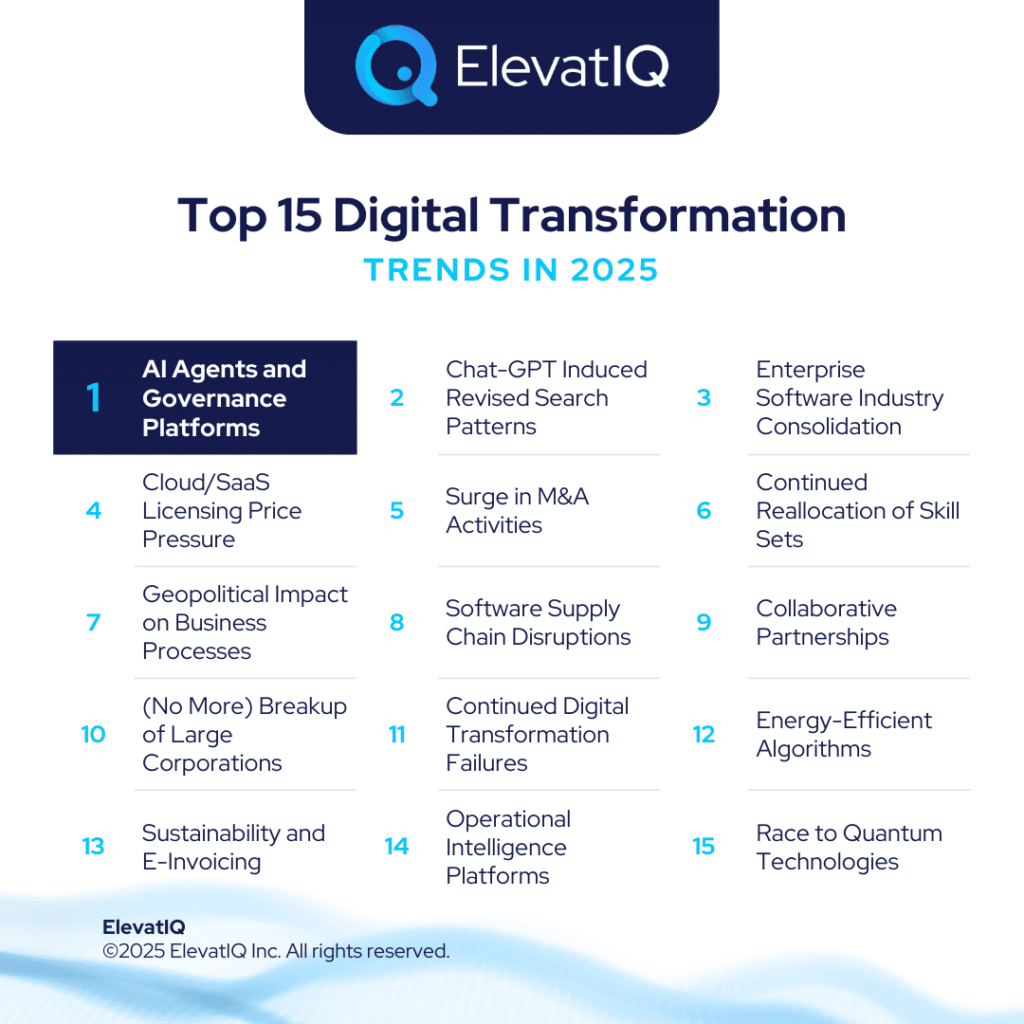

Top 15 Digital Transformation Trends in 2025

2024 turned out to be another slower year, following the trend of previous years. While there were hopes for a boost in the second half of the year, most companies remained cautious. They were cautious due to uncertainties surrounding the U.S. elections, ongoing geopolitical conflicts, and macroeconomic challenges. Despite some optimism that the new administration would be more business-friendly, the uncertainty will persist through 2025. Uncertainty is primarily due to tariff disputes and geopolitical tensions. With this outlook, most CFOs will be conservative with budgets for initiatives with uncertain short-term returns.

One promising factor expected to drive the economy is the ongoing investment in AI technologies. Many tech companies have significantly increased their spending on AI in hopes of boosting product prices and maintaining market share. These advancements, as a result, will transform interaction models for enterprise applications, improving lead and cycle times for most commercial transactions. The improved lead and cycle times, consequently, would offer a significant competitive edge for companies. Ultimately, this trend is likely to accelerate the replacement of legacy systems, making them AI-ready and driving digital transformation initiatives.

While AI’s broader influence is set to greatly impact the enterprise software market, policy changes associated with the potential implications of AI technologies may lead to stricter reporting requirements. These reporting requirements would affect not only tech providers but also other industries. This could result in higher financial and compliance costs, presenting opportunities for enterprise software vendors. Despite these challenges, expect a positive shift in 2025 if market conditions improve in the second half of the year. On the other hand, with the uncertainty surrounding tariffs and policy decisions, 2025 may be just as slow as 2024. Regardless of the outcome, these trends are likely to shape digital transformation initiatives and the enterprise software market.

1. AI-Augmented Agents and AI Governance Platforms

Throughout 2025, enterprise software companies will face mounting pressure to justify their pricing. The most immediate opportunities for value creation and revenue generation will likely surface from AI agents integrated into various software categories. These agents will power use cases such as customer service and “generative insights” for complex systems.

As AI agents become increasingly proficient at specialized tasks, how will businesses leverage agent-to-agent orchestration engines to enable smooth collaboration between AI and humans? What impact will the rise of fully autonomous workflows have on business operations, and how can organizations ensure they remain ahead of these advancements? Moreover, with evolving policies and regulations, how will new AI governance platforms emerge, and how can businesses navigate these changes? To gain insights into how AI is shaping the future of business, download the full top 15 digital transformation trends for 2025 report now.

2. Chat-GPT Induced Revised Search Patterns and Consumer Behavior

ChatGPT could give rise to a new wave of search engines with multi-modal capabilities, posing a threat to Google’s market dominance. As these emerging competitors gain traction, Google would be compelled to integrate generative AI into its search workflows. This shift would also disrupt paid media as search engines explore new monetization strategies centered around ChatGPT-driven interactions.

As consumer behavior evolves with the rise of AI-driven search engines, how should businesses adjust their content strategies to balance both organic and paid visibility? What role will these shifts play in transforming business processes and influencing the future of enterprise software? To uncover more about how these changes will impact your organization in 2025, download the full report on the top 15 digital transformation trends now.

3. Continued Consolidation of the Enterprise Software Industry

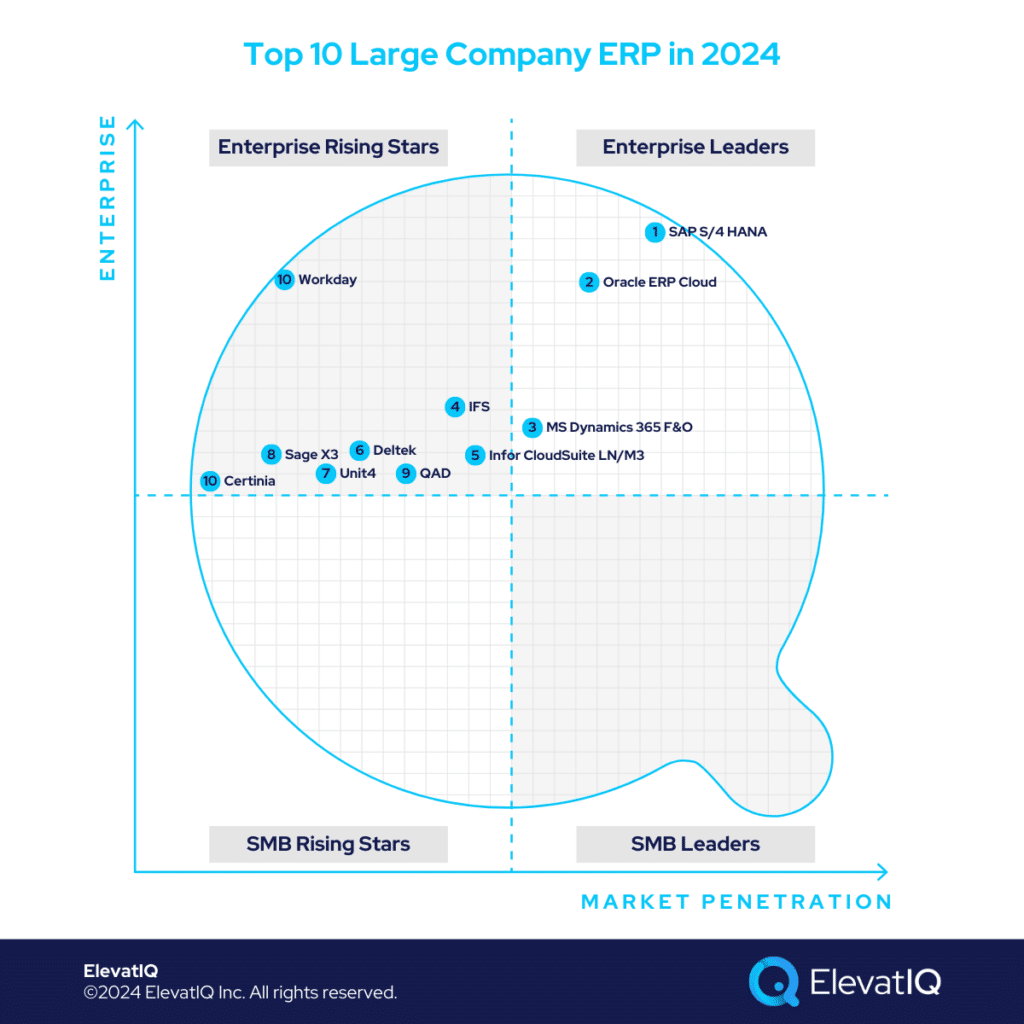

The consolidation of enterprise software categories accelerated in 2024 and is expected to continue in 2025. This consolidation would lead to broader, more overlapping product offerings. More confusion! A trend that will drive significant pricing and architectural shifts for customers. Depending on the acquirer’s strategy, certain features may be phased out, or entire products may be discontinued.

With the ongoing changes in the enterprise software landscape, how can businesses prepare for unexpected pricing adjustments that might trigger unplanned upgrade projects? Think surprise bills! What steps should organizations take to mitigate potential disruptions and ensure smooth transitions? To stay ahead of these trends and better navigate the challenges of 2025, download the full report on the top 15 digital transformation trends now.

4. Cloud/Saas Expense Reduction and Saas Licensing Price Pressure

As businesses grapple with cash constraints, many will look to cut costs by optimizing their SaaS spending. They would also reduce costs by eliminating unused software. Shelfware! In response to these cost-cutting measures—and amid a challenging purchasing environment—software vendors are likely to raise prices. We’ve already seen this trend with platforms like Smartsheet and ActiveCampaign, where small pricing adjustments significantly increase overall customer costs.

As private equity acquisitions continue to influence the market, how should businesses prepare for ongoing pricing shifts that are expected to persist into 2025? What strategies can organizations implement to manage these changes and maintain budget control? To learn more about the trends shaping pricing strategies and digital transformation in 2025, download the full report on the top 15 digital transformation trends now.

5. Surge in M&A Activities and Deal Flow

With interest rate cuts and changes in the U.S. administration, M&A activity is expected to accelerate in 2025. Since M&A trends closely align with ERP and digital transformation initiatives, the digital transformation sector is likely to see increased deal activity.

With a slightly improved outlook for 2025, how will software vendors allocate resources to R&D and innovation to stay competitive in an evolving market? What impact will this shift have on the development of new solutions and the digital transformation landscape? To gain a deeper understanding of these trends and their potential effects, download the full report on the top 15 digital transformation trends in 2025 now.

6. Continued Reallocation of Skill Sets and Their Impact on Business Processes

AI is rendering several skill sets obsolete, a trend that will persist in 2025 as its effectiveness across various use cases becomes clearer. At the same time, the rise of AI governance platforms and AI agents will create demand for new skills.

How will the ongoing shifts in technology and business strategies reshape traditional business processes, requiring the reconfiguration of business process software and driving architectural changes? What new software categories are likely to emerge as a result of these transformations? To explore these insights and stay ahead of the curve, download the full report on the top 15 digital transformation trends in 2025 now.

7. Geopolitical Impact on Business Processes

With the risk of new conflicts and the escalation of existing ones, geopolitical tensions are expected to persist in 2025. As global economies struggle, the cost of living remains high, and real estate markets reach unsustainable levels, new and unexpected supply chain disruptions are likely to emerge.

As governments respond to evolving global challenges, how will new regulatory measures and policy changes aimed at controlling information, currency, and monetary flows impact business processes, reporting requirements, and enterprise architecture? To better understand these developments and how they may affect your organization, download the full report on the top 15 digital transformation trends in 2025 now.

8. More Disruptions Caused by Software Supply Chain and Cybersecurity Issues

Recent disruptions, such as the CrowdStrike incident, have highlighted the risks posed by software supply chain vulnerabilities. This has prompted companies and governments to reassess their impact. As AI enhances the ability of malicious actors to identify and exploit these weaknesses, policy changes around software supply chain security are inevitable.

How will new regulations introduce accountability measures for open-source software impact pricing models and software architectures in the coming years? To explore how these regulatory changes will shape the future of enterprise software, download the full report on the top 15 digital transformation trends in 2025 now.

9. Collaborative Partnerships and Continued Acquisition of Networks Producing Data

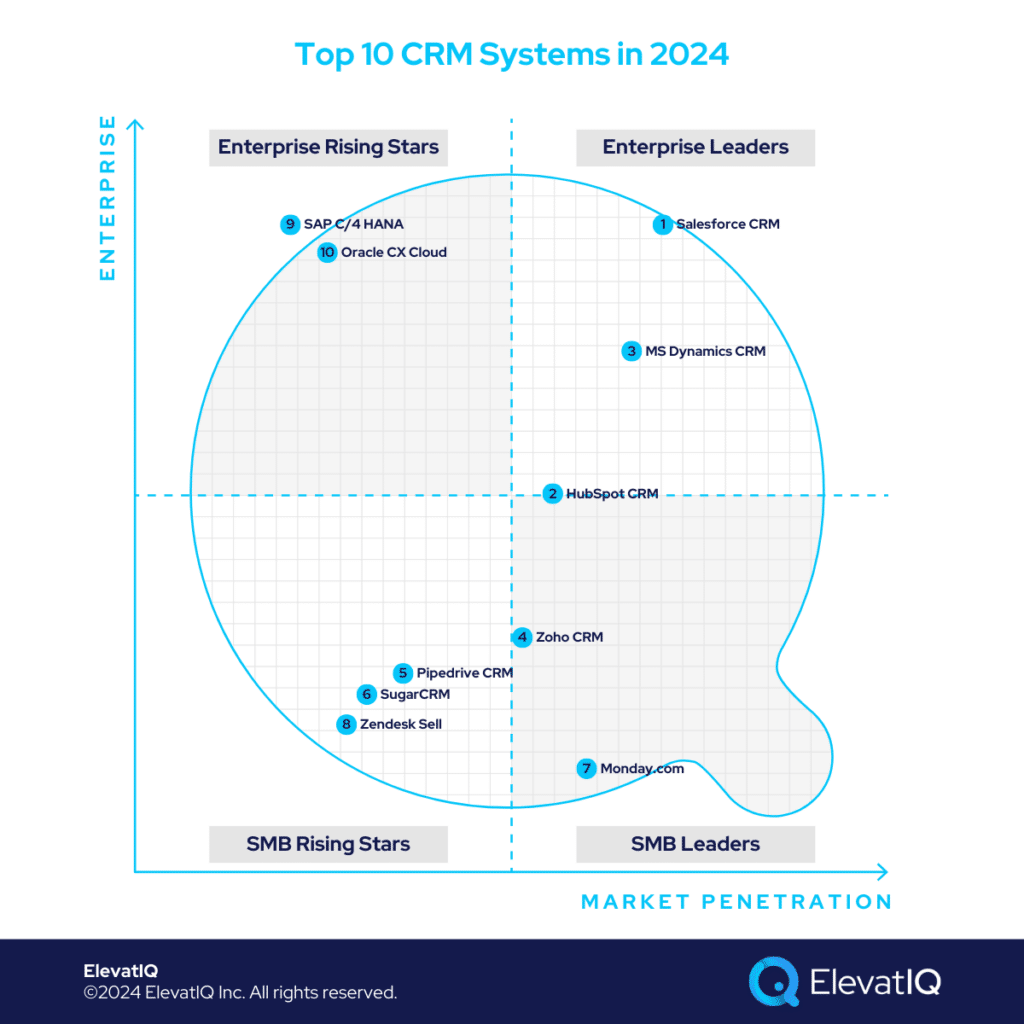

As data remains the key driver of AI effectiveness, 2024 saw partnerships forming even between competitors, such as the collaboration between Salesforce and Workday.

How will the continued trend of acquiring and integrating data-generating networks, such as Blue Yonder’s acquisition of One Network Enterprises, affect the future of enterprise software and digital transformation? Find out more about this evolving trend and other top digital transformation insights by downloading the full report on the top 15 digital transformation trends in 2025 today.

10. (No More) Breakup of Large Corporations and Antitrust Laws Blocking Large Deals

The incoming U.S. administration is expected to take a less stringent approach to scrutinizing mega-mergers compared to the current one. Deals like Google’s acquisition of HubSpot are likely to proceed, and the idea of breaking up large corporations, such as Google, will likely be off the table. Had such breakups occurred, they would have significantly impacted both front-end and enterprise processes for many organizations.

How will this shift lead to the acceleration of consolidation among large enterprise software companies, resulting in an even greater overlap of capabilities? To learn more about this and other emerging trends that are shaping the future of digital transformation, download the report on the top 15 digital transformation trends in 2025 today.

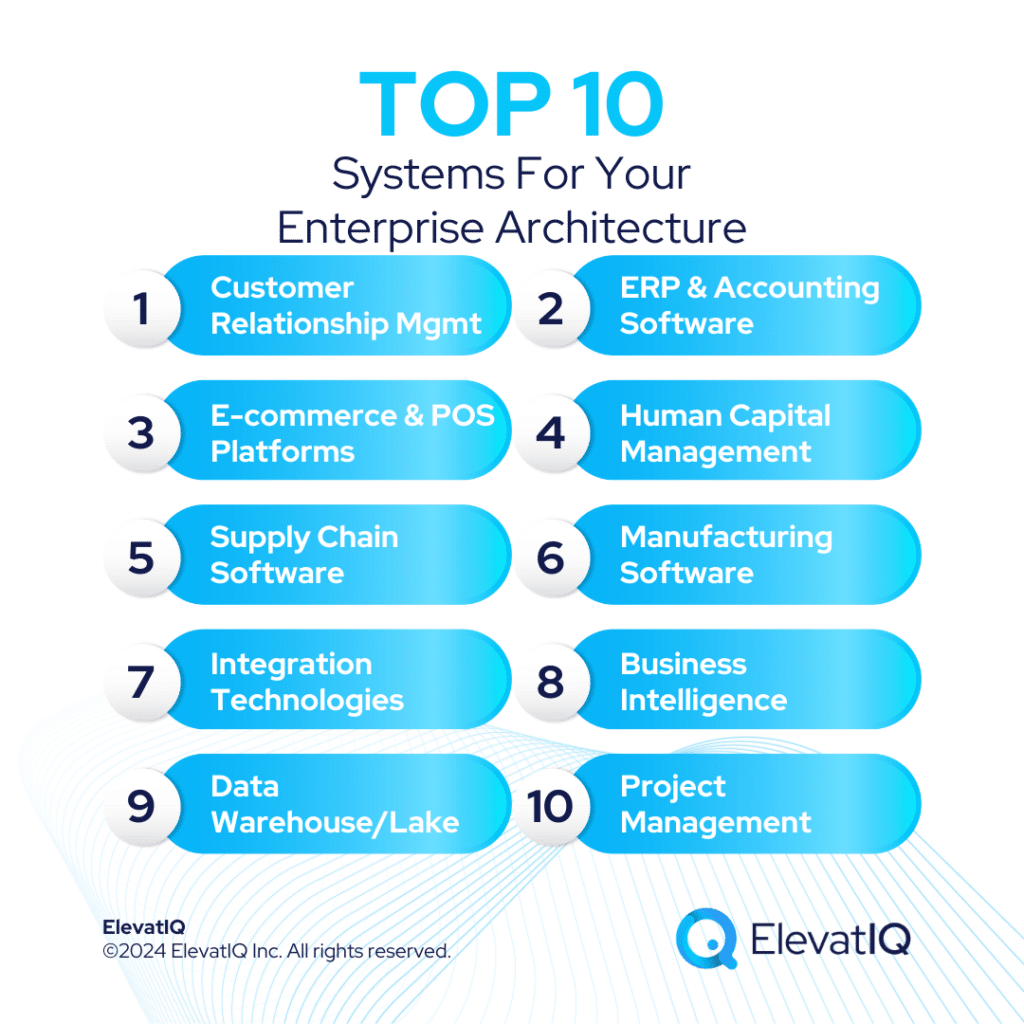

11. Continued Digital Transformation Failures and Focus on Enterprise Architecture

The consolidation-driven overlap will result in duplicated capabilities across enterprise software categories. This would create significant challenges for executives managing transformation initiatives. Companies like SAP have already begun focusing heavily on enterprise architecture. Smaller vendors are expected to adopt similar approaches.

How will this trend drive acquisitions in key areas like process mining, digital adoption platforms, and enterprise architecture visibility tools? To uncover more insights on this and other transformative trends, be sure to download the report on the top 15 digital transformation trends in 2025 today.

12. Energy-Efficient Algorithms and Computing

AI capabilities are currently constrained by infrastructure and energy limitations. As a result, significant investment will be directed toward data center energy technologies and energy-efficient algorithms.

How might this trend lead to the development of new models that surpass current ones, offering even more advanced and powerful capabilities? To explore this and other emerging trends shaping the future of digital transformation, download the report on the top 15 digital transformation trends in 2025 today.

13. Revised Processes for Sustainability and E-Invoicing

ESG and sustainability will remain key priorities for both governments and consumers. Policy changes in these areas will lead to new reporting requirements, which many software vendors will prioritize to capitalize on emerging trends.

As the ESG sector continues to evolve, with solutions competing for market share and overlapping capabilities, how will these developments influence business strategies? Additionally, with governments pushing for more efficient tax revenue collection through the evolution of e-invoicing processes, what impact will this have on reporting requirements and system architecture? To stay ahead of these trends, download the report on the top 15 digital transformation trends in 2025 now.

14. Omnichannel, Collaborative Experience, and Operational Intelligence Platforms

Companies excelling in omnichannel solutions, collaborative platforms, and operational intelligence will keep growing. The MACH ecosystem and real-time experiences are becoming mainstream. Tools like SmartSheet, Monday.com, Airtable, ClickUp, and Notion are redefining collaboration. Palantir is shaping operational intelligence. As these trends evolve, market leaders will gain more traction.

As emerging technologies continue to reshape the business landscape, how will legacy companies like Atlassian, Snowflake, and traditional commerce vendors adapt to stay competitive? Will they successfully catch up with the latest advancements or face challenges in their efforts? To explore how these shifts will impact the digital transformation journey, download the report on the top 15 digital transformation trends in 2025 today.

15. Race to Quantum Technologies

AI is driving demand for advanced infrastructure and computing power. This accelerates quantum technology development. Despite risks like q-day and post-quantum cryptography, investment in quantum is likely to grow, as seen before.

Could the advancements in quantum technology lead to the emergence of entirely new technologies and software categories? What potential breakthroughs can businesses expect in the near future as quantum developments accelerate? To dive deeper into this and other key trends shaping the digital landscape, download the report on the top 15 digital transformation trends in 2025 today.

Final Words

The year 2025 is expected to carry a level of uncertainty similar to that of 2024, resulting in a cautious approach for most CFOs. A potential catalyst for advancing the enterprise software market could be innovations powered by AI. Nevertheless, translating AI initiatives into tangible business outcomes may require time for companies to grasp fully.

For those contemplating digital transformation initiatives in 2024, allocate resources to a strategy aimed at mitigating financial and technical risks. Doing so will not only enhance your chances of securing the trust of financial executives but also guard against unforeseen challenges that may arise in the absence of such a plan.