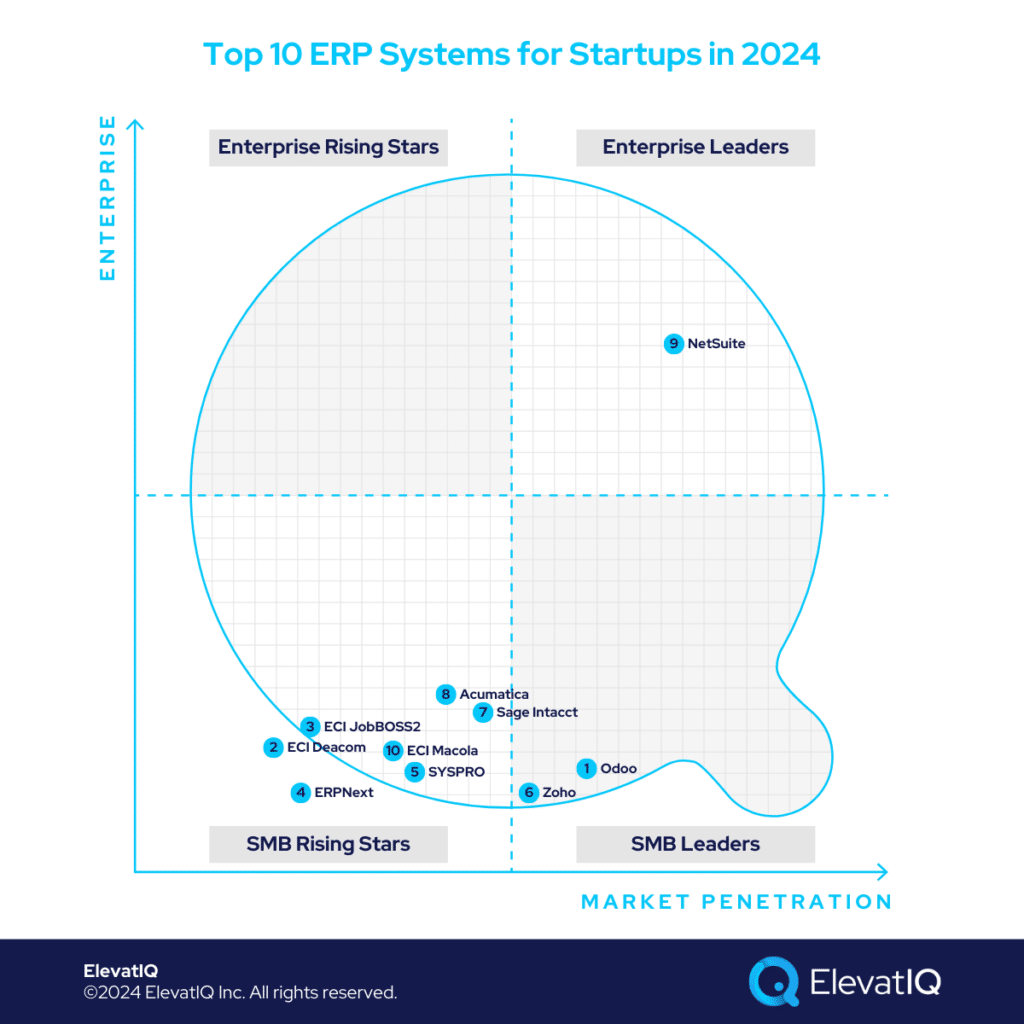

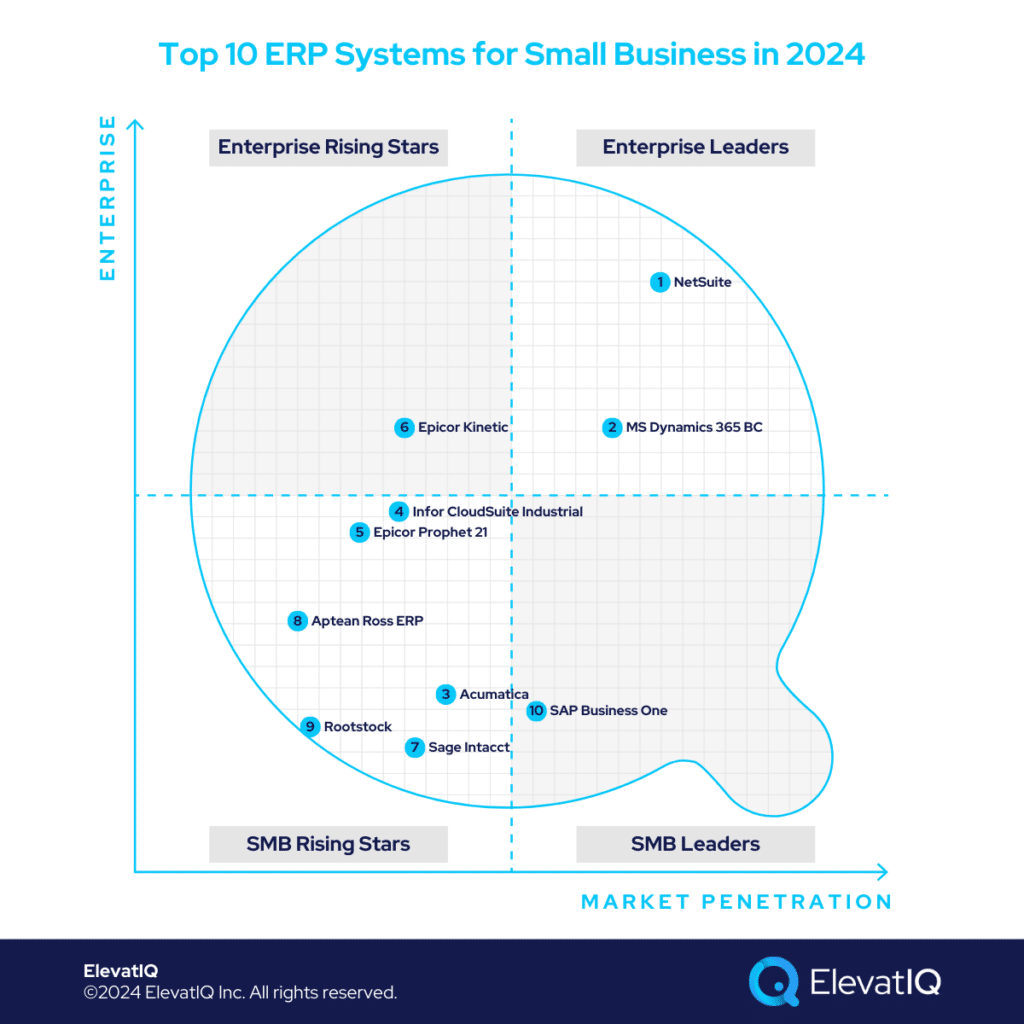

Top 10 ERP Systems for Small Business in 2024

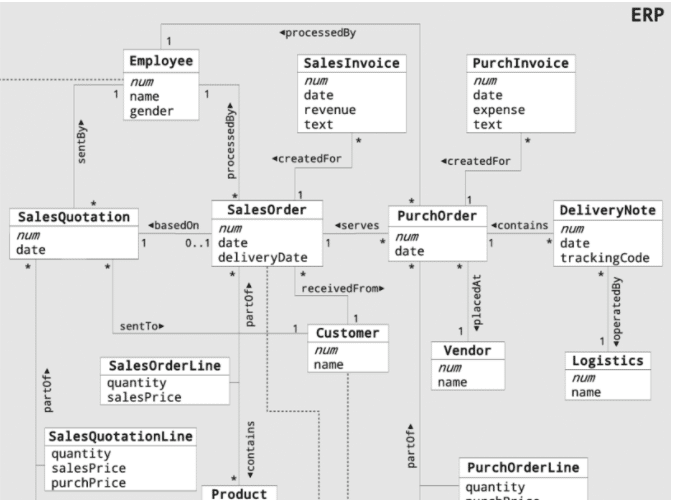

As businesses evolve beyond the startup phase, they often resort to employing various disjointed solutions, even if ERP may be part of their architecture. ERP adoption at this stage is primarily centered around financial reporting and basic transactions. The budget constraints of the previous stage lead to the creation of ad-hoc processes and unique data models, urging the need for streamlining to sidestep financial challenges at the next inflection point. Additionally, the expansion of departments introduces overlaps in responsibilities, making finding ERP systems for small business uniquely challenging.

To meet KPIs and delivery expectations, batch capabilities become pivotal at this stage. The increased workload arising from reconciling disconnected data silos and managing ad-hoc processes prompts exploration of process re-engineering and tightly integrated processes. This also triggers the consolidation of critical point solutions requiring tighter alignment of cross-functional processes, particularly those involving inventory. Inventory accuracy and financial control gain significance, especially if the small business is now owned by a private company with aggressive M&A and growth plans, necessitating a superior ERP implementation, often requiring expert assistance.

While a micro view is important at this stage of ERP selection, complete automation of planning, procurement, and scheduling may not be a critical focus. Additionally, if executive teams lack experience in such transformations, they might not fully appreciate their value. Their tactical perspective and critical success factors are likely to guide them toward systems aligning with their priorities and current needs. So, which ERP systems are best suited for smaller businesses?

Criteria

- Definition of small organizations. $10-100 mil in revenue or 25-300 employees. Low implementation budget up to $100K. No appetite for integration or custom development. Some systems and processes could remain siloed. Little to no planning is needed.

- Overall market share/# of customers. The higher the market share among small organizations, the higher it ranks on our list.

- Ownership/funding. The more committed the management to the product roadmap, the higher it ranks on our list.

- Quality of development. The more cloud-native capabilities, the higher it ranks on our list.

- Community/Ecosystem. The larger the community with a heavy presence from small organizations, the higher it ranks on our list.

- Depth of native functionality for specific industries. The deeper the publisher-owned out-of-the-box functionality, the higher it ranks on our list.

- Quality of publicly available product documentation. The poorer the product documentation, the lower it ranks on our list.

- Small business market share. The higher the focus on small organizations, the higher the ERP system ranks on our list.

- Ability to natively support diversified business models. The more diverse the product, the higher it ranks on our list.

- Acquisition strategy aligned with startups. The more aligned the acquisitions are with the small organizations, the higher they rank on our list.

- User Reviews. The deeper the reviews from small organizations, the higher the score for a specific product.

- Must be an ERP product. It can’t be an edge product such as QuickBooks, Freshbooks, Xero, Zendesk, HubSpot, or Salesforce. It also can’t be an add-on owned by ISVs or VARs that sits on top of other accounting platforms.

10. SAP Business One

SAP Business One proves excellent for smaller companies prioritizing financial control over extensive operational features, particularly suitable for companies in geographies where other operationally rich ERP solutions might not be available. In contrast to DIY-friendly options like Odoo or Zoho, SAP Business One has more detailed ERP layers but not as detailed as those found in NetSuite or Acumatica.

The cloud version lacks the deep industry functionality inherent in the on-premises version, especially in contrast to specialized solutions like Aptean Ross. Diversified business models, such as equipment dealerships, seeking robust field service capabilities may find SAP Business One less accommodating than alternatives like Acumatica or Prophet 21. Due to a perceived lack of momentum in the SAP Business One portfolio, a slight downgrade has been made, yet it retains its position at #10 of top ERP systems for small Business.

Strengths

- Global Capabilities. Ideal for companies in geographies where other operationally rich solutions might not be accessible.

- Financial traceability and governance workflows built with the product. The transactional maps to track complex multi-entity workflows are built as part of the product.

- Power of HANA. Companies with complex product mixes and resource-intensive product models, such as serial number processes, may require the power of HANA even for smaller operations.

Weaknesses

- Behind in cloud capabilities. The cloud version is not as rich operationally as the on-prem variant, requiring third-party add-ons and code base from VARs.

- The cloud ecosystem is not as developed as its on-prem variant. The cloud ecosystem doesn’t have as many companies investing in add-ons and integration.

- Lack of SAP’s commitment to the SMB market. SAP’s focus is on retaining its enterprise market, which puts the SMB market at a disadvantage.

9. Rootstock

Utilizing the Salesforce platform, Rootstock, alongside SAP Business One, MS Dynamics 365 Business Central, and Epicor Prophet 21, caters to distributors and project-centric custom manufacturers. Particularly attractive to companies on the Salesforce platform, Rootstock faces limitations inherent in the Salesforce platform. Newer CRM systems, including Salesforce, lack the same database-level referential integrity enforced by traditional ERP systems. While enhancing the user experience for sales and marketing teams, this design may pose financial control challenges.

Rootstock’s current implementation base is limited, relying on various apps within the Salesforce ecosystem, thereby elevating integration and maintenance risks. Additionally, issues like the disconnected reporting layer in Salesforce contribute to a less cohesive experience compared to newer ERP systems. Despite these considerations, Rootstock maintains a strong position for smaller businesses, securing its spot at #9 on our list of top 10 ERP systems for small businesses.

Strengths

- Salesforce-native experience. The transition would be easier for companies already using the Salesforce platform for other departments.

- Pre-integrated with other best-of-breed Salesforce apps. The transactional maps to track complex multi-entity workflows are built as part of the product.

- Cloud-native and mobile-friendly. Companies with complex product mixes and resource-intensive product models, such as serial number processes, may require the power of HANA even for smaller operations.

Weaknesses

- Data integrity and financial control issues. CRM-friendly data models bypass the database-level referential integrity, potentially causing financial control issues.

- Limited install base. The current install base of Rootstock is substantially limited compared to other solutions positioned for smaller companies.

- Limited consulting base and ecosystem. While Rootstock leverages the Salesforce ecosystem, the companies that would deeply understand Rootstock IP are limited.

8. Aptean Ross ERP

Aptean Ross ERP caters to process manufacturers and distributors with extensive requirements for traceability, formulation, and nutrient support. Similar to Epicor Prophet 21, Aptean Ross ERP has undergone rearchitecting to incorporate cloud-native functionality.

While not as globally localized, Aptean Ross ERP excels in providing deeper operational functionality tailored to specific industries. Positioned between larger solutions like Sage X3 and Microsoft Dynamics 365 Business Central and smaller ones like Odoo or Zoho, Aptean Ross requires consulting support for setup and implementation.

Given its targeted focus on specific industry verticals, Aptean Ross ERP may face challenges with companies with diversified business models. Despite these considerations, Aptean Ross ERP retains its position at number 8 on our list of the top 10 ERP systems for small businesses.

Strengths

- Last-mile capabilities for the process industry. The last-mile capabilities, such as recipes, formulation, and batch production capabilities, are pre-baked as part of the solution.

- Pre-integrated essential bolt-ons. Supported and maintained by Aptean. But don’t forget to vet pre-baked workflows for your use cases.

- Relatively Cloud-native. While legacy, the solution is available as a cloud version, making it easier for smaller companies to implement ERP without worrying about IT.

Weaknesses

- Limited consulting base and ecosystem. The consulting base is limited to Aptean, and since Aptean is privately equity-owned, the support and professional services may not be as friendly as those of family-owned businesses.

- Clunky technology underneath with potentially poorer documentation. Since it’s not a complete rewrite, it retains the legacy code base, exception flows, data model, and documentation.

- Limited focus. Companies that are diverse with their business model or active in the M&A cycle might outgrow the solution quickly, requiring another implementation.

7. Sage Intacct

Distinguished from other options, Sage Intacct holds a unique market position, concentrating on service-centric sectors like oil and gas, construction, utility, non-profit, and media. While lacking the extensive operational capabilities of Acumatica or NetSuite for product-centric industries, Sage Intacct boasts enhanced multi-entity functionality tailored to its design and target market.

However, Sage Intacct falls short of Acumatica’s versatility in supporting diverse business models such as manufacturing, distribution, field service, and construction. Born in the cloud ERPs like Acumatica and NetSuite, Sage Intacct features a modern interface akin to Acumatica or Microsoft Dynamics 365 Business Central. Positioned beyond smaller startup solutions like Odoo or Zoho, Sage Intacct necessitates consulting assistance for setup and configurations.

Despite these considerations, Sage Intacct maintains its position at number 7 on our list of the top 10 ERP systems for small businesses.

Strengths

- Great as a corporate financial ledger. The accounting and financial capabilities are enterprise-grade to support global financial operations in one database while using best-of-breed solutions or ERP in the 2-tier setting.

- Last-mile capabilities for service-centric organizations. Service-centric organizations have very unique needs, such as revenue recognition, partner accounting, and subscription accounting, which are pre-baked with the solution.

- Cloud-native. The technology is cloud-native, with modern APIs to integrate with best-of-suite offerings.

Weaknesses

- Limited focus. The core capabilities, especially for inventory-centric organizations, are substantially limited, making it more of a best-of-breed enterprise-grade cloud accounting solution as opposed to a true ERP.

- Overly complicated security and macro capabilities that smaller companies might not find as valuable.

- Integration challenges for smaller companies. The reliance on external CRM and field service software causes challenges with integration and maintenance in the long run.

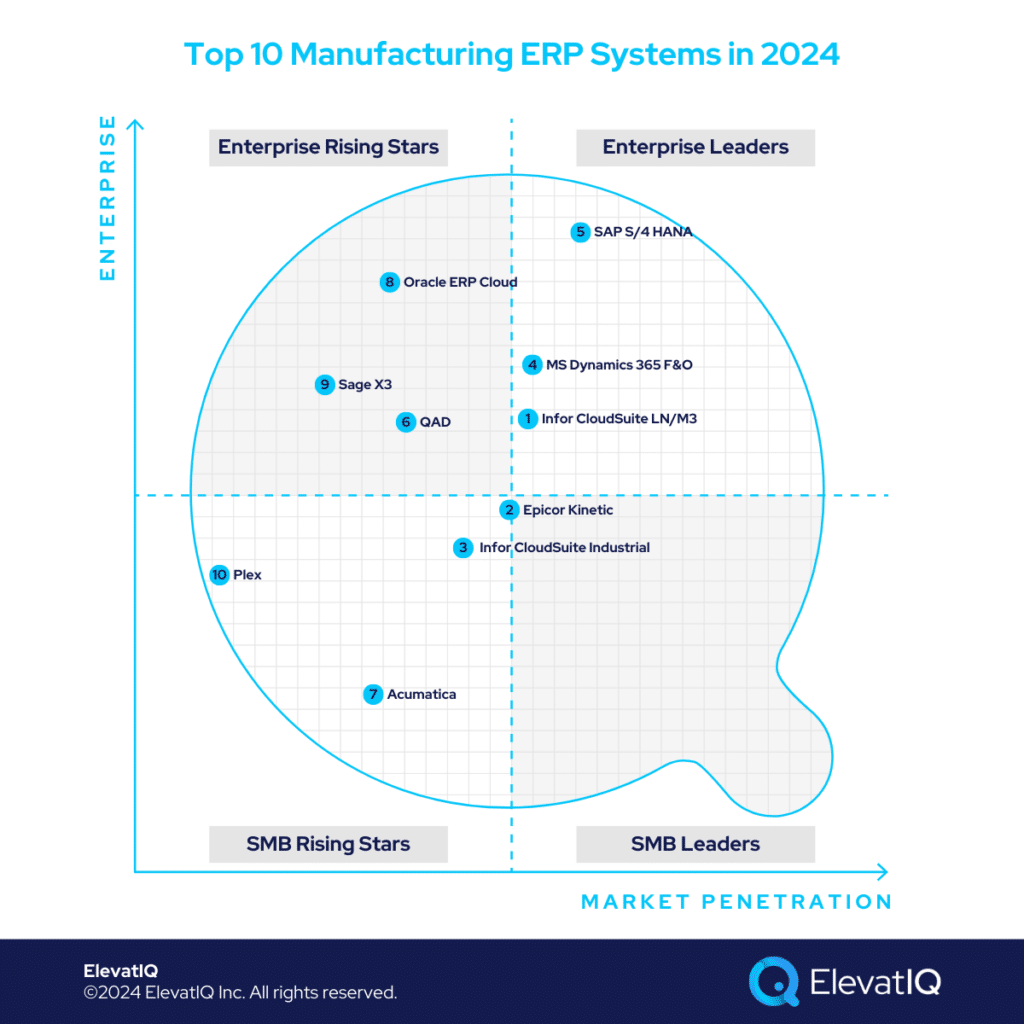

6. Epicor Kinetic

Epicor Kinetic serves as a specialized manufacturing solution, catering to hybrid manufacturing scenarios that demand formal manufacturing processes and intricate inventory management, particularly in sectors like metal, automotive, and aerospace. Tailored for organizations straddling manufacturing, construction, and distribution, Epicor’s core processes uniquely suit this intersection.

The modernized Epicor Kinetic boasts mature cloud capabilities, including enterprise search, setting it apart from its legacy counterparts. While laden with operational features for larger enterprises, its focus remains limited, potentially presenting an overly complex data model for smaller organizations with constrained implementation budgets. Offering out-of-the-box MES functionality, Epicor Kinetic appeals to smaller companies seeking pre-integrated Industry 4.0 capabilities without hefty consulting expenses. As a result, Epicor Kinetic secures the 6th position on our list of the top 10 ERP systems for small businesses.

Strengths

- Great for formal manufacturing organizations. The manufacturing organizations that follow formal manufacturing processes with revision numbers would relate to the product more.

- Last-mile capabilities for complex manufacturing organizations. 90% of the capabilities required by verticals such as metal, automotive, and aerospace are pre-packaged with the core platform.

- Mature cloud capabilities. Although a legacy product, it includes mature cloud capabilities such as enterprise search and transactional maps for end-to-end transactional traceability.

Weaknesses

- Requires consulting help to be successful with the product. The data layers are highly detailed, requiring substantial consulting help to be successful with the product.

- Limited focus. The limited focus on certain business models poses the risk of requiring other ERP systems to support complex and diverse business operations.

- Limited ecosystem and consulting base. The consulting base is highly limited, primarily relying on Epicor’s professional services for consulting and support.

5. Epicor Prophet 21

Epicor Prophet 21 caters to smaller industrial distributors, offering deeper operational functionality despite being less globally and locally oriented than SAP Business One or Microsoft Dynamics 365 Business Central. Its out-of-the-box capabilities make it a preferred choice for smaller distributors aiming to avoid expensive integration and custom development risks. Although distribution-focused, it lacks the diversification seen in other solutions on this list that cater to various business models like industrial manufacturing or field service capabilities.

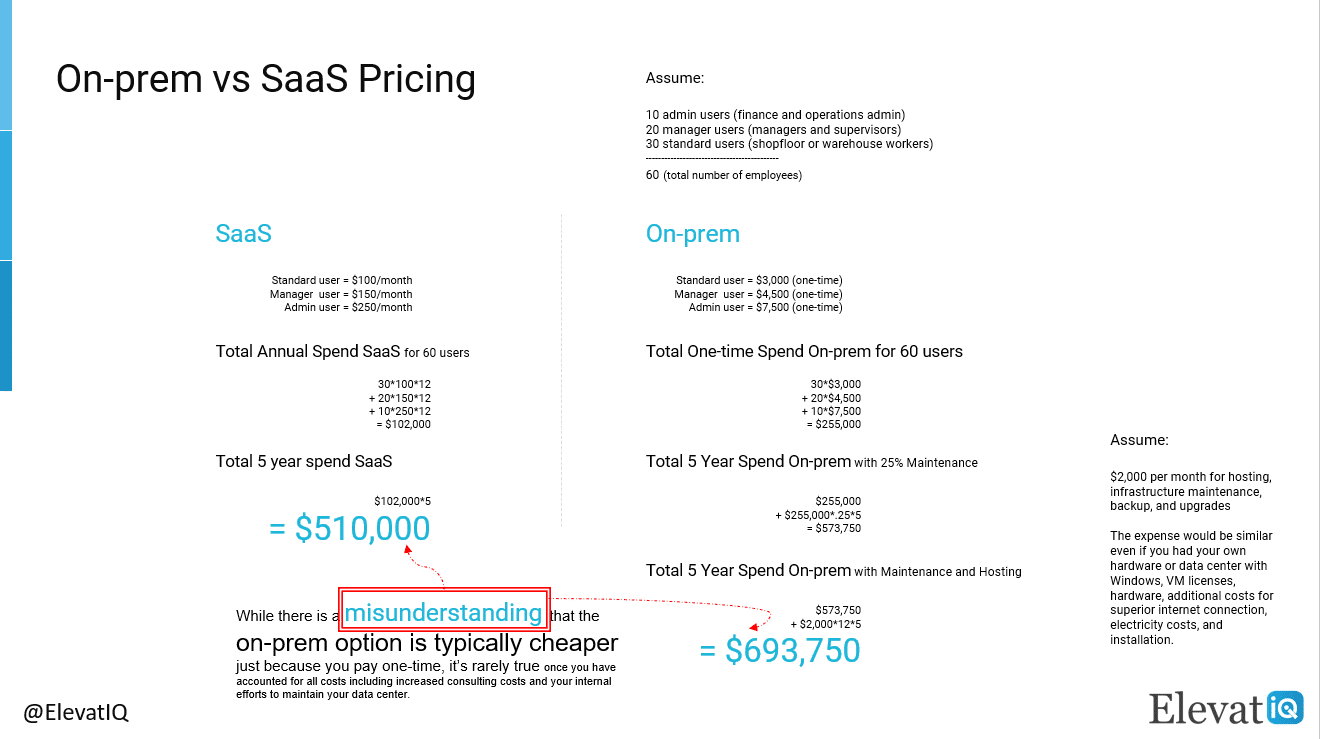

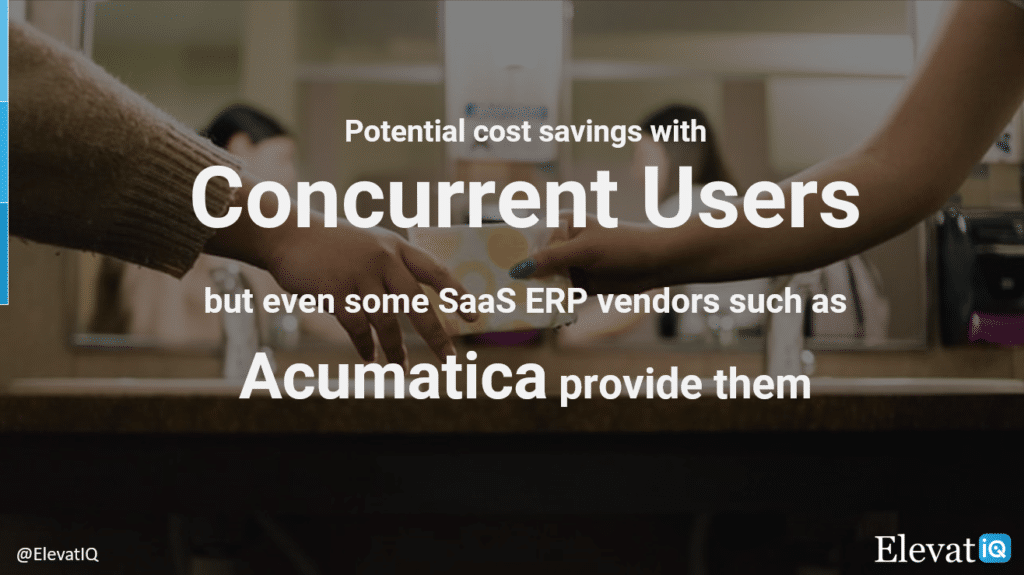

While Epicor Prophet 21 has undergone a rearchitecture with the Epicor Kinetic UX framework, a significant portion of the code remains legacy. The SaaS version offers concurrent users, potentially reducing costs for companies with multiple shift workers reutilizing licenses. Despite legacy aspects, it maintains its position at number 5 on our list of the top 10 ERP systems for small businesses due to its strong presence in buying groups.

Strengths

- Ideal for industrial distributors. Last-mile capabilities include support for buying groups and complex kits, with light manufacturing built as part of the product.

- Ecosystem integration in the industrial space. Epicor Prophet 21 has pre-baked integration with most tools prevalent in the industrial distribution space, such as eCommerce platforms.

- Mature cloud capabilities. Although a legacy product, it includes mature cloud capabilities such as enterprise search.

Weaknesses

- Requires consulting help to be successful with the product. The data layers are highly detailed, requiring substantial independent ERP consulting help to be successful with the product.

- Limited focus. The limited focus on certain business models poses the risk of requiring other ERP systems to support complex and diverse business operations.

- Limited ecosystem and consulting base. The consulting base is highly limited, primarily relying on Epicor’s professional services for consulting and support.

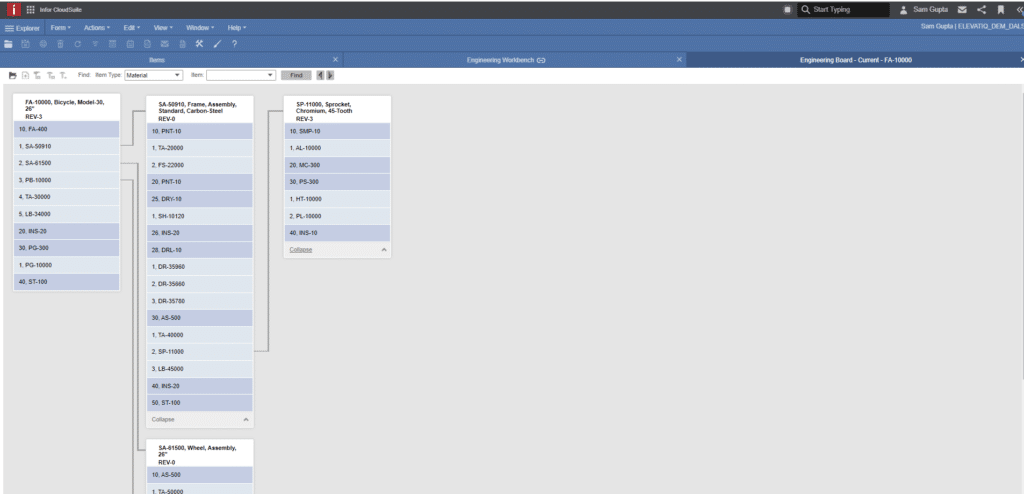

4. Infor CloudSuite Industrial

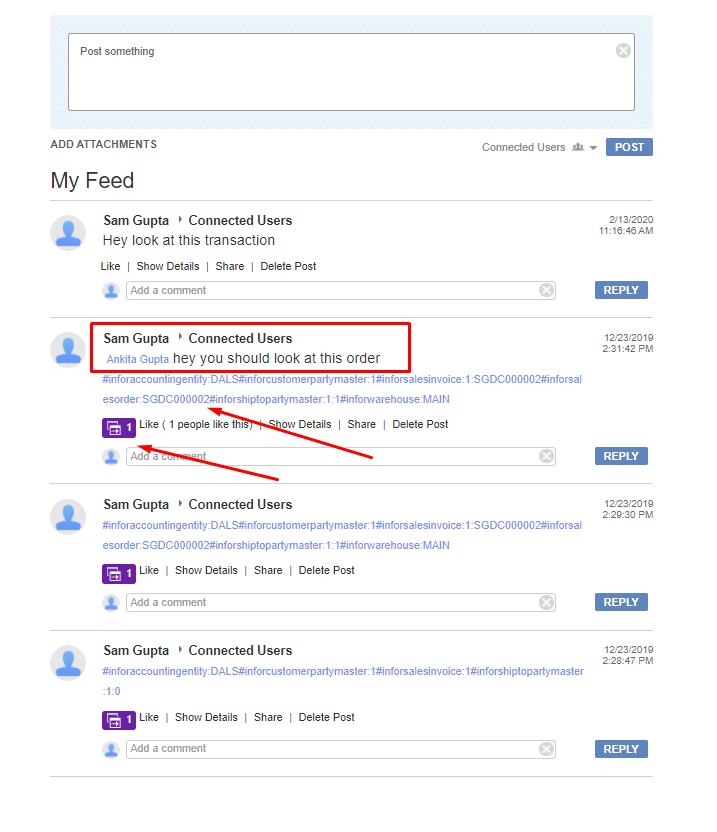

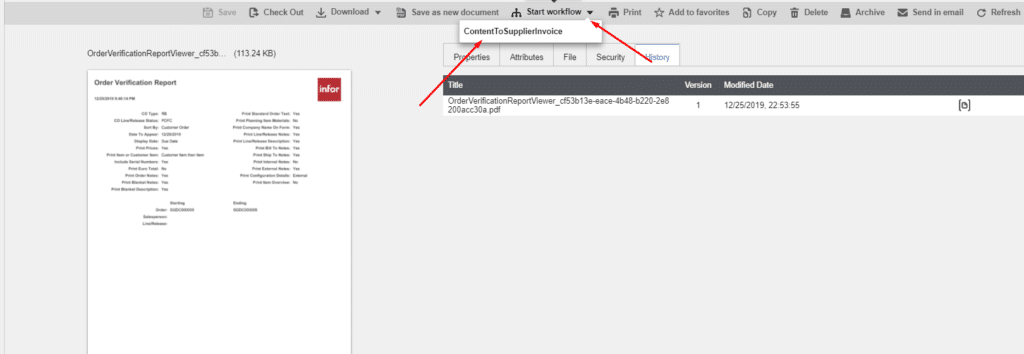

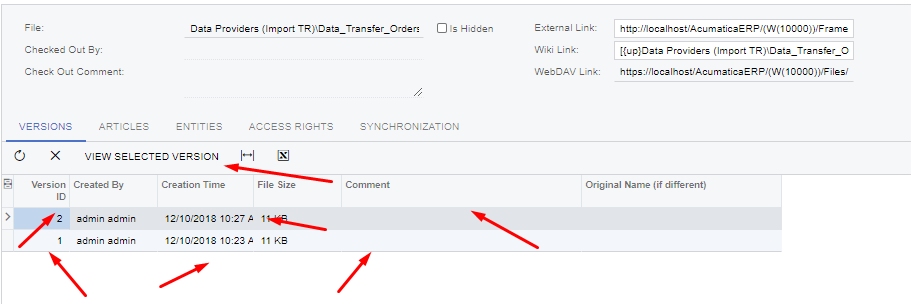

Infor CloudSuite Industrial stands out as a robust solution for larger OEMs engaging in mix-mode manufacturing. Unlike Acumatica or NetSuite, it surpasses them in size, offering comprehensive support for multi-entity structures and global operations. With inherent capabilities for diverse manufacturing processes like JIT and Kanban, Infor CloudSuite Industrial eliminates the need for numerous add-ons. Additionally, it includes Infor OS, facilitating seamless integration with other Infor products like Infor WMS and Infor CRM.

Although larger than startup-focused solutions such as Odoo or Zoho, Infor CloudSuite Industrial, tailored for manufacturing, may require assistance from a consulting company. It may not be the ideal choice for businesses with hybrid models like manufacturing and distribution or distribution and construction. Despite these considerations, Infor CloudSuite Industrial maintains its position at number 4 on our list of the top 10 ERP systems for small businesses.

Strengths

- Ideal for industrial manufacturers. The data model is especially friendly for companies with or without formal manufacturing processes with complex field service operations.

- Last-mile capabilities. Mixed-mode manufacturing capabilities, especially for manufacturers that might require all modes of manufacturing, including ETO, MTO, or MTS.

- Infor OS. Unlike other systems on this list, Infor OS doesn’t require a separate license for external iPaaS tools to integrate with external applications.

Weaknesses

- Requires consulting help to be successful with the product. The data layers are highly detailed, requiring substantial consulting help to be successful with the product.

- Limited focus. The limited focus on certain business models poses the risk of requiring another ERP system to support complex and diverse business operations.

- Limited ecosystem and consulting base. The consulting base is highly limited, primarily relying on a limited number of Infor resellers.

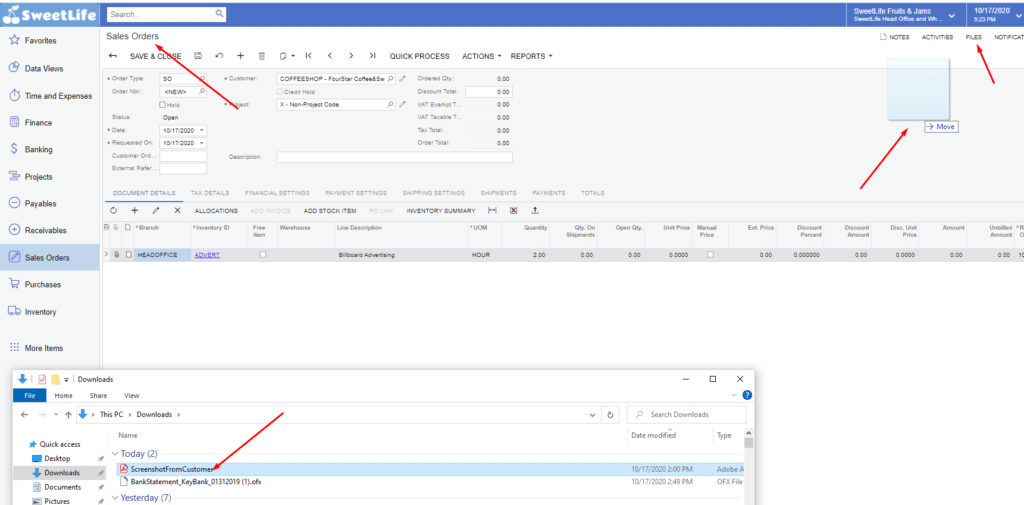

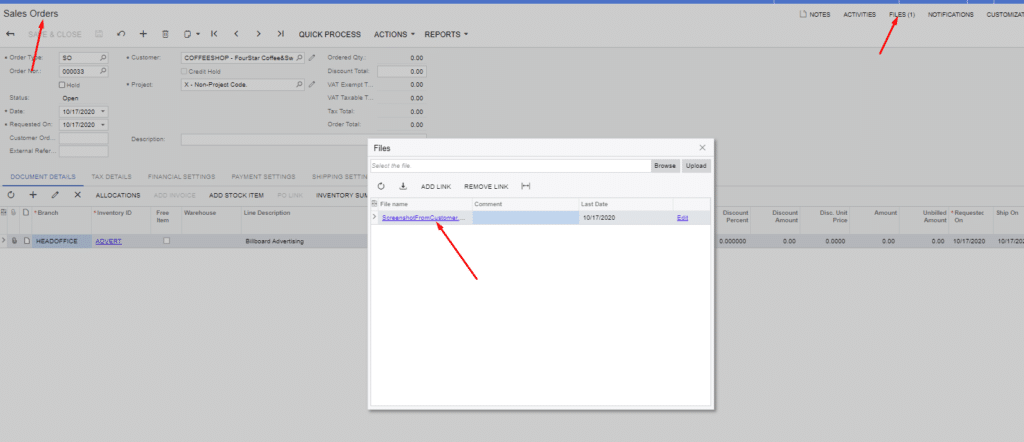

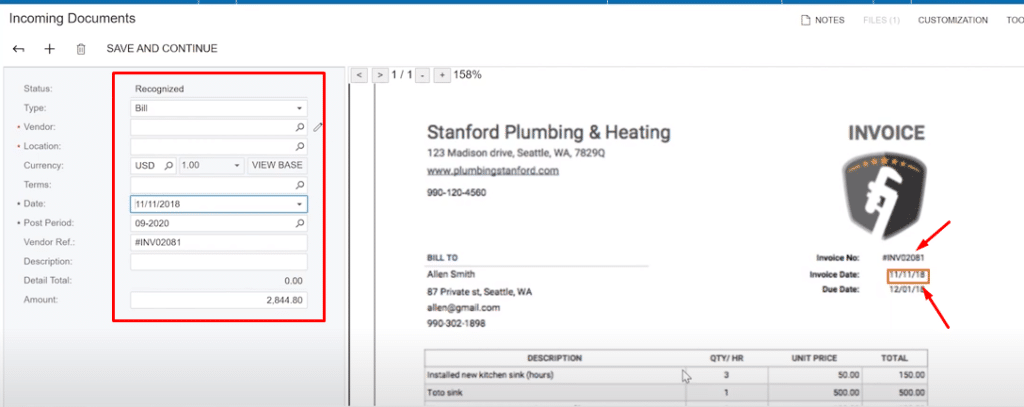

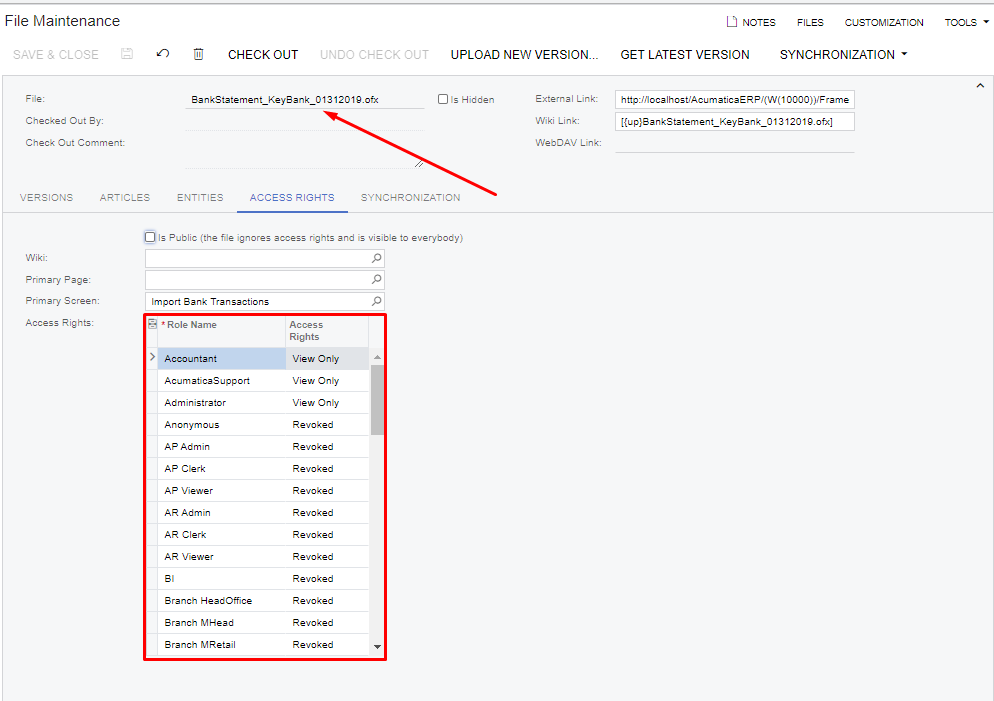

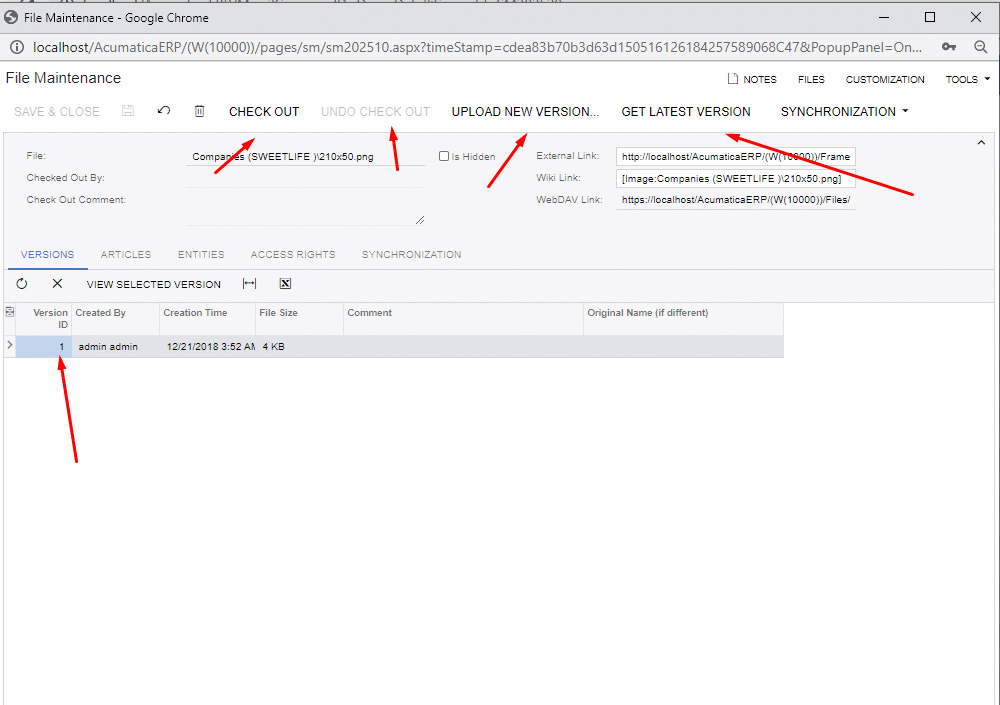

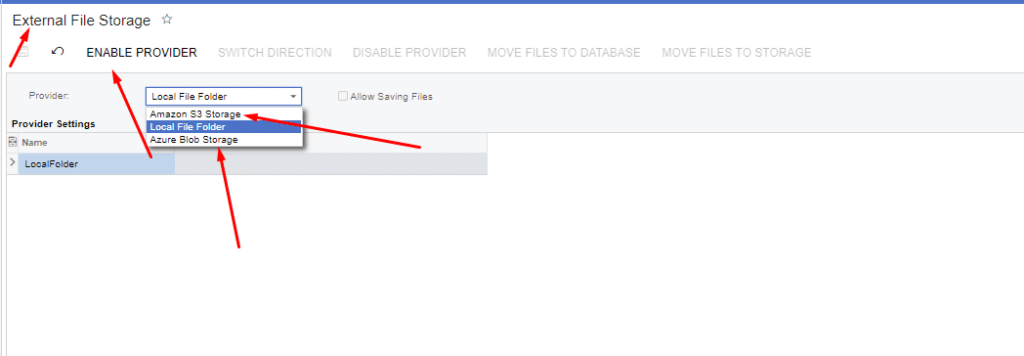

3. Acumatica

Acumatica, akin to NetSuite and Sage Intacct, is a cloud-native ERP solution with extensive multi-branch capabilities spanning manufacturing, distribution, construction, and field service, all consolidated in a single database. This broad functionality distinguishes Acumatica from more specialized solutions like Epicor Kinetic, Epicor Prophet 21, and Infor CloudSuite Industrial.

Despite its focus on small businesses, Acumatica lacks robust globalization and localization features, catering to a limited number of countries by default. This simplicity, however, benefits smaller companies by avoiding unnecessary layers of multi-entity operations. While well-suited for operations in countries like the US, UK, and Australia, Acumatica’s scope is restricted compared to solutions providing localized capabilities in more regions. Although targeting small businesses, Acumatica surpasses Odoo or Zoho in scale, necessitating consulting help for implementation. These aspects solidify Acumatica’s standing at #3 on our list of the top 10 ERP systems for small businesses.

Strengths

- Rich operational capabilities packaged in one database. Business models as diverse as field service, manufacturing, construction, and distribution in one database.

- Cloud-native, with the experience being very similar to other SAAS products, such as Salesforce or Quickbooks.

- Deep batch capabilities. While some solutions on this list might not have scalable layers for batch operations, the Acumatica data model is friendly for most 1:N capabilities companies seeking to decouple and optimize their operations.

Weaknesses

- Requires consulting help to be successful with the product. The data layers are highly detailed, requiring substantial consulting help to be successful with the product.

- Limited global application. Acumatica is relevant only in certain countries where they might have localization supported.

- Limited mature last mile capabilities. While Acumatica has a vibrant marketplace to augment its core capabilities, the last-mile capabilities required for manufacturing or industrial distribution might be limited.

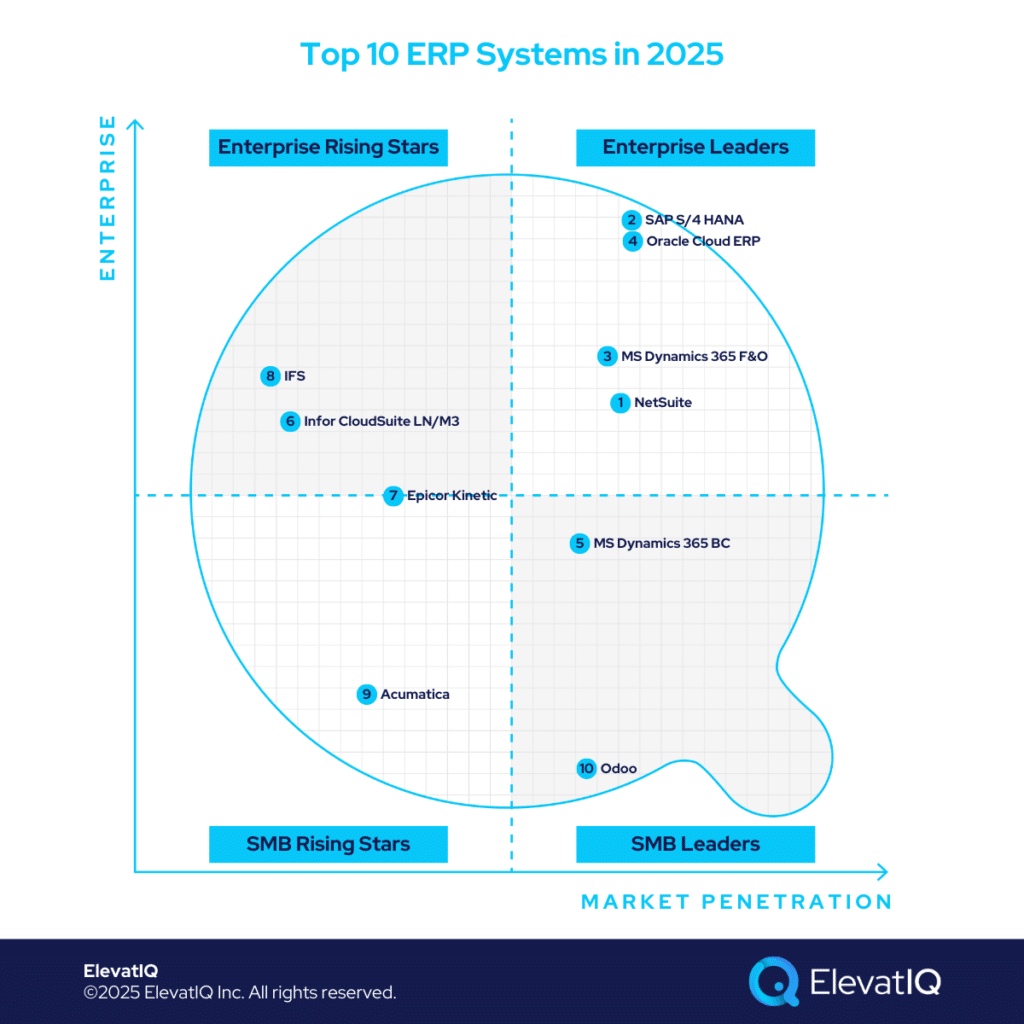

2. Microsoft Dynamics 365 Business Central

MS Dynamics 365 Business Central excels for diverse businesses in the service and product-centric industries. It is especially friendly for holding and private equity companies trying to streamline their entire portfolio on one solution. While the operational capabilities might be limited, its vibrant marketplace can fill the gap for most industries, making it a truly diverse ERP system in the small business space.

It is also one of the most localized and globalized solutions with a consulting base present in most countries, making it a truly global solution to keep all global entities without requiring another ERP because of the diversity or outgrowth of the business model because of active M&A activities. Because of these reasons, Microsoft Dynamics 365 Business Central retains its position at number 2 on our list of the top 10 ERP systems for small businesses.

Strengths

- Diverse capabilities.Supports multiple industries and business models and pre-baked integration for the best-of-breed CRM and field service solutions.

- Ecosystem, with consultants present in most countries and solutions available to augment the core capabilities of most industries.

- Global capabilities. Supported and actively installed in most countries globally, making it a true global ERP for smaller businesses.

Weaknesses

- Requires consulting help to be successful with the product. The data layers are highly detailed, requiring substantial consulting help to be successful with the product.

- The channel is not as regulated. The Microsoft channel is very complex, without any direct support for its resellers and partners, making navigating the Microsoft channel extremely hard.

- Limited mature last mile capabilities. While Microsoft Dynamics 365 BC has a vibrant marketplace to augment its core capabilities, the last-mile capabilities required for manufacturing or industrial distribution might be limited.

1. NetSuite

NetSuite stands out as a globally adopted and diverse solution for smaller businesses. While it boasts strong financial capabilities for both public and private sectors, the experience can be patchy due to the legacy interface despite being a cloud-native ERP. Scalability issues with data layers make NetSuite challenging to implement in spaces like manufacturing and industrial distribution. However, it excels for holding companies and private equity firms streamlining their portfolio companies on one solution.

In contrast to Acumatica, NetSuite, like SAP Business One and Microsoft Dynamics 365 Business Central, excels in deep globalization, covering over 100 countries with country-specific apps for regulatory compliance. While startups may be enticed by its introductory offer, NetSuite’s scale demands consulting help, setting it apart from simpler solutions like Odoo or Zoho. NetSuite maintains its position as the number 1 choice on our list of the top 10 ERP systems for small businesses.

Strengths

- Diverse capabilities.Supports multiple industries and business models with pre-baked integration flows available through Celigo.

- Ecosystem, with consultants present in most countries and solutions available to augment the core capabilities in most industries.

- Global capabilities. Supported and actively installed in most countries globally, making it a true global ERP for smaller businesses.

Weaknesses

- Requires consulting help to be successful with the product. The data layers are highly detailed, requiring substantial consulting help to be successful with the product.

- Weaker data model. The data model is not as structured as with SAP or Acumatica, making it harder to understand and follow.

- Limited mature last mile capabilities. While NetSuite has a vibrant marketplace to augment its core capabilities, the last-mile capabilities required for manufacturing or industrial distribution are extremely limited.

Conclusion

Defining SMB can be subjective, yet small companies share specific needs upon outgrowing the startup phase. Limited budgets and expertise hinder expensive integrations, requiring comprehensive functionality within the suite.

When evaluating an ERP solution as a small company, avoid smaller solutions for startups or larger ones for mid-size enterprises. Identifying the right-sized solution is crucial for a successful implementation. Taking the help of an independent ERP consultant might go a long way to finding a solution uniquely tailored to your needs.