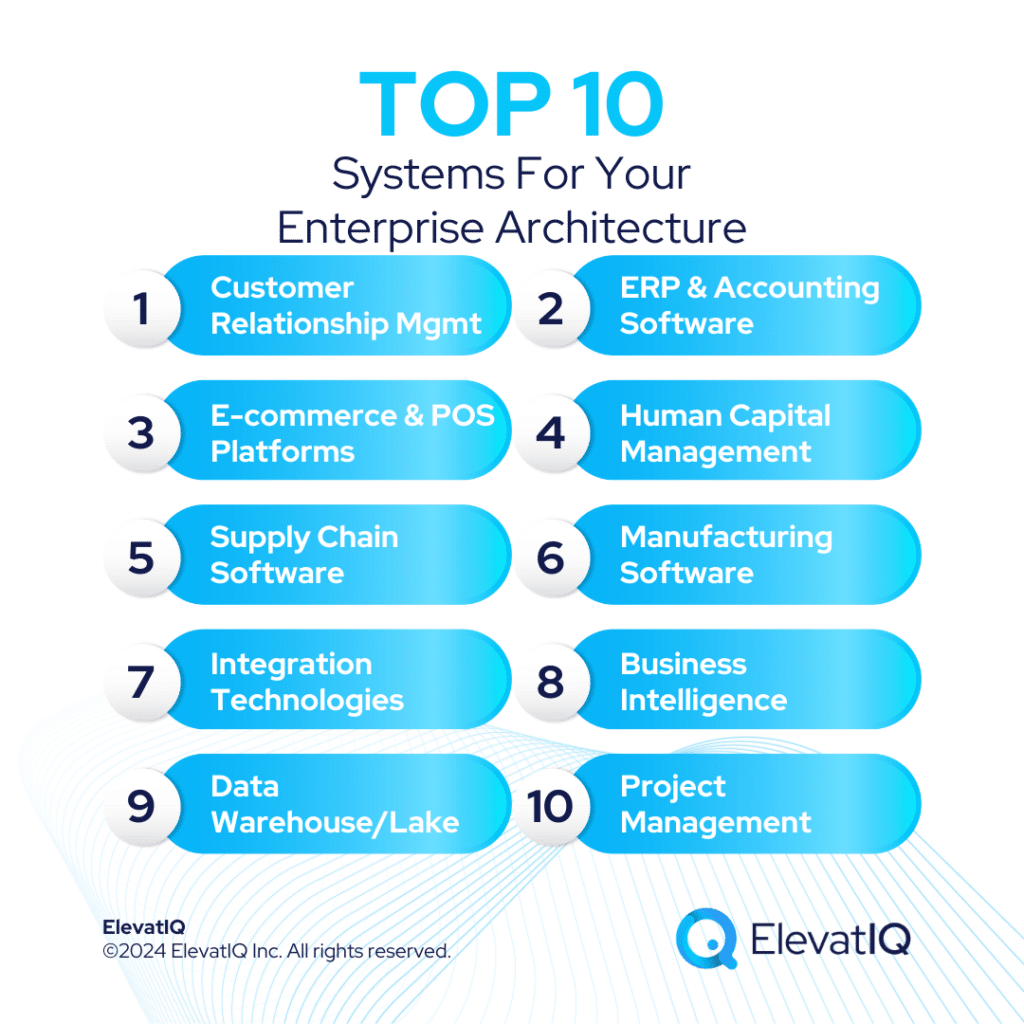

Top 10 Systems for Your Enterprise Architecture

Enterprise architecture is more than a technical concept. But what is enterprise architecture? Think of enterprise architecture as the connected business systems that drive your operational processes with four primary perspectives. 1) business architecture, 2) process architecture, 3) data/information architecture, and 4) system architecture. Generally, most industries have two choices when building their architecture. They can either buy a system or build it themselves. But regardless of whether you buy or build, your enterprise architecture is equally important.

Also, some people might feel that ERP might be the answer to all of their system issues. They might also feel that enterprise architecture is only relevant for larger companies. However, even ERP systems require a well-defined architecture around them. So, regardless of the organization’s size, the lack of architecture results in ERP implementation failure. As well as poor adoption of digital initiatives and unforeseeable business disruptions. Understanding the enterprise architecture and each system’s role is crucial for your digital journey. In this article, we have covered major systems that your architecture might need as you grow.

10. Project Management

- Which companies need to include PM as part of their enterprise architecture? In general, your enterprise architecture may not require project management software unless you execute these projects for your core business operations. For example, the ad-hoc engineering projects executed to improve processes or a CapEx building would not be part of your enterprise architecture. In other words, they can remain siloed. As far as the scope of enterprise architecture goes, these projects are applicable to businesses that sell them as their core offerings. These businesses include marketing agencies, defense contractors, sign manufacturers, or construction supply manufacturers.

- Why do you need project management software? Generally, most project-centric organizations seem to be human-resources-driven. And these projects need to be estimated accurately and monitored throughout the process to avoid financial loss. So this is the core reason why PM software is critical for these organizations.

- Who needs to interact with project management software? Most commonly, these projects typically serve many different stakeholders. It could include the subject matter experts or individual contributors. It could also include project managers, estimators, and financial executives interested in the financial health of the project.

- Which capabilities do you need in the project management software? Typically, the capabilities crucial in project management software include resource scheduling, project governance, procurement, and timesheet management. You might also choose to go for packages such as timesheet software vs. project collaboration software.

- What are the different options for project management software? Generally, there are two choices for project management software. For example, it can be standalone software or integrated with financials. In the startup phase, you might be OK with keeping it standalone. But as your project volume and scheduling complexity grow, you might need an option natively integrated with your financials.

9. Data Warehouse/Data Lake

- Which companies need to include data warehouses as part of their enterprise architecture? Generally, most SMB companies might not include a data warehouse in their architecture. Because the operational systems crucial for their workflow take priority. However, once you have multiple systems in your architecture and struggle to get 360 degrees of your business due to the disparate data sources, you might need to include it in your architecture.

- Why do you need data warehouse software? Typically, companies require a data warehouse when they need to consolidate insights from multiple systems, external or internal. Moreover, the drivers for data warehouses could be regulatory or forecasting. As well as for enabling decision support systems. It can also help them with historical data that is unavailable through their operational systems. Historical data typically gets lost when operational systems are replaced.

- Who needs to interact with data warehouse software? In general, there are several stakeholders for data warehouse software. But the primary consumer would either be a BI tool. Or data scientists who might further augment the data and feed it back to the BI tool.

- Which capabilities do you need in the data warehouse software? Depending upon the use case, several technologies are available to build a data warehouse or lake. But the most basic ones would be a separate data store. As well as ETL technology to move data nightly. The ETL technology helps avoid the impact on the operational performance due to the overhead exerted by the ETL pull.

- What are the different options for data warehouse software? Generally, there are numerous technologies available to build data warehouses. But the easiest one would be to rent data warehouse capabilities, available through major cloud providers such as Azure, AWS, or GCP.

8. Business Intelligence (BI, S&OP, CPM, and ODP)

- Which companies need to include business intelligence as part of their enterprise architecture? Typically, companies need business intelligence systems such as S&OP, CPM, and operational data platforms. They need it when they might have business performance issues such as inventory, cash flow, or waste in the manufacturing process. However, these systems are often siloed in SMB organizations unless offered pre-integrated with the ERP, etc. But as the complexity of your architecture and systems increase, you might need to integrate them.

- Why do you need business intelligence software? Mostly, these analytical systems have pre-built workflows. These workflows can augment your datasets or allow additional dimensions such as seasonality to be added. They might also provide you with insights that might be harder with operational systems. It might be harder due to the rigidness of their data structure and impact on operations. In general, the role of business intelligence is to provide interactive analytics from data that you may have in your data warehouse.

- Who needs to interact with business intelligence software? The consumers of business intelligence software are typically business users who need additional insights and KPIs for their workflow.

- Which capabilities do you need in the business intelligence software? Generally, the main capabilities required in business intelligence software would be interactive analytics. And the analytical workflows to facilitate collaboration among business users.

- What are the different options for business intelligence software? Typically, several options are available, with some offering their internal data store for the temporary storage of interim datasets. And the options could also be function specific. For example, a separate tool might be available for S&OP. Or the tool may offer connected planning as part of the suite.

7. Integration Technologies

- Which companies need to include integration technologies as part of their enterprise architecture? Unless you have siloed systems or maintain everything in one system without additional channels, you may require an iPaaS. On the other hand, workflow collaboration would be an additional layer on top of the core operational architecture. You need it to enable master data control and ad-hoc workflows. Generally, Workflow collaboration tools don’t impact the enterprise architecture as much unless they are overused or overengineered.

- Why do you need integration technologies? Essentially, integration technologies allow you to keep all your integration code in one place. Without an iPaaS, your choice would be to keep the integration code inside the source or destination system. And due to the additional overhead required, this choice may be more expensive to maintain over time. They might also be prone to bugs as the source and destination systems upgrade their interfaces. Additionally, the integration technologies allow safeguards if systems operate at different speeds.

- Who needs to interact with integration technologies? Mainly, the integration technologies are used by developers or admins who need to ensure that integration flows work as expected.

- Which capabilities do you need in the integration technologies? In general, the integration technologies must support various integration patterns such as HTTP, FTP, or Queue-based. It must also allow building an orchestration layer to transform and massage data in different formats.

- What are the different options for integration technologies? Generally, there are several options available depending on the budget and capabilities. For example, if the company doesn’t want to utilize an iPaaS, they might host integration code in their existing data center or write it inside the source or destination system.

6. Manufacturing Software/MES

- Which companies need to include manufacturing software as part of their enterprise architecture? Typically, These systems are applicable to manufacturing companies. They might use a separate MES system or a collection of tools that might serve a similar function as an MES. They also need a MES system if they have real-time integration with machines. We also need to collect and process operational data to optimize shop floor workflow. On the other hand, CAD, engineering, and R&D software typically have minimum impact on the enterprise architecture. The only cases where they might have an impact are when they need to be integrated with the operational flow to minimize data entry.

- Why do you need manufacturing software? Since the shop floor is the primary cost driver for manufacturing companies, they need different tools to improve shop floor productivity. As the maturity of the shop floor and the order volume increase, they might need to integrate their shop floor technologies more.

- Who needs to interact with manufacturing software? Typically, the primary stakeholders are plant floor users, supervisors, and manufacturing executives who need them for their operational workflow.

- Which capabilities do you need in the manufacturing software? In general, the shop floor capabilities might include scheduling and in-process inspections. As well as real-time integration and control of the machines, and engineering and R&D workflows.

- What are the different options for manufacturing software? Mostly, the options could be siloed manufacturing software if your accounting function is completely siloed and disconnected from operations. It could also include an MES in conjunction. With an ERP, or a standalone manufacturing ERP (depending upon the company’s operational complexity).

5. Supply Chain Software (P2P, WMS, and TMS)

- Which companies need supply chain software? It would depend upon your business model. If you have an extremely busy warehouse, WMS might be the first system you might introduce even before an ERP system. As the complexity of your business grows and order volume increases, you will be adding several specialized systems to your enterprise architecture, including TMS and P2P. Generally, systems such as strategic sourcing may not have as much impact on the enterprise architecture and can remain siloed.

- Why do you need supply chain software? Most ERP systems may not be as efficient for warehouse or transportation operations. For example, suppose the out-of-the-box processes of ERP aren’t sufficient to meet the desired efficiency. Or integration requirements with warehouse equipment. In that case, you might need a specialized warehouse or transportation system.

- Who needs to interact with supply chain software? Generally, the primary consumer of the supply chain systems would be warehouse operators and supervisors, logistics managers, and operations executives.

- Which capabilities do you need in the supply chain software? The capabilities could be as simple as barcode scanning, rate shopping, or full-blown supply chain control tower capabilities to monitor the entire supply chain.

- What are the different options for supply chain software? You have several options for supply chain management, with some software offering end-to-end traceability, including any exceptions as goods move through the supply chain. However, as the system complexity increases, you might need to select a specialized system for each area of the supply chain where you might have the most issues in your processes.

4. Human Capital Management

- Which companies need to include human capital management as part of their enterprise architecture? Most companies start with essential payroll software that might be clubbed with an accounting system. However, as the number of employees grows in the organization and depending upon the criticality of human resources and compliance needs, you might need a specialized HCM system. The HR and HCM systems can remain siloed for SMBs as they don’t impact the enterprise architecture much. However, the integration may be required if you have HCM processes embedded as part of your operation flow, such as sales comp calculation.

- Why do you need human capital management software? They need a specialized HCM system to meet each state and country’s compliance and reporting requirements. Generally, HR managers have one of the most complex recruiting, onboarding, and learning workflows, which drives the need for a specialized HCM system.

- Who needs to interact with human capital management software? The primary consumers of the HCM systems are employees, HR managers, and finance executives.

- Which capabilities do you need in the human capital management software? The capabilities of an HCM system could include onboarding, training, skill development, performance management, and recruiting.

- What are the different options for human capital management software? The options for HR and HCM could include simple payroll software or a full-blown HCM system to manage the needs of the entire HR department.

3. E-commerce and POS Platforms

- Which companies need to include digital commerce as part of their enterprise architecture? Most companies selling products or services through retail locations or virtually would require several tools to enable their sales process. For example, if the order volume is too low, they might process the orders directly in the ERP or accounting software.

- Why do you need digital commerce software? If digital is your primary customer acquisition channel, you need tools designed to be efficient for the channel. For example, a POS system is designed for faster processing at retail locations. eCommerce platforms, on the other hand, have several capabilities tailored to the needs of digitally-savvy customers.

- Who needs to interact with digital commerce software? These tools are primarily used by the sales and marketing teams to interact with and find customers.

- Which capabilities do you need in digital commerce software? At a minimum, you need a content and commerce management system that allows you to build a decent web presence and optimize the site for search engines. Then, you might have more robust needs, such as digital asset management and a digital experience platform. It will also provide a product information management system to support experiences such as buy-online-pickup-in-store and omnichannel.

- What are the different options for digital commerce software? There are several options available depending upon the digital maturity of the organization. As you grow your digital presence and revenue, you will be including specialized software such as product information management or digital experience management.

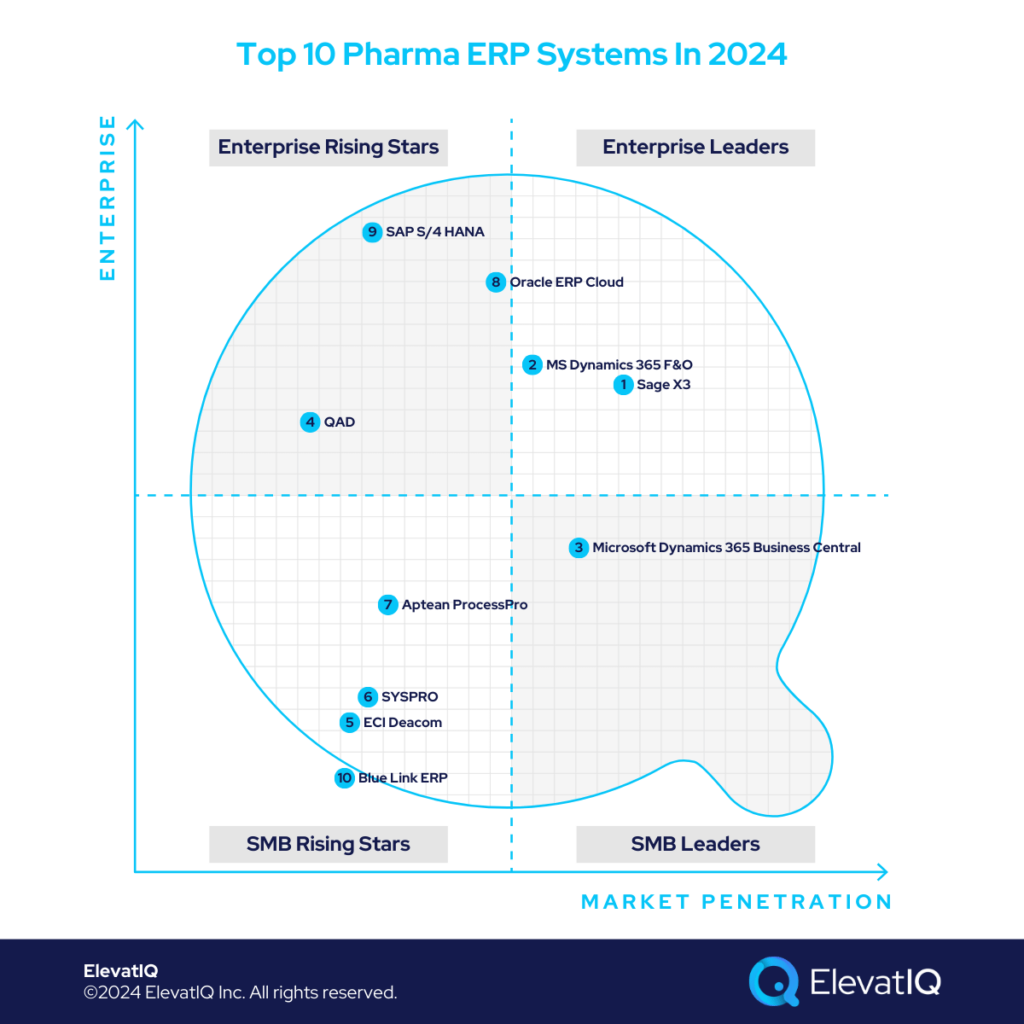

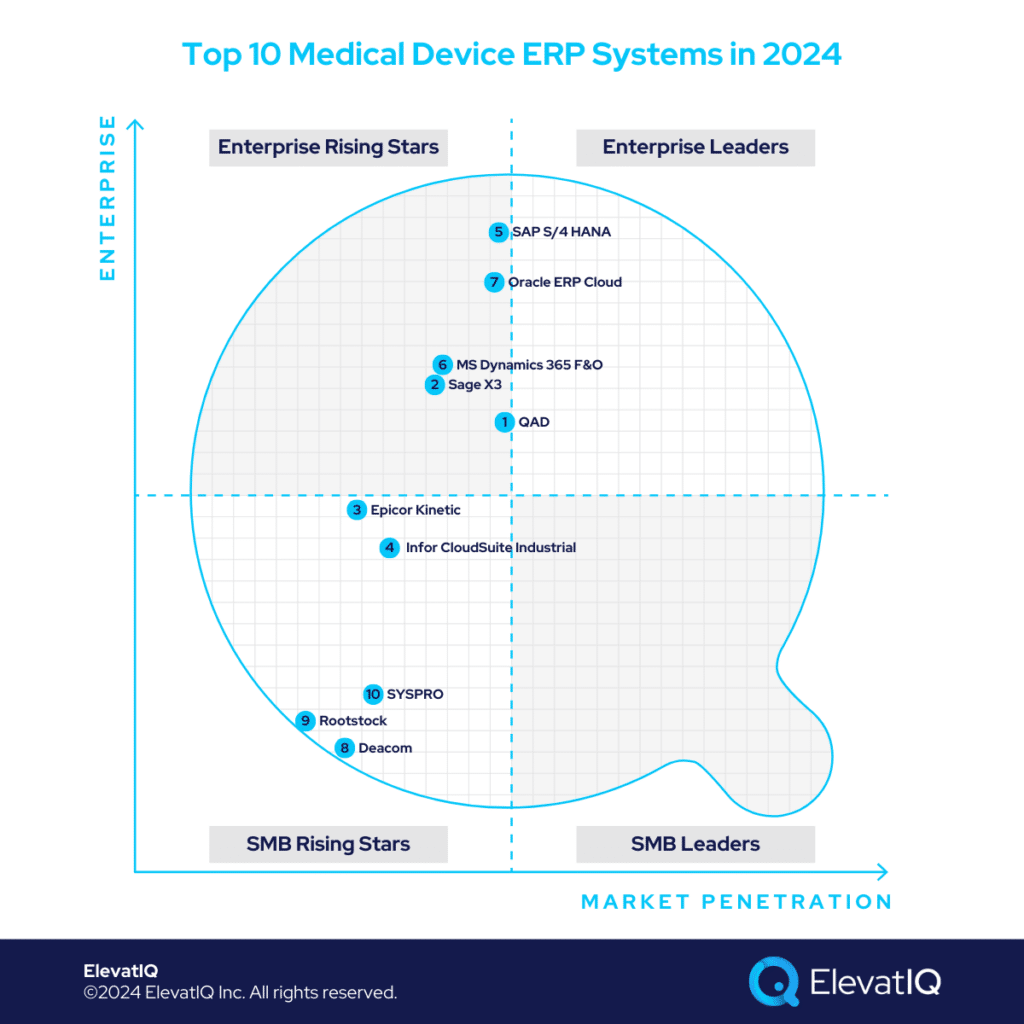

2. ERP and Accounting Software

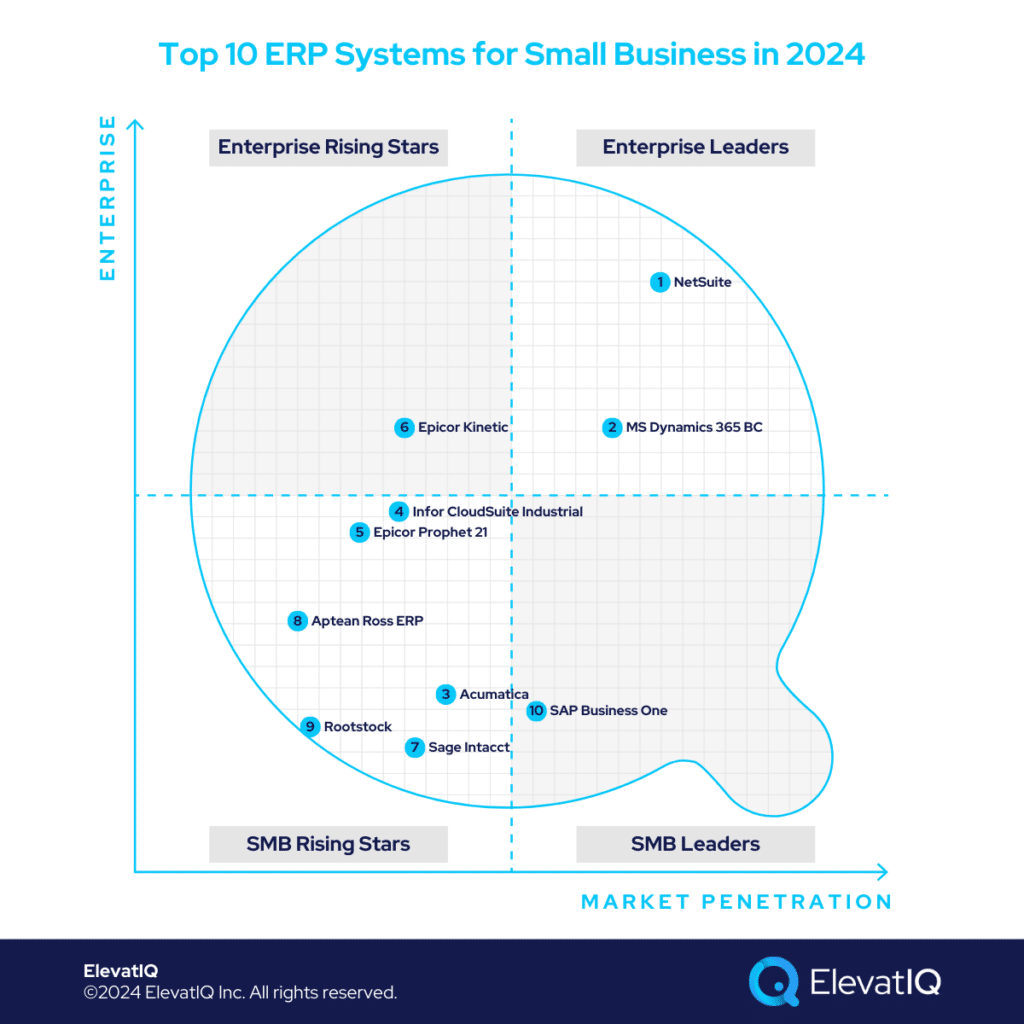

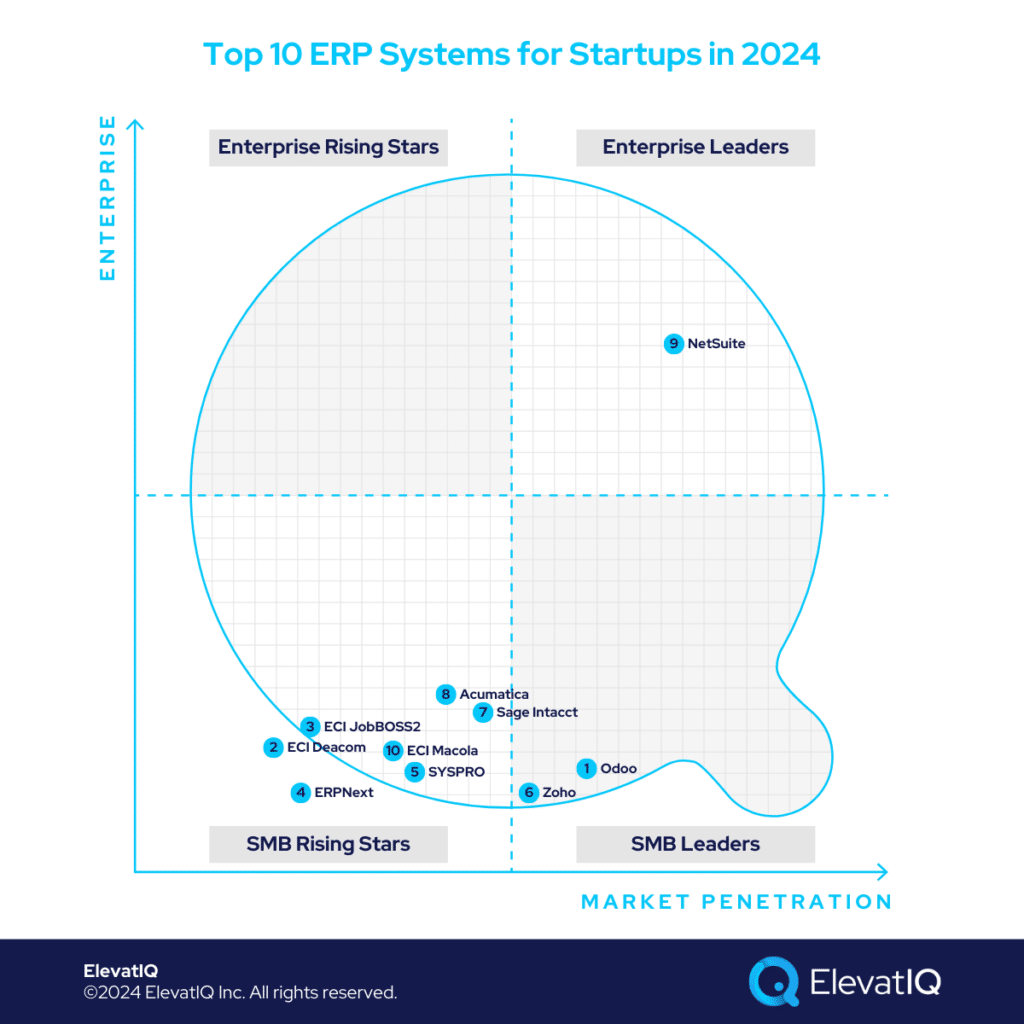

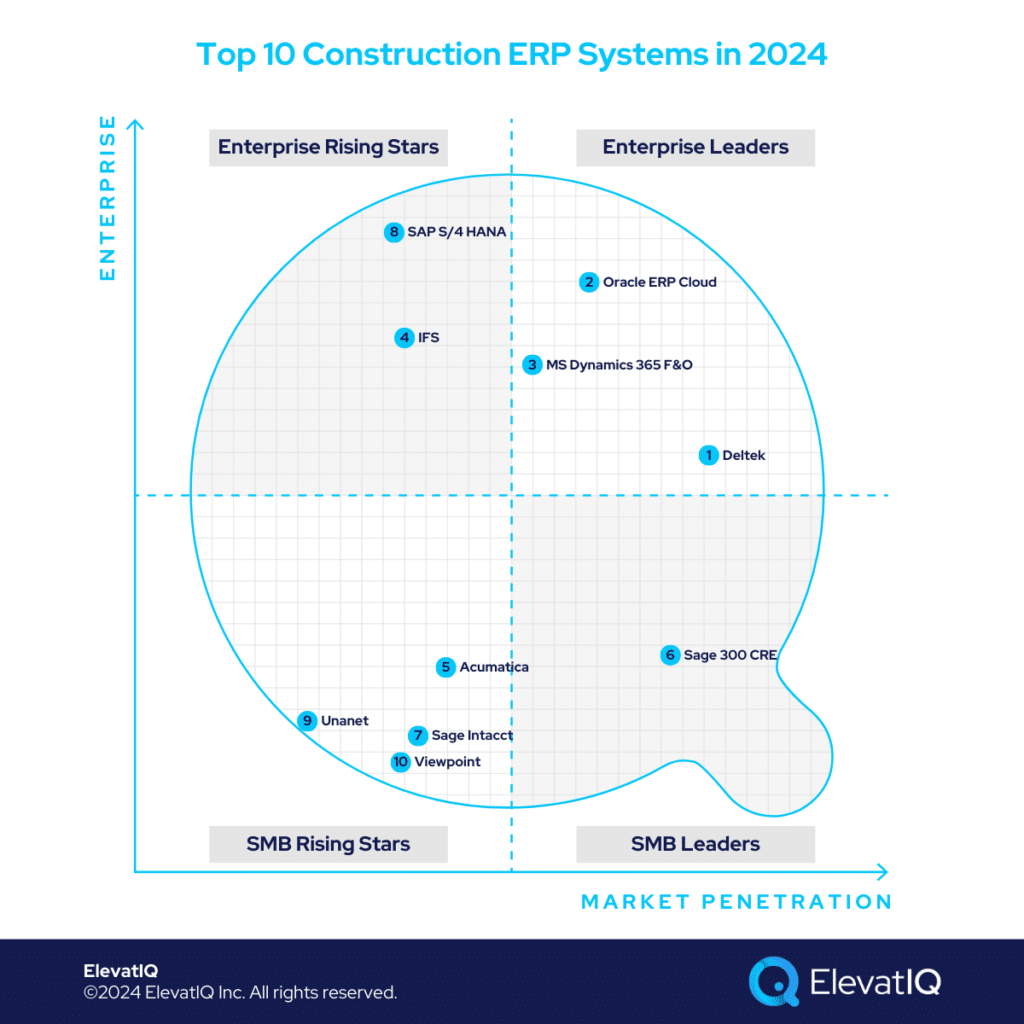

- Which companies need to include ERP as part of their enterprise architecture? The companies need an ERP system when siloed systems become a bottleneck to their growth and require substantial admin efforts to enter data in multiple systems. Companies that might be below $10 million in revenue might be able to manage without a fully integrated ERP.

- Why do you need ERP software? The ERP systems are designed for a cross-departmental operational workflow where the alignment of multiple functions such as sales, finance, procurement, and operations is necessary to deliver goods and services timely. And the ERP systems offer cross-departmental insights and KPIs that would be inaccurate and require substantial efforts with siloed systems.

- Who needs to interact with ERP software? Everyone who touches the operational core, including sales, operations, finance, and procurement, might interact with an ERP system.

- Which capabilities do you need in the ERP software? At a minimum, an ERP system could include sales order processing, AR, AP, GL, purchase order processing, cost accounting, manufacturing, and project management. ERP systems typically don’t have operational capabilities for HR, marketers, and sales. Instead, they might use specialized software that integrates with ERP, such as HCM or CRM, for their operational workflow.

- What are the different options for ERP software? There are several options available as the maturity of an organization grows, starting from essential accounting software to full-blown ERP systems. These systems might be able to manage most operational workflows where departments might overlap financially.

1. Customer Relationship Management

- Which companies need to include CRM as part of their enterprise architecture? The smaller companies start with a standalone CRM system to manage their customer interactions until the point of order processing. Then, as the order volume grows, the CRM must be integrated with the ERP and eCommerce systems.

- Why do you need CRM software? CRM systems manage the entire workflow for sales and marketers during the pre-sales process. It starts with marketing automation, lead follow-up, and opportunity tracking. As well as quoting, customer journey builder, and marketing spend tracking. And finally, sales planning and forecasting, as well as territory management, are important.

- Who needs to interact with CRM software? The primary consumer of CRM software is sales and marketing teams.

- Which capabilities do you need in the CRM software? When you start, a small CRM with primary lead distribution and account tracking capabilities may be sufficient. But as you grow, you need more advanced marketing automation, territory planning, and quote management capabilities.

- What are the different options for CRM software? Several options are available, starting from standalone software for CRM and marketing automation. But as you grow, you will need at least the entire sales and marketing function to be integrated with at least light integration with the ERP system.

Conclusion

With these systems, you are touching the surface of the complexity of enterprise architecture. As the technologies mature and operational complexity increases with ever-growing customer expectations, the enterprise architecture will likely play a more significant role in the enterprise system design.

So when you are looking at a new system next time, think about how the system might fit in the architecture. And what you need to do to ensure that the data integrity across your enterprise architecture is maintained. And hopefully, this post has given you some insights into how each system fits into the digital architecture.