NetSuite vs Odoo ERP Independent Review 2024

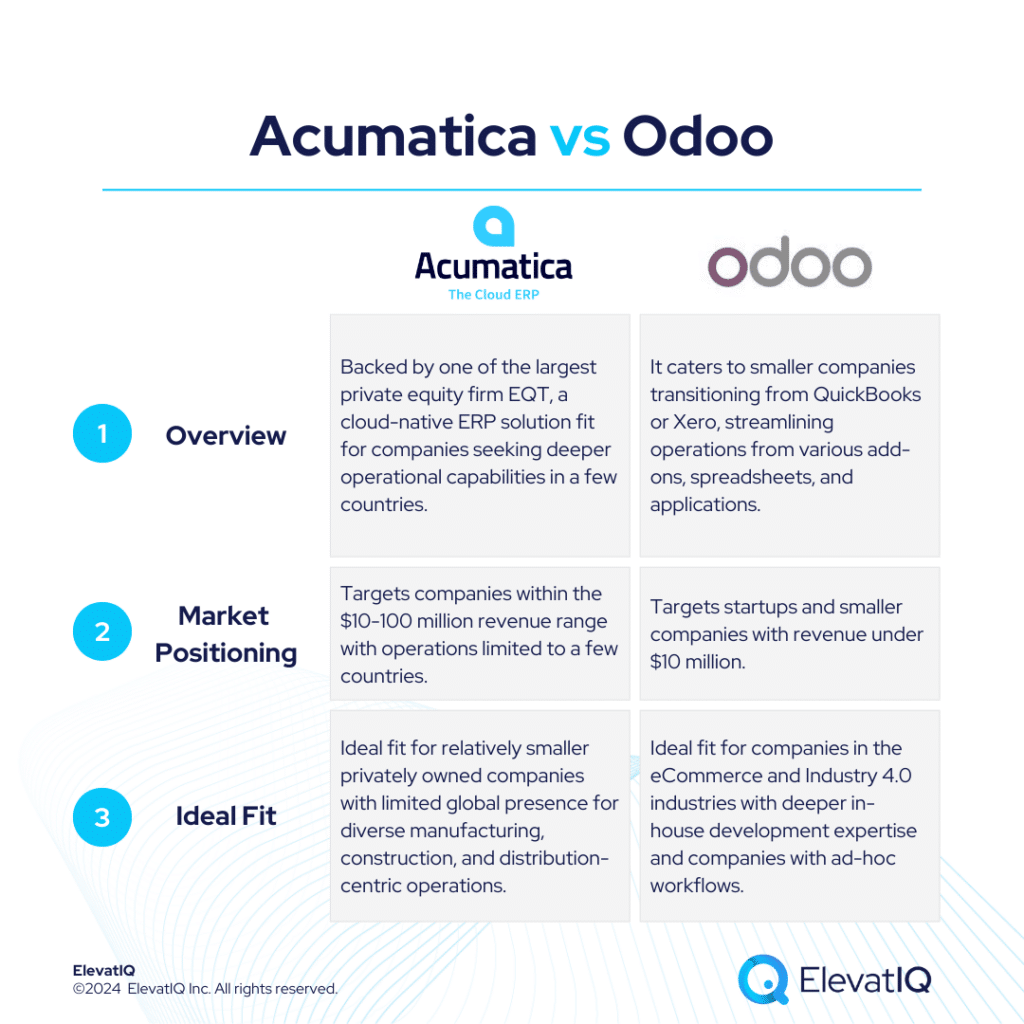

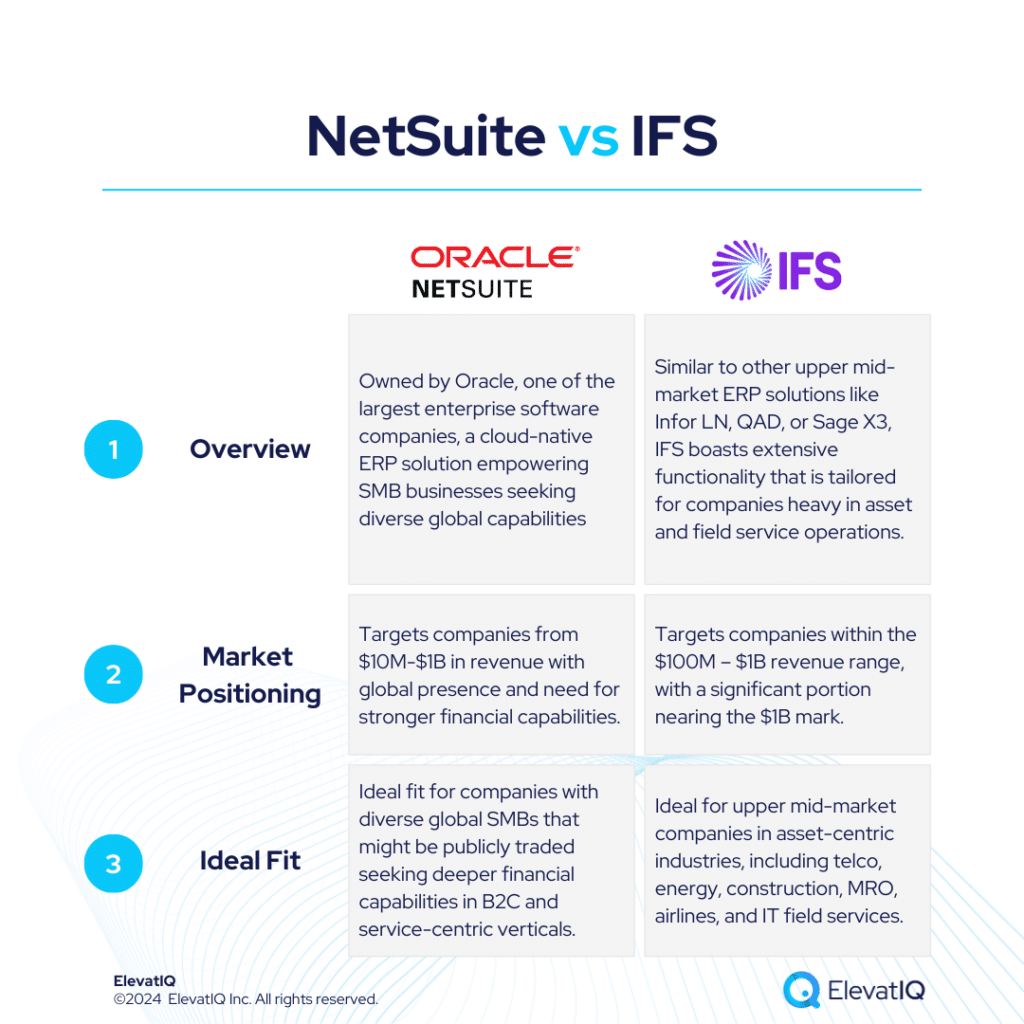

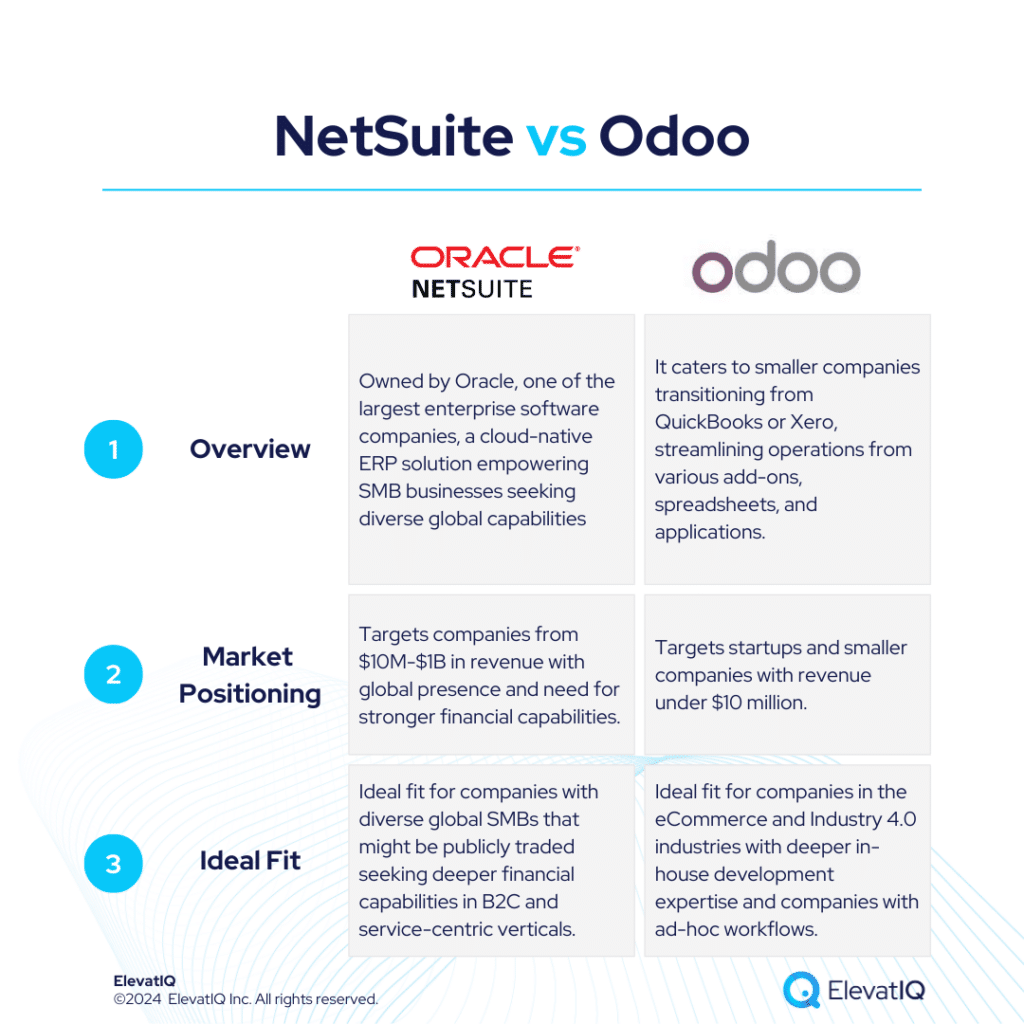

NetSuite caters well to particularly globally spread small to mid-market companies seeking robust financial capabilities with localization in numerous countries. It offers solutions tailored to specific business models. On the other hand, Odoo caters to smaller companies transitioning from QuickBooks or Xero, streamlining operations from various add-ons, spreadsheets, and applications. NetSuite also targets companies from $10M-$1B in revenue with global presence and need for stronger financial capabilities. Whereas, Odoo primarily caters to startups and smaller companies with revenue under $10 million.

NetSuite is suitable for a diverse range of companies, particularly service-centric, distribution-centric, commerce-centric, and B2C organizations. It also performs well across various industries but may lack depth for industrial distributors and manufacturers, focusing more on lighter manufacturing and consumerized products like health and beauty, fashion, apparel, and CPG. On the other hand, Odoo’s unique advantage lies in hosting operations across multiple countries in a single database. Distinguishing from solutions like QuickBooks or Xero, it might also use separate financial instances for each country. The other similar ERP systems designed for multi-entity operations might not contain CRM-specific processes.

With robust financial capabilities and an integrated HCM solution, NetSuite is well-suited for service-centric industries, including smaller banks, credit unions, financial services, non-profit organizations, as well as the technology and media sectors. On the other hand, Odoo is an excellent choice for budget-conscious companies, especially those with in-house development teams. Therefore, choosing between NetSuite vs Odoo requires a detailed examination, and this comparison offers valuable insights for ERP selection projects. Let’s delve deeper into the specifics.

| NetSuite | Odoo | |

| Started in | 1998 | 2014 |

| Ownership by | Oracle in 2016 | Odoo S.A. |

| No. of customers | 37,000+ | 100,000+ relatively smaller companies |

What is NetSuite?

NetSuite stands out as the leading ERP solution, driven by its success particularly for diverse industries seeking stronger financial capabilities over the operational, robust ecosystem, credible marketplace add-ons, and comprehensive functionality. Not as complex as some competitors like SAP S/4 HANA and Microsoft F&O, NetSuite also excels in supporting diverse business models, including omnichannel architecture, matrix/dimensional inventory, and subscription-based models.

While NetSuite excels across industries, it may not be the ideal choice for industrial distributors and manufacturers due to limitations in pricing and item master capabilities. Its strength lies in supporting lighter manufacturing and also consumerized products like health and beauty, fashion, apparel, and CPG. With robust financial capabilities and an integrated HCM solution, NetSuite is well-suited for service-centric industries, including smaller banks, credit unions, financial services, non-profit organizations, as well as the technology and media sectors.

While NetSuite remains the top-ranked solution due to its product quality, there might be challenges with over-customization and integration issues, leading to implementation failures. Working with NetSuite demands thorough vetting of their solution and architecture.

What Is Odoo?

Odoo caters to smaller companies particularly transitioning from QuickBooks or Xero, streamlining operations from various add-ons, spreadsheets, and applications. It provides basic transactional processing across several enterprise software categories, such as ERP, CRM, and HCM. And a lot more in a consolidated database, thus eliminating the need for costly integrations.

An excellent choice for budget-conscious companies, especially those with in-house development teams, Odoo may face challenges without guidance from experienced ERP consultants. While Odoo’s modular design allows flexible app purchasing and provides scalability, it lacks tight integration at the data model level. This limitation can be a concern for companies particularly aiming for stringent financial control at the data layer. This is especially true for less seasoned companies that might already struggle to regulate their internal process and data codings.

A rapidly growing platform with substantial funding and a large user base, it particularly caters to startups and smaller companies with revenue under $10 million. Its unique advantage lies in hosting operations across multiple countries in a single database. Distinguishing from solutions like QuickBooks or Xero, it might also use separate financial instances for each country. The other similar ERP systems designed for particularly multi-entity operations might not contain CRM-specific processes.

NetSuite vs Odoo Comparison

Navigating the choice between NetSuite vs Odoo is a significant decision for businesses particularly looking for operational efficiency and strategic alignment. Thus, this section delves into the comprehensive comparison of NetSuite vs Odoo across various critical dimensions.

| NetSuite | Odoo | |

| Global Operational Capabilities | Natively localized in over 100 countries. | Fit for smaller companies that might have entities in many different countries. |

| Diverse Capabilities | Supports diverse business models across multiple countries. | The data and process model supports diverse industries, including product and service-centric startups. |

| Best-of-breed Capabilities | Contains pre-integrated components like HCM and FP&A, though the maturity of these components may vary. | Extremely limited best-of-breed capabilities compared to its larger peers. |

| Last-mile Capabilities | Limited last-mile capabilities, especially for manufacturing. | The last-mile capabilities for specific micro-verticals are limited. |

| Operational Functionalities | Richer financial capabilities over operational features. | Matrix functionality built as part of the inventory core. Also, maintains a cohesive design across screens and modules being a cloud-product. |

| Integration Capabilities | Offers several pre-integrated solutions with more options from Celigo. | It lacks tight integration at the data model level. This limitation can be a concern for companies aiming for stringent financial control at the data layer. |

| Manufacturing Capabilities | Limited BOM layers for assembly-centric operations, requiring additional add-ons. | Matrix functionality built as part of the inventory core. However, many advanced transactions may have limited support natively. |

| Pricing Model | Named-user based with inflexible long-term contracts. | Per-user, per-app, per-month model |

| Key Modules | 1. Financial Management 2. Accounting 3. Global Business Management 4. Inventory Management 5. Order Management 6. Supply Chain Management 7. Warehouse Management 8. Procurement 9. Customer Relationship Management | 1. Sales 2. CRM 3. Inventory Management 4. Accounting and Finance 5. Purchase Management 6. Project Management 7. Manufacturing Management 8. Human Resources Management 9. Website and eCommerce |

NetSuite vs Odoo Feature Comparison

Both platforms offer a plethora of features and functionalities designed to streamline business operations and enhance efficiency. In this feature comparison, we delve into particularly the distinct capabilities of NetSuite vs Odoo across various critical dimensions, providing insights to aid businesses in making informed decisions regarding their ERP selection. Thus, this section discusses features under each of the following modules, particularly financial management, and supply chain management.

Financial Management Comparison

In this section, we are discussing a detailed comparison of the financial management capabilities particularly offered by NetSuite vs Odoo. By examining their respective strengths and functionalities, particularly in managing financial processes. Businesses can therefore gain valuable insights to determine the best-suited ERP solution for their financial management needs.

| NetSuite | Odoo | ||

| Financial Management | General Ledger | Supports complex general ledgers including public reporting requirements of several countries. | A financial record-keeping system that tracks all financial transactions and integrates seamlessly with other modules. |

| Accounts Receivable and Accounts Payable | Automates and streamlines invoice delivery, payment processing, and collections management as well as accounts payable processes. | The AR tracks money owed to the business by customers, while AP manages money the business owes to suppliers. | |

| Cash Flow Management | Provides visibility to optimize cash flows, monitor bank accounts, and manage liquidity. | Helps monitor and forecast company’s cash inflows and outflows to ensure liquidity and financial stability. | |

| Tax Management | Manages domestic and global tax, generates detailed reports, and analyzes transactions real-time. | Automates tax calculations, updates, and reporting, ensuring compliance and efficiency across multiple currencies and modules. |

Supply Chain Management Comparison

In this comparison, we explore and analyze the supply chain management capabilities of NetSuite vs Odoo, shedding light particularly on their respective strengths and weaknesses.

| NetSuite | Odoo | ||

| Supply Chain Management | Warehouse Management | Provides the ability to optimize day-to-day warehouse operations, eliminate manual processes and minimize handling costs. | Optimizes inventory control, streamlines operations, and enhances visibility with real-time tracking and automated processes. |

| Service Management | Automates inventory management processes with multi-location fulfilment, cycle counting, replenishment, traceability and item visibility. | Streamlines service delivery, enhances customer satisfaction, and optimizes resource allocation with integrated project management and invoicing. | |

| Inventory Management | Provides the ability to optimize day-to-day warehouse operations, eliminate manual processes and minimize handling costs. | Offers real-time tracking, multi-location management, and automated reordering to optimize stock levels and streamline operation. | |

| Other Features | Procurement – Streamlines procurement processes with source management, purchase management, vendor management and invoice processing. | Purchase Order Management – Automates procurement processes, optimizes supplier interactions, and ensures accurate order tracking and invoicing. | |

| Supply Chain Planning – Provides the ability to analyze demand, determine replenishment requirements, add stock and create orders according to an up-to-date supply plan. | Sales Order Management – Streamlines the entire sales process, from creating and sending quotations to converting them into sales orders and managing invoicing, all within a single platform. | ||

| Supply Chain Execution– Optimizes all supply chain assets, controls costs at each step. | Requisition Management – Streamlines the process of creating, reviewing, and approving purchase requisitions, ensuring compliance with budgets and procurement policies. |

Pros of NetSuite vs Odoo

When evaluating ERP solutions, understanding the distinct advantages of NetSuite vs Odoo is crucial. In this section, we are particularly exploring the strengths of NetSuite vs Odoo across various dimensions. Thus, shedding light on their respective capabilities and functionalities.

| NetSuite | Odoo |

| Provides richer financial capabilities over operational, with leaner operational layers built with the product compared to Epicor Kinetic. | It is widely adopted, especially among Industry 4.0 companies and other machinery businesses. |

| Ideal for SMBs operating in different countries. | It can support many different business models, many different localizations, countries, etc, as part of the same product. |

| The data model is B2C friendly, supporting integration with B2C channels. | The availability of cheaper technical talent globally helps product-centric startups extend or augment core capabilities. |

| Ideal for eCommerce-centric SMBs because of the ecosystem and the integration operations available for eCommerce-centric companies. | The lean data model and workflows make it easier for product-centric startups transitioning from QuickBooks-like solutions. |

Cons of NetSuite vs Odoo

Just like recognizing strengths is important, it’s also crucial to weigh the specific drawbacks of NetSuite vs Odoo. Therefore, in this section, we will delve into the limitations and challenges associated with NetSuite vs Odoo across various operational and financial dimensions.

| NetSuite | Odoo |

| Not a great value for companies operating only in a few countries. | The open-source nature leads to a tendency to over-customize, resulting in an inferior product experience. |

| May struggle with transactional workload requirements of companies over $1B and the ones that might be acquiring 10-20 entities every year. | Consisting primarily of developers, the ecosystem particularly doesn’t have a seasoned program, change management, and business consultants. |

| Not ideal for startups with simpler operating models. | The last-mile capabilities for specific micro-verticals are limited, requiring significant customization for their work with specific industries. |

| Named-user-based pricing requires allocating fixed costs, even for seasonal workers or external users accessing the subset of data such as customer or vendor portals. | Mature capabilities such as MRP, allocation, and batch are not as detailed as with other richer ERP systems. |

| Not fit for companies seeking OEM-owned integration with core operational systems such as CAD or PLM. | Adoption in the apparel manufacturing space, which is more complex, may not be as widespread. |

| The last-mile capabilities required for manufacturing or industrial distribution are extremely limited. | To tailor, customize, and configure these capabilities—already included in the suite, Odoo requires a very mature internal IT team. |

Conclusion

In conclusion, selecting between NetSuite vs Odoo requires a careful evaluation of the business’s specific needs and growth potential. NetSuite is ideal for globally-oriented, mid-market businesses with diverse financial and operational requirements, particularly in service-centric and B2C sectors. With robust financial management features, multi-country localization, and strong integration capabilities, it caters well to businesses seeking comprehensive ERP solutions with scalability.

However, for smaller businesses and startups with budget constraints, Odoo stands out with its flexible modular design and affordability. Its open-source nature offers great potential for customization, though this also demands a capable in-house development team to ensure smooth implementation and avoid over-customization issues.

Both systems have their strengths and limitations, so businesses should carefully evaluate their specific need. Also, seeking assistance from an independent ERP consultant can significantly aid the decision-making process. To get a 360-degree view of feature comparisons, it’s essential to explore not only NetSuite vs. Odoo but also insights from other analyses such as NetSuite vs. Acumatica, SAP S/4 HANA, Oracle Cloud ERP, Dynamics F&O, Dynamics 365 BC, Infor LN, Infor M3, Epicor Kinetic and IFS.