Top 15 Retail Digital Transformation Trends in 2025

2024 turned out to be an unexpectedly challenging year for retailers. Although a rebound was anticipated in the second half, the market’s recovery fell short of expectations. Signs of improvement emerged toward the year’s end, but winter proved to be one of the slowest periods. The period was slowest, primarily influenced by factors such as administrative changes, an extreme cold wave, and broader macroeconomic conditions. Building upon these challenges, uncertainty is expected to continue through 2025. It will continue primarily driven by tariff threats, a slowing U.S. economy, and weakening consumer confidence.

Macroeconomic headwinds won’t be the only obstacles disrupting retailers’ plans—artificial intelligence will also play a significant role in shaping consumer behavior. Consumer traffic is expected to shift toward alternative search platforms like Perplexity and OpenAI, reducing Google’s overall traffic share and pushing retailers to optimize for a broader range of search engines. Additionally, vector-based SEO changes present another challenge, requiring retailers to refine their strategies by focusing on core intent and integrating multimedia assets into their content.

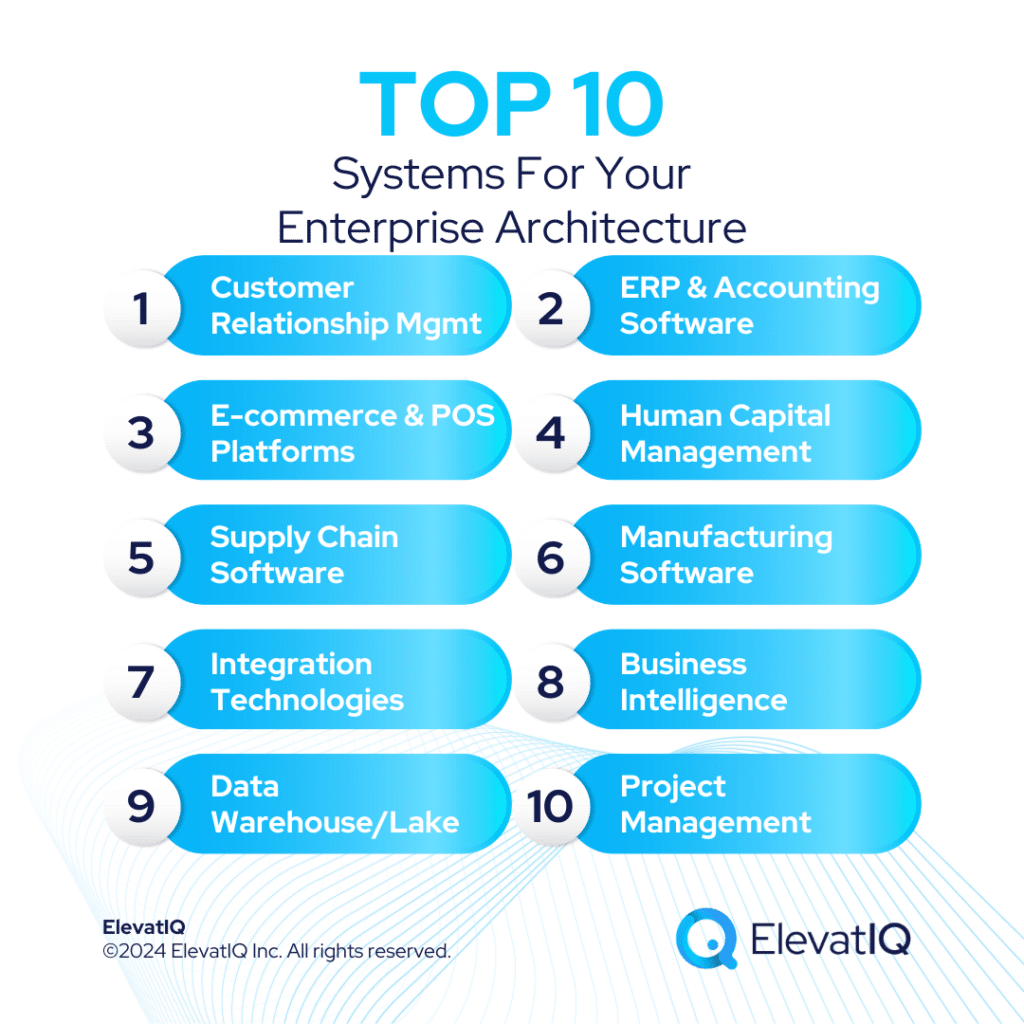

With ongoing uncertainty surrounding tariff threats, retailers will need to retool their supply chains throughout the year. Amid this uncertainty—and the urgency to keep pace with AI—most retail transformation efforts will center on leveraging AI-driven opportunities. These may include replacing legacy systems with AI-enabled solutions or restructuring processes in response to shifting consumer behavior and business processes. Buyers must be strategic in their business cases, prioritizing AI-centric use cases, as missed opportunities could result in lost market share or diminished competitive advantage. Understanding these retail digital transformation trends is crucial for preparing future initiatives. Join us as we explore the top 10 retail digital transformation trends for 2025.

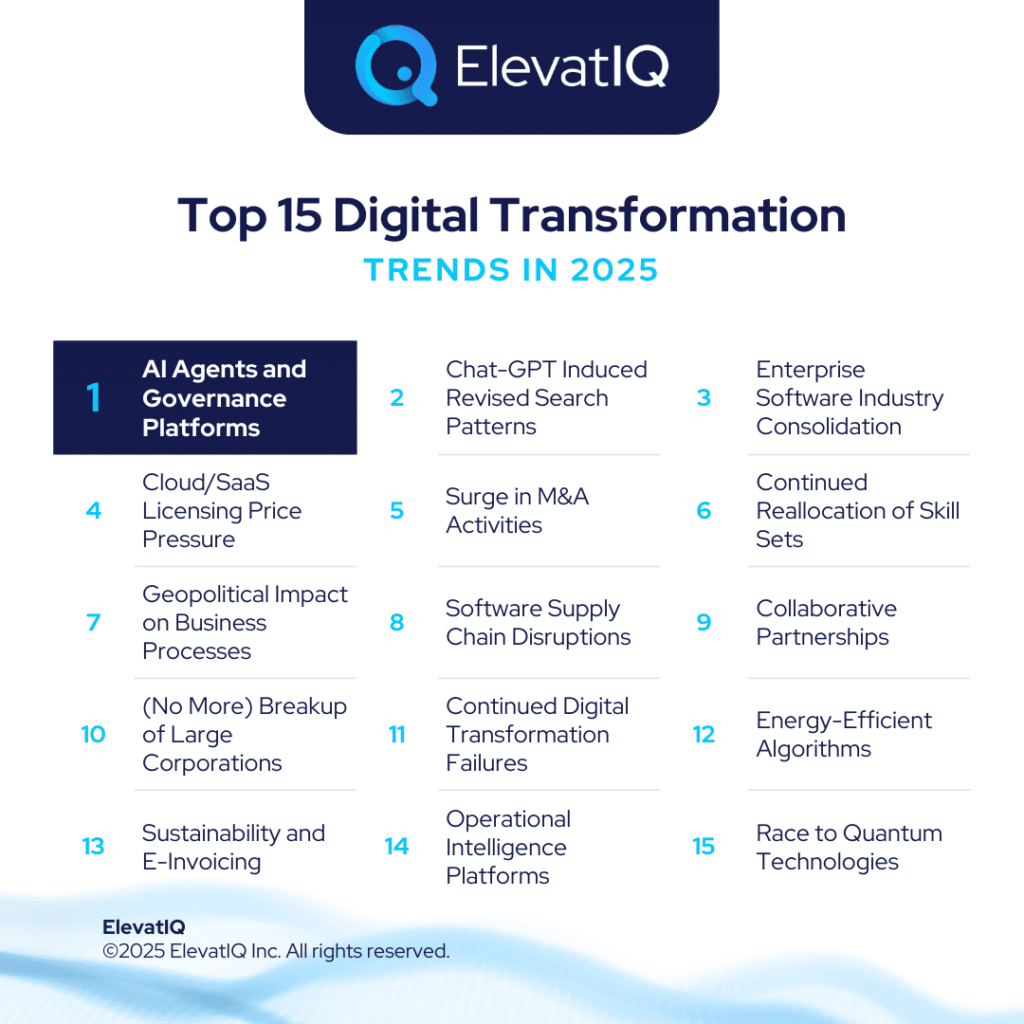

1. AI-Augmented Customer Experience and AI Governance Platforms

In 2025, enterprise software companies will face increasing challenges, compelling them to justify their pricing models. One of the few viable strategies will be integrating AI agents across various retail software categories. These AI agents would help not just as a pricing justification but also as a new revenue stream. These AI agents will initially focus on customer-centric use cases before expanding to outbound applications, such as targeted interactive promotions.

How will AI agent-to-agent orchestration shape the future of retail operations? Can AI governance platforms provide the oversight needed for seamless collaboration between humans and artificial intelligence? As retailers grapple with data silos across merchandising, POS networks, and supply chains, how can cross-functional AI agents unlock meaningful insights without causing disruptions? With AI becoming deeply embedded in workflows, businesses must refine their strategies to ensure security, auditability, and optimal performance. Stay ahead of these transformative trends—download the full Top 15 Retail Digital Transformation Trends in 2025 report now!

2. Chat-GPT Induced Revised Search Patterns and Consumer Behavior

Generative AI technologies would pave the way for new types of search engines that support multi-modal search, posing a threat to Google’s market dominance. As these new search engines gain market share, Google would be compelled to integrate generative AI into its search processes.

How will the rise of ChatGPT-driven search impact paid media strategies for retailers? As search engines evolve their monetization models, how can businesses optimize their content to stay visible across both organic and paid channels? With consumer behavior shifting, what adjustments must retailers—both online and offline—make to remain competitive? As discoverability changes for local stores and eCommerce alike, businesses must rethink their digital strategies to stay ahead. Download the full Top 15 Retail Digital Transformation Trends in 2025 report now to uncover key insights and action plans!

3. Expedited Content Generation

As generative technologies mature and as AI agents become embedded with the core process, content creation time and maintenance would primarily be the responsibility of agents. The agents might be responsible for tailoring the experience, such as changing the content based on weather patterns or locally developing situations.

How will AI-driven dynamic pricing reshape competition in retail? As autonomous systems track and adjust prices in real time, what strategies can brands adopt to stay ahead? With AI accelerating content creation, how can retailers balance speed with quality to maintain a competitive edge? As these innovations drive efficiency and intensify market competition, businesses must adapt quickly to thrive. Download the full Top 15 Retail Digital Transformation Trends in 2025 report now to explore key insights and strategies!

4. Vector-based SEO Optimization

As Google integrates more generative AI into its search algorithm, SEO will increasingly prioritize vector-based strategies, emphasizing intent detection across various sources, including images and multimedia content.

How can retailers keep their digital presence strong as strategies continue to evolve? With shifting consumer behaviors and algorithm changes, what content and engagement tactics will drive sustained traffic? As competition intensifies, how can brands refine their digital approaches to stay ahead? The future of retail is rapidly changing—download the full Top 15 Retail Digital Transformation Trends in 2025 report now to stay informed.

5. AI-based Personalization Strategies and Targeting

Adopting technologies like DeepFakes marks a new era of personalization, enabling companies to create web-based deepfake experiences that offer consumers immersive interactions similar to trial-room simulations—potentially replacing the Metaverse for these applications.

How will evolving regulations on deepfakes impact the future of personalization in retail? As governments scrutinize AI-generated content, what limitations—or opportunities—might emerge for brands leveraging the Metaverse? Could stricter policies reshape how retailers engage with consumers through personalized experiences? With regulatory shifts on the horizon, businesses must stay ahead of potential changes. Download the full Top 15 Retail Digital Transformation Trends in 2025 report now to explore what’s next!

6. Continued Consolidation of the Enterprise Software Industry

In 2024, enterprise software saw significant consolidation, a trend expected to persist into 2025 as categories become increasingly integrated and overlapping. These shifts will likely impact pricing models and system architecture for retailers.

How can businesses safeguard themselves against the risks of feature phase-outs and product discontinuations after an acquisition? With pricing structures subject to sudden changes, what strategies can retailers adopt to stay agile? Could unexpected upgrades disrupt operations, or can proactive planning turn these shifts into opportunities? As the retail landscape evolves, staying informed is crucial. Download the full Top 15 Retail Digital Transformation Trends in 2025 report now to prepare for what’s ahead!

7. Continued Adoption of QR Codes

QR code adoption has surged in recent years, becoming a staple across media platforms. Its use is set to expand further in warehouse operations, which currently rely primarily on 2D applications. Meanwhile, brands are leveraging QR codes to create immersive experiences, seamlessly connecting the physical and digital worlds.

How can retailers move beyond traditional training materials and brochures to create truly immersive brand experiences? As omnichannel engagement evolves, what role will interactive and cross-channel innovations play in shaping customer interactions? Can businesses leverage these advancements to build deeper connections and drive loyalty? The future of retail engagement is here—download the full Top 15 Retail Digital Transformation Trends in 2025 report now to stay ahead of the curve!

8. Continued Supply Chain Disruptions

Persistent supply chain disruptions will continue to impact core operations and customer experiences. To navigate these challenges, retailers may need to restructure their supply chain networks, improving resilience and inventory predictability.

How will the overhaul of fulfillment strategies impact the broader retail ecosystem? As businesses rethink their system architecture and business processes, what key challenges and opportunities will arise? Can transformation initiatives in fulfillment lead to more efficient and customer-centric operations? The future of retail fulfillment is rapidly changing—download the full Top 15 Retail Digital Transformation Trends in 2025 report now to uncover actionable insights and strategies!

9. In-store Experiences

In-store experiences will remain a top priority, as physical retail continues to be the primary channel for most businesses. AI is set to transform in-store interactions by enhancing self-service stations and enabling cashier-less experiences.

How can retailers leverage the integration of POS solutions in composable technologies to create seamless omnichannel experiences? With vendors like Salesforce and commercetools offering bundled solutions, how can businesses ensure smooth agent interactions and enhance the overall customer journey? What challenges must be addressed to fully unlock the potential of these integrated technologies? The future of omnichannel retail is evolving—download the full Top 15 Retail Digital Transformation Trends in 2025 report now to explore the key strategies shaping this transformation!

10. Supply Chain Visibility Platforms and Improved Forecasting

As supply chain platforms merge and consolidate data, connectivity will strengthen, leading to improved forecasting accuracy. Brands that leverage these advancements will enhance their supply chain management, positively impacting their bottom line and driving further digital transformation in retail.

How will the push for greater efficiency impact competition among retailers, particularly in the adoption of supply chain visibility platforms? As larger brands gain a competitive edge, what can smaller businesses do to stay relevant? With ongoing industry consolidation on the horizon, how can retailers adapt to maintain their position in the market? The future of retail supply chains is shifting—download the full Top 15 Retail Digital Transformation Trends in 2025 report now to stay ahead of these crucial developments!

11. Last-mile Traceability

Last-mile traceability, traditionally a weak point in supply chains, is undergoing a major transformation. Industry-wide fragmentation and data gaps have long hindered visibility, but leading players like Blue Yonder and e2open have recently acquired technologies to enhance last-mile tracking.

How will advancements in last-mile technologies reshape consumer expectations in the coming years? As businesses integrate these innovations into their operations, what challenges will arise in meeting growing demands for faster, more efficient delivery? With consolidation in last-mile technologies likely by 2025, how can retailers prepare to stay competitive in this changing landscape? Stay informed on the latest trends—download the full Top 15 Retail Digital Transformation Trends in 2025 report now to gain valuable insights!

12. AI-augmented Products

As AI becomes ubiquitous, it’s no longer confined to major devices but is even embedded in everyday items like toothbrushes. This widespread integration will reshape consumer expectations, positioning AI as the new standard, similar to the transition from mechanical to electrical devices.

How can brands effectively leverage AI-powered products to differentiate themselves in a competitive market? As demand grows for advanced infrastructure and enhanced processing capabilities, what investments will retailers need to make to stay ahead? With the rise of powerful command and control centers, how can businesses ensure they are equipped to handle this technological shift? Stay ahead of the curve—download the full Top 15 Retail Digital Transformation Trends in 2025 report now to discover the key strategies for success!

13. Sustainability

Sustainability may take a backseat compared to previous years, as the new US administration is expected to roll back some of these initiatives. With declining revenue expectations and reduced consumer confidence, the focus on sustainability efforts could further diminish.

How can brands continue to prioritize consumer-driven initiatives while justifying premium pricing in a competitive market? As sustainability becomes a core differentiator, how will businesses adapt their strategies to stay aligned with these values, even in the face of changing policies? With the evolving retail landscape, how can companies balance consumer demand with long-term sustainability goals? Stay ahead of the trends shaping the industry—download the full Top 15 Retail Digital Transformation Trends in 2025 report now for in-depth insights and strategies!

14. Micro-fulfilment

While micro-fulfillment may remain a key trend for larger brands due to its competitive advantage, smaller retailers may hesitate to invest in technology initiatives due to uncertainties surrounding macroeconomic conditions. This could encourage larger brands to double down on such initiatives, using them to differentiate themselves in a slowing economy.

How can retailers effectively modernize their tech stacks to support evolving business models like BOPIS, ROPIS, and curbside pickup? What operational adjustments will be necessary to seamlessly integrate these new approaches into existing workflows? As consumer demand for convenience grows, how can businesses ensure they are fully equipped to capitalize on these opportunities? Stay ahead of the game—download the full Top 15 Retail Digital Transformation Trends in 2025 report now to review these trends in detail!

15. Composable, Omnichannel, and Unified Commerce

While larger brands are expected to invest in composable and unified commerce initiatives, the growth of composable technologies may not match the pace seen in previous years.

How will the increasing momentum of AI impact brands’ investments in composable technologies? As AI continues to evolve, what shifts in strategy should retailers expect, and how can they balance this with their existing digital transformation initiatives? Could AI’s growth lead to new opportunities that make composable systems less of a priority, or will they coexist? Stay informed on the latest trends shaping the retail industry—download the full Top 15 Retail Digital Transformation Trends in 2025 report now for detailed insights!

Final Words

2024 proved to be an unexpectedly tough year for retailers. As we move into 2025, uncertainty looms, driven by several factors. On top of these macroeconomic hurdles, artificial intelligence is emerging as a significant disruptor, reshaping consumer behavior and pushing retailers to adapt. While the full impact of AI remains unclear, brands must start incorporating it into their digital strategies, which requires laying a strong foundation with solid architecture, data, and process models. For guidance on navigating these trends and building that foundation, it’s worth consulting independent retail experts.