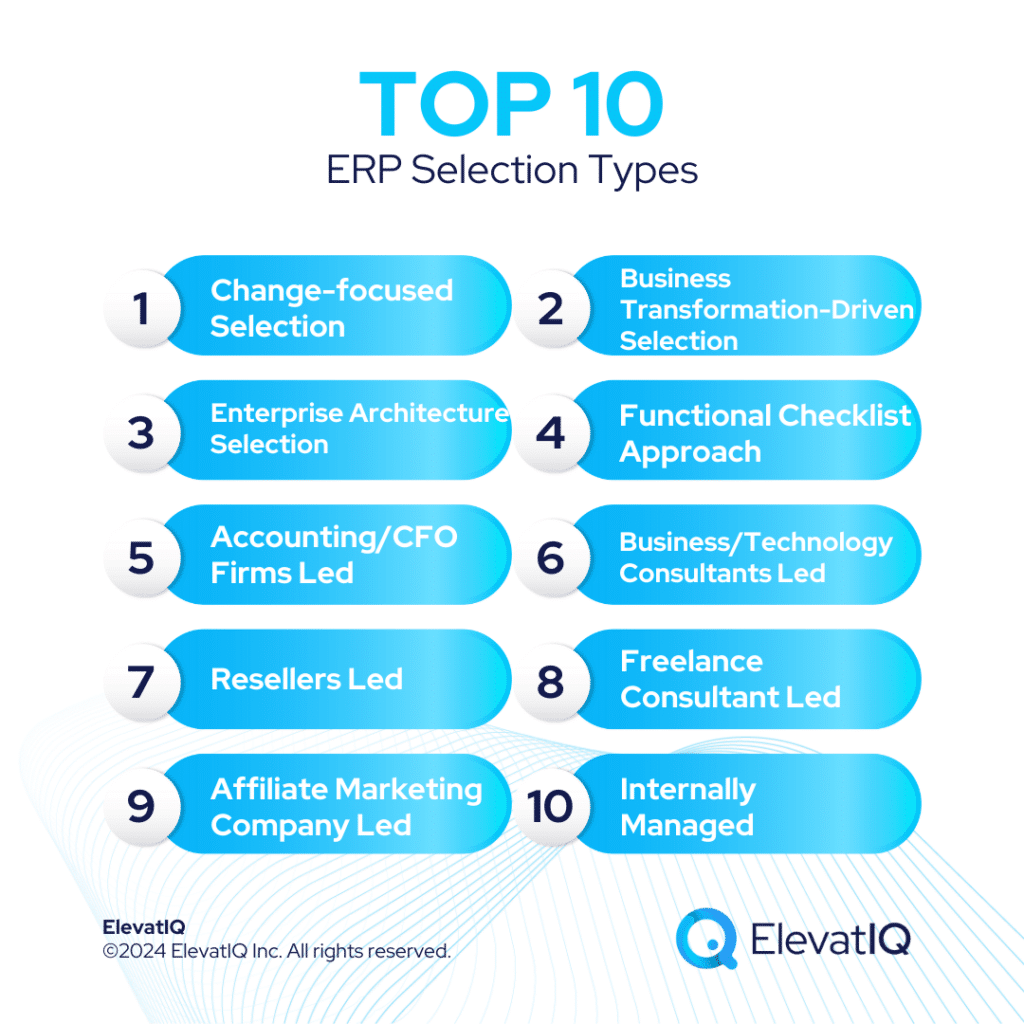

Top 10 ERP Selection Types

ERP selection is not just about filling functional checklists. Asking teams to vote. Or picking a system that works for everyone. It’s a lot more than that. Done right, ERP selection addresses several perspectives, including change management and business transformation. As well as technical and financial feasibility, program management, and enterprise architecture. Depending upon their strengths and prior expertise, each ERP selection consulting company may have varied approaches, with very few being “truly independent” and capable of performing exhaustive searches across hundreds of solutions.

The challenge starts with the misalignment of the ERP term. Is ERP supposed to be every single system in the enterprise architecture? A functional system catering to the needs of a specific department, such as accounting or finance? A reporting and planning system? Or a crystal ball that can provide answers to your questions? In reality, ERP is none of that. In fact, the ERP term, per se, doesn’t have much meaning. It’s the enterprise architecture that matters.

But an ERP system (or several ERP-like systems) is generally the foundation of this architecture. Also, the ERP companies have evolved so much that they can offer the entire enterprise architecture out-of-the-box, which only adds to the confusion due to the overlapping boundaries and their broadened scope. Understanding different ERP selection types and their pros and cons is the first step to aligning the expectations of what ERP means to your organization and what you might need to do to be successful with it. So which are the top ERP selection types in 2023?

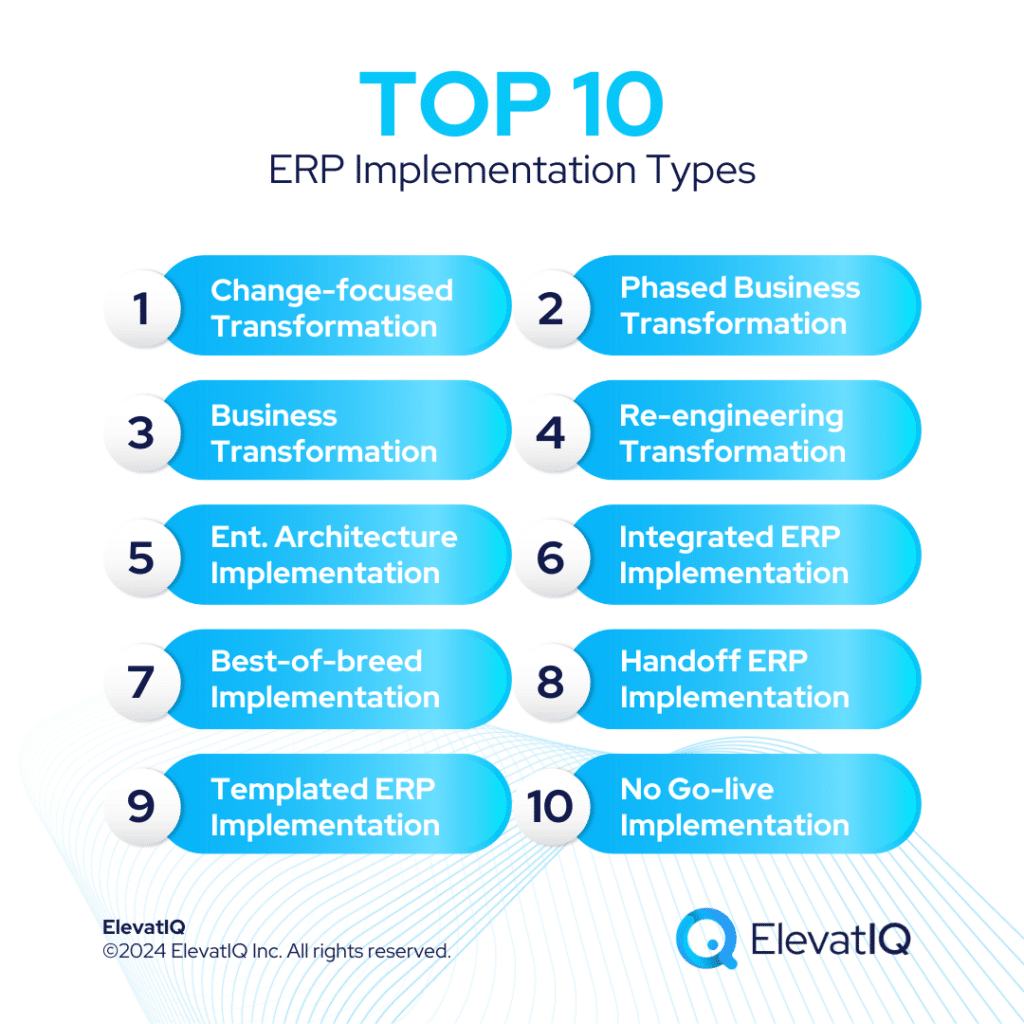

1. Change-focused Business Transformation Driven Selection

This ERP selection approach is perhaps the most comprehensive, taking the enterprise view, combining most cross-functional processes, and identifying key business transformation objectives. It starts with building a couple of process model versions: the first focused on user training and another on technical implementation. The as-is processes often combine financial forecasts, driving the to-be processes based on financial goals.

Due to their nature, either the private equity or the board will drive them – in the hope of a complete overhaul of business and financial operations. Depending upon the organization’s size, the CEO might lead these projects with the help of business transformation consulting firms. These projects might require substantial changes in the organizational structure, key personnel changes, business model transformation, reconfiguration of business processes, as well as operational capacity.

Covering the majority of cross-functional business processes, including order-to-cash, hire-to-retire, and forecast-to-deliver, they might implement these processes using one system. Or a couple of systems, including ERP, CRM, eCommerce, and BI, taking the enterprise view for the architecture. The projects might result in the selection of just one technology or a combination of technologies. The overwhelming nature of these projects requires a business transformation consulting firm to continue through the implementation phase to ensure success.

Pros

- Much higher chances of getting business results from technology investments

- Happy users with cross-functional alignment and adoption

- Lower technical and financial risks during the implementation phase

Cons

- Expensive

- The selection phase might take longer, demotivating champions hoping for short-term results.

- Requires commitment from the top. It can’t be done at the department level.

2. Business Transformation-Driven Selection

The major difference between business transformation-driven and change-focused ERP selection is that this one would not invest as much time in user-centric processes. It starts by identifying financial forecasts and KPIs and might document the process only from the technical and business perspective. The users might not be involved during the selection phase or may have limited involvement.

These projects are still driven at the CEO or board level due to the cross-functional changes and alignment required. Limiting the scope to only the business or technical issues, they might still use a business transformation consulting firm. While the process and data re-engineering may be done, it might not be successful. Why? Because users might not be willing to make changes because of their limited end-to-end visibility of drivers requiring these changes.

The limited documentation may lead to biased decision-making and users making assumptions. Including committing and then backing off due to their gaps in understanding. Like change-focused selection, this approach would cover all the cross-functional processes, taking the enterprise view for the architecture. The selection phase may require choosing different systems and technologies. The overwhelming nature of these projects requires a business transformation consulting firm to continue through the implementation phase to ensure success.

Pros

- Less expensive than change-focused business transformation due to the reduced time for user-centric processes

- Shorter implementation time than change-focused transformation

- Focus on the business drivers ensures alignment of business goals with technical implementation.

Cons

- The users might not accept the system, leading to data and process siloes.

- Longer selection phase than the functional ERP selection

- Requires commitment from the top.

3. Enterprise Architecture Replatform-Driven Selection

The major difference in this approach from the previous two is that this is a very technical implementation, ignoring the user and business transformation perspective. It might start by defining technical problem statements such as the outgrowth of current systems or digitally transforming processes. But doesn’t go through the financial analysis of identifying the KPIs or analyzing user-centric processes.

These projects are driven by IT or CIO with limited involvement of the business or users. Due to their perception of these projects being technical in nature and not yielding short-term results aligned with the compensation structure of business executives, IT teams might struggle to get traction from other business groups. Limiting the scope of the consulting firms, they might hire an independent ERP consultant to lead the selection.

While their projects are likely to have a sound enterprise architecture, they might fall short due to the lack of process and data re-engineering and over-bloatedness caused by the lack of control in changing business processes or data. Like the previous two approaches, this approach would cover all the cross-functional processes, taking the enterprise view for the architecture. The ERP selection phase may require choosing different systems and technologies. Due to the way this selection type is approached, even if a business transformation firm is involved, it might struggle to get business results.

Pros

- Technical issues such as master data governance may not be a problem.

- Shorter implementation time than business transformation-centric initiatives

- Time savings for business

Cons

- Adoption issues.

- Longer selection phase than the functional ERP selection

- The systems might be substantially over-engineered because of the missing process and data reengineering step

4. Functional Checklist Approach

The major difference in this approach from the previous ones is that this is a siloed functional implementation, ignoring the technical and integration perspective. It might start by defining business transformation objectives but does not dig deep enough to realign the data and processes meaningful for the technical teams. Due to the misalignment, the technical teams might completely ignore the recommendations provided by the selection consulting firm. The siloed perspective might lead to choosing an outdated technology, which might be functionally complete but never work for users because of the integration or master data issues.

These projects might be driven by CFO or controllers with limited involvement of other teams. The business executives might expedite the process to meet short-term business results, leading to substantial technical debt. Limiting the scope of the consulting firms, they might hire an independent ERP consultant to lead the selection.

Due to the missing technical and integration perspective, the overall admin efforts might increase in reconciling various ledgers and resolving integration issues. This selection approach would force every single process from the ERP lenses without capitalizing on the synergies offered through other best-of-breed systems. The ERP selection phase would require selecting only the ERP, delaying the other integration decisions for the implementation phase.

Pros

- Cheaper

- Faster

- Can be done at the department level

Cons

- Substantial technical debt and higher costs in the long term

- Increased work for operational teams in reconciling different data siloes and integration issues

- Higher chances of implementation failure, even after investing in the selection phase

5. Accounting/Fractional CFO Firms Led

Companies not familiar with the ERP industry often ask for advice from their current accounting or fractional CFO firms due to their fear of being non-compliant with tax authorities. While most accounting firms and fractional CFO firms might claim to be independent, they are not necessarily independent ERP consultants. These companies generally have internal practices for a few mainstream accounting systems and try to sell their IPs on top of that, making their business model similar to a VAR or ISV.

The business model of accounting and CFO firms generally revolves around creating manual reports and bookkeeping, so they will not include any solutions where they would earn reduced revenue for their services. Since these consultants may have implemented only a couple of systems, their selection advice is likely to be biased toward those systems.

These companies don’t run hundreds of ERP selection engagements every year. Not to mention tracking the evolution of the ERP systems and vendors on a daily basis. Ignoring other potentially relevant solutions, they might compare a couple of systems of their knowledge. They might also ignore other systems in the architecture, leading to bigger integration issues and creating a backlog that might drive much higher maintenance costs in the future.

Pros

- Cheaper

- Faster

- Can be done at the department level

Cons

- Biased selection approach towards their IP, revenue, and solutions of their familiarity

- Increased admin work in reconciling different ledgers

- Higher chances of implementation failure, even after investing in the selection phase

6. Business/Technology Consultants Led

In this approach, companies not familiar with the ERP industry might hire a business or technology consultant for the selection advice. Examples of such consulting companies would be IT companies, lean consulting firms, HR, or business process consulting firms. Since these consultants may have implemented only a couple of systems, their selection advice is likely to be biased toward those systems. Despite their claims to be independent, they are not necessarily independent ERP consultants, as they don’t run hundreds of ERP selection engagements every year. Not to mention tracking the evolution of the ERP systems and vendors on a daily basis.

Some of these companies might also have partnerships set up in the background and might recommend solutions where they might receive kickbacks. The easiest way to find out if a vendor is tied to any solution or not is to look at their content strategy. If the content strategy compares many different solutions and publishes a list of many providers, the ERP publishers won’t sign the partnership with them due to their fear of their IP falling into their competitor’s hands.

They might also ignore other systems in the architecture, leading to bigger integration issues and creating a backlog that might drive much higher maintenance costs in the future.

Pros

- Cheaper

- Faster

- Can be done at the department level

Cons

- Biased selection approach towards the solutions of their familiarity and where they will receive kickbacks

- Might drive substantial process overhead because of the increased work in reconciling different ledgers

- Higher chances of implementation failure, even after investing in the selection phase

7. Resellers Led

In this approach, companies not familiar with the ERP industry might engage with a reseller who might offer ERP selection advice for free (or at lower costs) in the hope of receiving kickbacks from the software provider they resell. Or earning the implementation business. They would structure the selection process in a way that favors their solutions. In the hope of locking down the customers with a contract, they might emphasize not spending much time during the selection process.

Ignoring other potentially relevant solutions, they might compare a couple of systems of their knowledge. They might recommend against most practices, such as process documentation or change management, as that will delay their deal. Since the process of re-engineering might be done only from the perspective of their tool, it might fire back if you use any other systems or tools that are not compliant with their ecosystem.

For example, going for another freight solution to get better deals on rates might throw off the architecture completely or force you to use the tool in their ecosystem that might not have the most friendly rates. They might also ignore other systems in the architecture, leading to bigger integration issues and creating a backlog that might drive much higher maintenance costs in the future.

Pros

- Might be free

- Faster

- Can be done at the department level

Cons

- The misguided selection process leans toward reseller’s systems

- Higher chances of ERP implementation failure due to selecting a system that does not fit

- Biased architecture may result in substantial operational efficiencies

8. Freelance Consultant Led

Offering ERP selection advice, these freelance consultants are generally ex-executives and hobbyists consultants. They might have a couple of ERP implementations under their belt but may not understand the ERP industry as well. Having implemented only a couple, their selection advice is likely to be biased toward those systems. While these companies might claim to be independent, they are not necessarily independent ERP consultants, as they don’t run hundreds of ERP selection engagements every year. Not to mention tracking the evolution of the ERP systems and vendors on a daily basis.

Savvy ERP vendors might not prefer to engage with them as they might be perceived to be affiliated with a solution or vendor, and they fear a biased selection process, leaving out potentially relevant solutions. They would not have enough data and insights to identify the red flags in the contracts or “selection gotchas” that you learn only if you track these systems on a daily basis. Some of these companies might also have partnerships set up in the background and might recommend solutions where they might receive kickbacks.

Ignoring other potentially relevant solutions, they might compare a couple of systems of their knowledge. They might also ignore other systems in the architecture, leading to bigger integration issues and creating a backlog that might drive much higher maintenance costs in the future.

Pros

- Might be free

- Faster

- Can be done at the department level

Cons

- The misguided selection process leans toward consultants’ expertise with few systems.

- Higher chances of ERP implementation failure due to selecting a system that does not fit

- Biased architecture may result in substantial operational efficiencies.

9. Affiliate Marketing Company Led

These companies are primarily content marketing companies that make money by selling qualified leads. Some of these companies might claim to be helping with ERP selection, but they are not necessarily the subject matter experts on ERP systems. Their recommendations are likely to be based on the providers in their network who are willing to pay for their lead-generation services.

By offering match-making services without technical and functional subject matter expertise, they generally work with OEMs and resellers and don’t charge their customers for the recommendations. Conducting hardly one interview of a few attributes to identify the ERP vendors, they would recommend ERP vendors. Their advice is not meant to be the selection advice, and they are most certainly not independent ERP consultants. Examples of such companies include G2, Capterra, Software Connect, Software Advice, Technology Advice, and many more.

Their role ends as soon as they make an introduction to the ERP vendors. Helping with process reengineering, contract analysis, or enterprise architecture would be a stretch for them.

Pros

- Might be free

- Easy way of shortlisting potential solutions

- A centralized place to learn about various solutions in the market

Cons

- Their recommendation might mislead your ERP selection

- No technical or functional expertise to be informed with recommendations

- Not really an ERP selection

10. Internally Managed

Companies implementing an ERP system for the first time underestimate the expertise required in selecting an ERP. Researching over the internet, they might follow generalized recommendations such as building a checklist, asking vendors to demonstrate the solutions, and selecting a system that might be fit.

Despite hiring additional capacity exclusively for the ERP project, the internal resources might struggle to build consensus due to the power struggle. Getting the attention of different internal groups due to the lack of their framework might be equally challenging. Finally, most teams might have preferences for a tool of their choice and might not be willing to give up on them to create a streamlined architecture.

Since the internal teams don’t track the ERP space on a daily basis, they generally have overarching assumptions in their model, such as assuming API means easier to integrate, or just because the company website says the tool is integrated with Salesforce, there wouldn’t be any surprises. What if the selected version of the ERP might not be compatible with this version of Salesforce? Assumptions such as this might fire back and make the cheapest deal the most expensive.

Pros

- Perception of it being cheaper

- Might be easier to collaborate with internal teams

- Can be done at the department level

Cons

- The internal team might take forever due to the missing framework

- Powerful forces might shut down other departments, leading to a biased selection process.

- Sweeping assumptions might drive much higher licensing fees and overengineered systems.

Final Words

Most ERP selection consultants feel that the ERP system is all about documenting and meeting the requirements. It’s actually the opposite. With enterprise systems, complying with requirements on their face value almost always leads to overengineered processes and overbudgeted projects. The prescriptive suggestion of software engineering to push back on the needs is often ignored by ERP selection consultants, who might not have a deep background in software implementation and engineering.

So if you are thinking of including an ERP selection phase, ensure you don’t treat it as any different than how you would approach a software development project. The SDLC phase has never been optional – and it will never be, regardless of whether you opt for modular assembly – or build from scratch. But most importantly, stay away from companies who walk away right after the ERP selection. Because the technical teams will likely shred those recommendations as soon as they take over, defeating the entire purpose of the ERP selection phase.