such needs, you might encounter limitations with this ERP because it’s not designed for that purpose.

- Limited ecosystem and consulting base. As with any other prescriptive products, the ecosystem and consulting base will be limited as well.

2. NetSuite

NetSuite is ideal for apparel SMBs with a global presence that do not require solutions as large as SAP S/4HANA or Oracle Cloud ERP. Thus, NetSuite secures the #2 position on our list of top apparel manufacturing ERP systems.

Strengths

- Well adopted ISVs and PLMs in its ecosystem. The vendors within the NetSuite ecosystem are highly adopted in the apparel category. ISV, PLM, TMS, WMS, and other solutions perform exceptionally well. Therefore, you receive a product as good as what your software publisher delivers.

- Data model friendlier for retail and distribution companies. The data model, particularly the one required for apparel manufacturers, is not as complex as it is for other types of manufacturing. This makes NetSuite a great fit for apparel manufacturing.

- Not a bad solution for apparel manufacturing. Apparel manufacturers don’t need as deep production capabilities with complex BOMs and routing steps, making the light manufacturing capabilities of NetSuite a decent fit.

Weaknesses

- Complex apparel manufacturing requiring shop floor scheduling etc might need add-ons. For complex apparel manufacturing capabilities such as shop floor scheduling, you often rely on add-ons, which can introduce more complexity.

- Several add-ons required. NetSuite would require several add-ons, including tools for merchandising, planning, PLM, vendor collaboration, and increasing vendor and ERP implementation risk.

- Limited native operational capabilities. The native capabilities are extremely lean for complex operational use cases, requiring several add-ons to fill up those gaps.

1. Infor CloudSuite M3

Infor CloudSuite M3 is designed for global apparel companies and includes tailored processes specific to the apparel industry. Customizing this suite is complex and challenging with other products. Thus, it acquires the #1 spot on our list of top apparel manufacturing ERP systems.

Strengths

- Comprehensive apparel manufacturing capabilities. The core ERP capabilities are present with a data model tailored and delivered specifically for apparel manufacturing.

- Comprehensive suite combining most components apparel companies need. A suite where PLM, WMS, TMS, merchandising, planning, and all of that are part of the same solution from the same vendor. This integration helps reduce your implementation budget because these capabilities are unified.

- Extensibility. You are going to have far more flexibility when customizing the product.

Weaknesses

- Not as diverse. It is not as diverse. If your business model and transactions require many different processes, such as a discrete business model in apparel manufacturing, you might encounter issues.

- Not suitable for SMBs below $250M in revenue. This might not be the best fit for apparel companies below 250 million in revenue, as the ecosystem and consulting base are also fairly limited.

- Ecosystem. The consulting base is extremely limited, and very few VARs are available. It might be even more limiting if you care for local help.

Conclusion

In conclusion, apparel manufacturing companies are essential players in the global fashion industry, specializing in producing a wide array of clothing and accessories. They operate within robust textile industries in urban centers and regions with skilled labor, contributing significantly to local economies and global supply chains. From design and material sourcing to production and distribution, these companies ensure the diverse demands of consumers are met with high-quality products. Modern apparel manufacturing processes leverage technology for efficiency and adaptability, reflecting the dynamic nature of fashion trends and consumer preferences.

When evaluating ERP systems for apparel manufacturing, the rankings reveal diverse strengths and weaknesses across various solutions. Infor CloudSuite M3 emerges as the top choice due to its comprehensive suite tailored specifically for apparel industry needs, integrating PLM, WMS, TMS, merchandising, and planning seamlessly. In contrast, solutions like Oracle Cloud ERP and SAP S/4HANA cater to global enterprises with robust financial compliance and operational capabilities, albeit requiring substantial investment and a mature IT team for implementation.

NetSuite and MS Dynamics 365 BC offer more accessible options for SMBs with global ambitions, focusing on scalable solutions without the complexity of larger ERP systems. Each ERP system reviewed provides unique benefits, reflecting the diverse needs and operational scales of apparel manufacturers in today’s competitive market landscape. Ultimately, the right ERP system, chosen with the guidance of an independent ERP consultant, will not only streamline operations and enhance efficiency but also support the company’s growth.