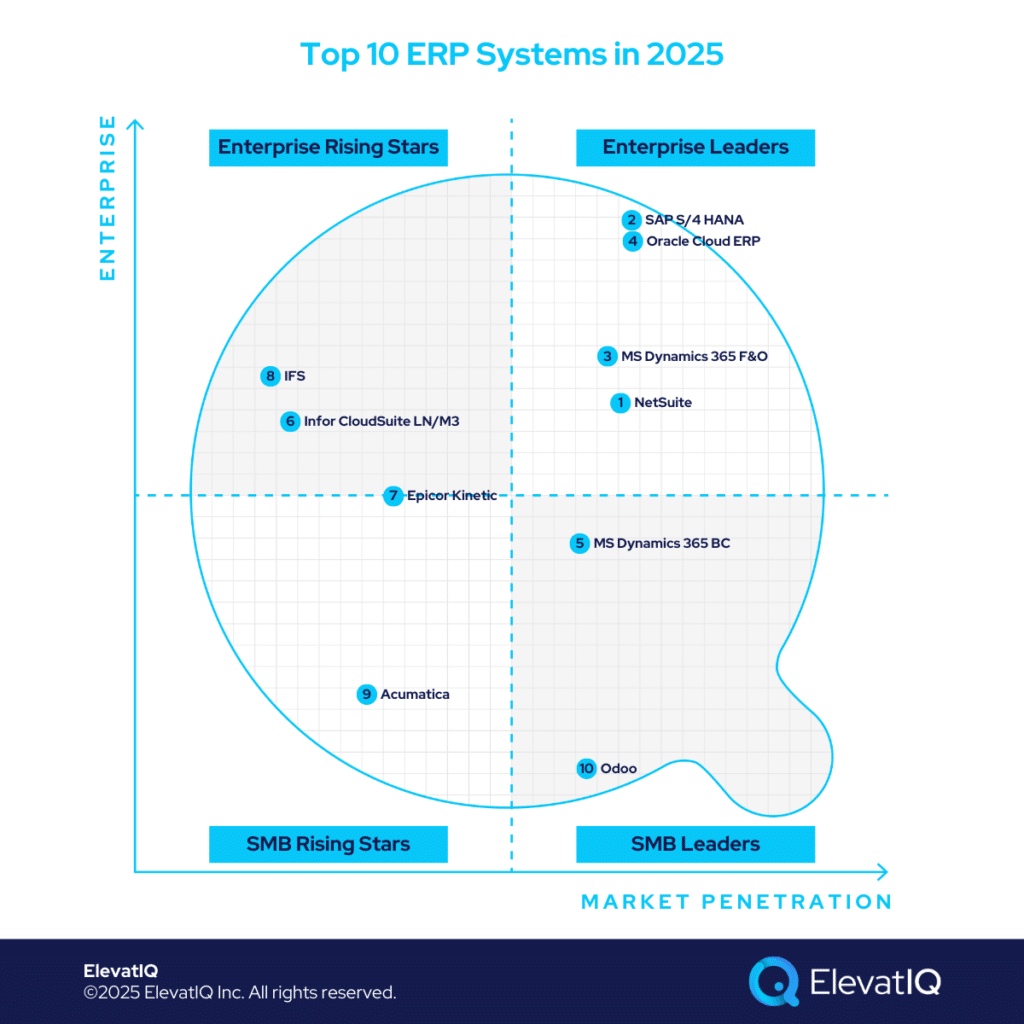

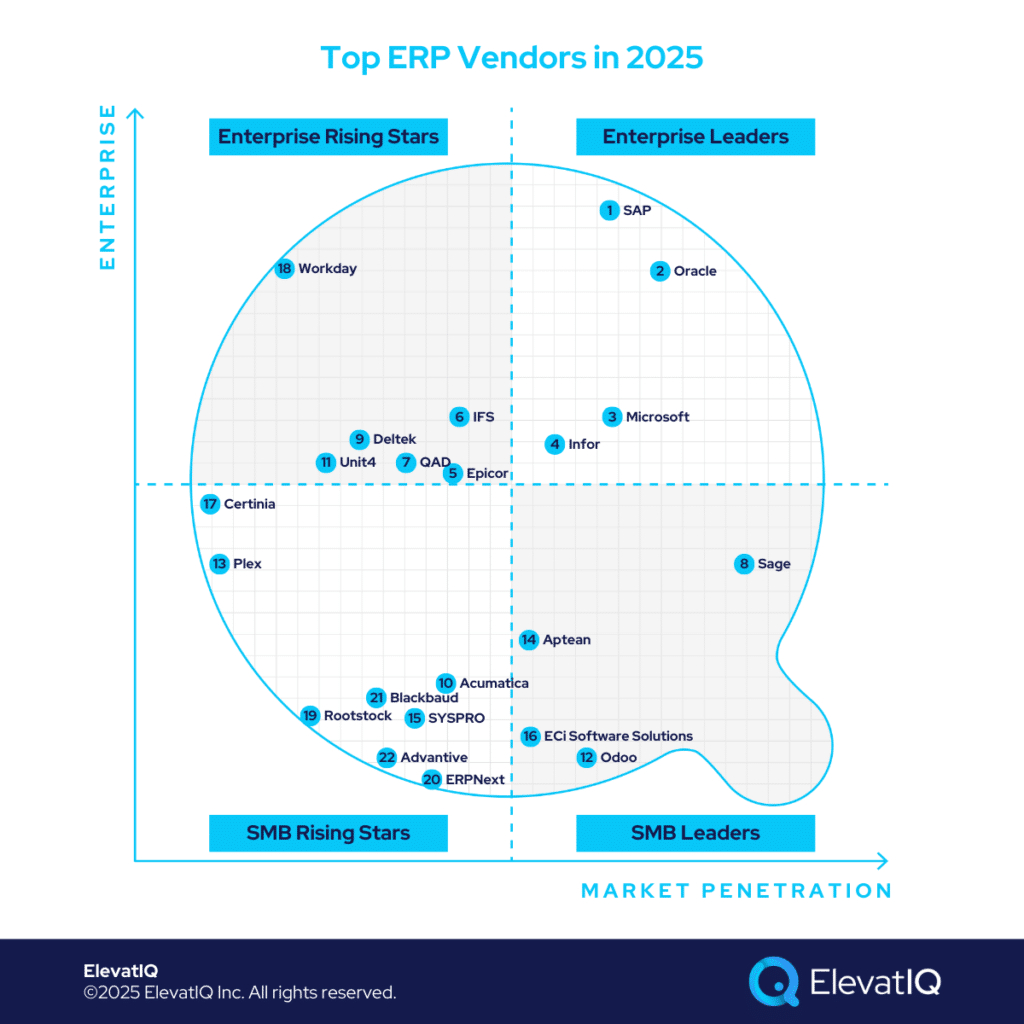

Top 10 ERP Systems in 2025

AI advancements have pushed ERP systems to a critical inflection point in 2025. While generative AI remains in the experimental phase, its impact on application interaction models is still evolving. To stay competitive, buyers will explore AI-centric ERP solutions; however, finding mature, AI-driven systems may prove challenging.

Another key factor that could significantly impact ERP rankings in the coming years: is whether cloud nativeness will continue to drive procurement cycles. While migrating legacy systems to the cloud has been a major focus recently, this trend may lose relevance once AI agents reach maturity. At that point, systems with legacy data models could become just as user-friendly as their cloud-native counterparts.

Despite ongoing changes, several established factors remain relevant and were considered in our evaluation this year. These include whether a system is designed to support diverse business models or emphasizes suite-centric capabilities with pre-integrated, industry-specific solutions.

For instance, a large enterprise engaged in frequent M&A may prioritize a robust global financial core over extensive operational features or specialized integrations for individual business units. Horizontal solutions typically emphasize global and generic ERP capabilities, while industry-specific functionality is often delivered through third-party solutions. Conversely, what suits an enterprise may not align with a startup’s needs.

Broader industry trends are equally relevant, such as solution consolidations or vendor acquisitions, which often reshape a system’s architecture and scope. Additionally, consider adjacencies like community strength and market momentum. Each ERP system has its unique strengths, and identifying the right fit requires careful analysis of specific needs and efficiency goals. Join us as we explore the top ERP systems.

10. Odoo

Odoo is a solid choice for smaller companies transitioning from QuickBooks or Xero, consolidating operations previously managed through spreadsheets, add-ons, and disconnected applications. It provides essential transactional processing across ERP, CRM, and HCM categories, all within a unified data model and app suite.

Ideal for budget-conscious businesses, particularly those with in-house developers, Odoo’s modular design enables flexible app purchasing for startups unable to commit for longer term fixed costs. However, its data model lacks tight integration, which may concern companies requiring strict financial control. This limitation can be especially challenging for less experienced firms struggling with internal processes and data management.

Another drawback is Odoo’s limited support for advanced ERP processes and transactions, typically found in more mature systems like Acumatica or NetSuite. How does this impact growing businesses looking for scalability without excessive customization costs? While Odoo offers a compelling entry point for startups and smaller enterprises, does its multi-country management capability outweigh its constraints in advanced ERP functionalities? Compared to competitors like Zoho and ERPNext, is Odoo’s connected data model enough to justify its ranking? To see how Odoo stacks up against the top ERP solutions of 2025 and find the best fit for your business, download the full Top ERP Systems in 2025 Report now.

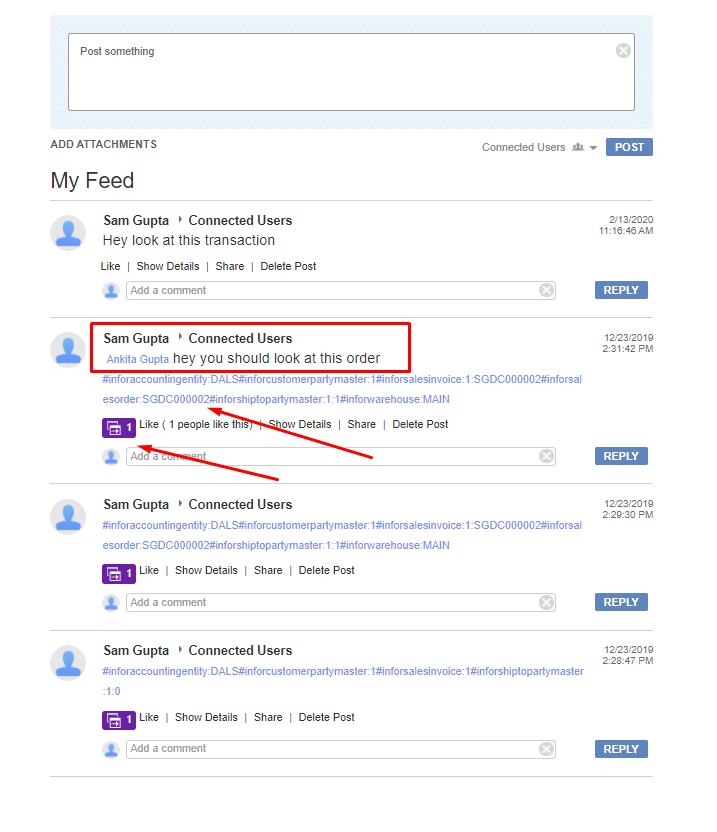

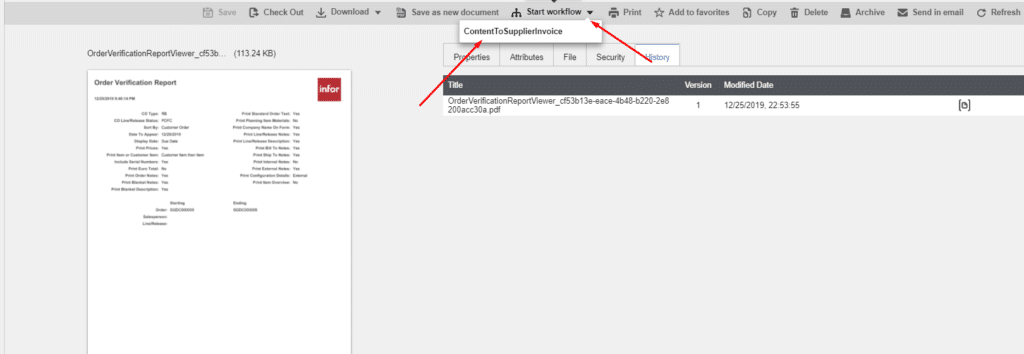

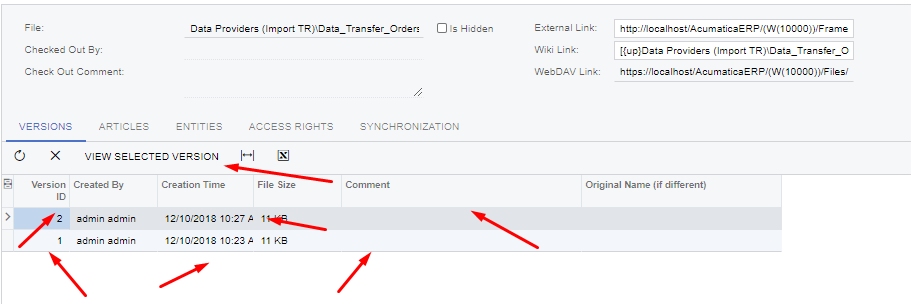

9. Acumatica

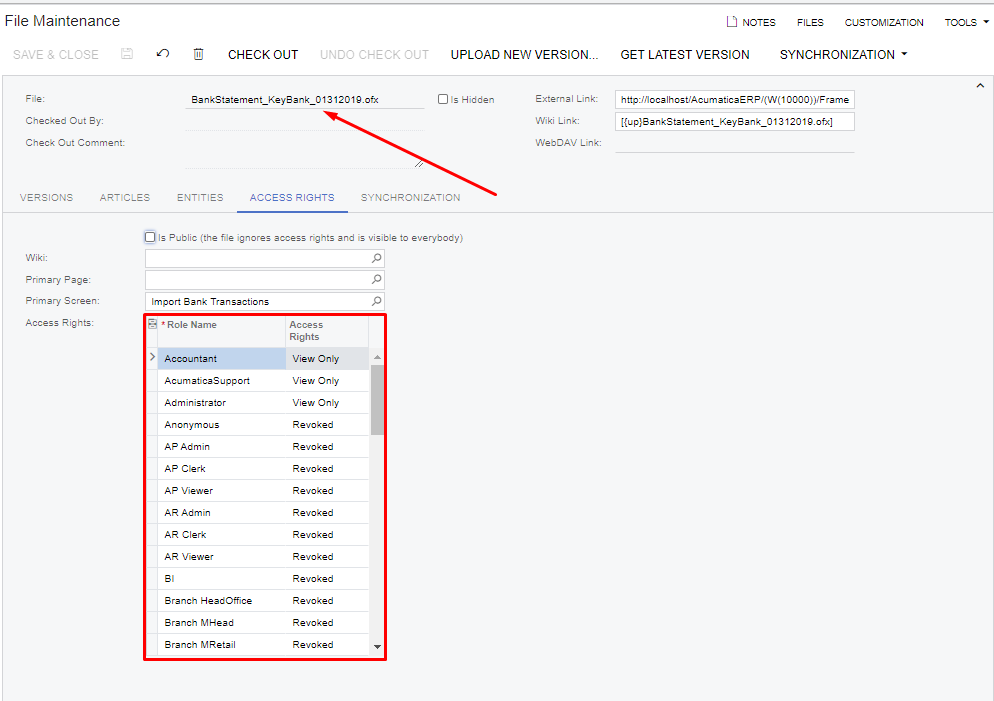

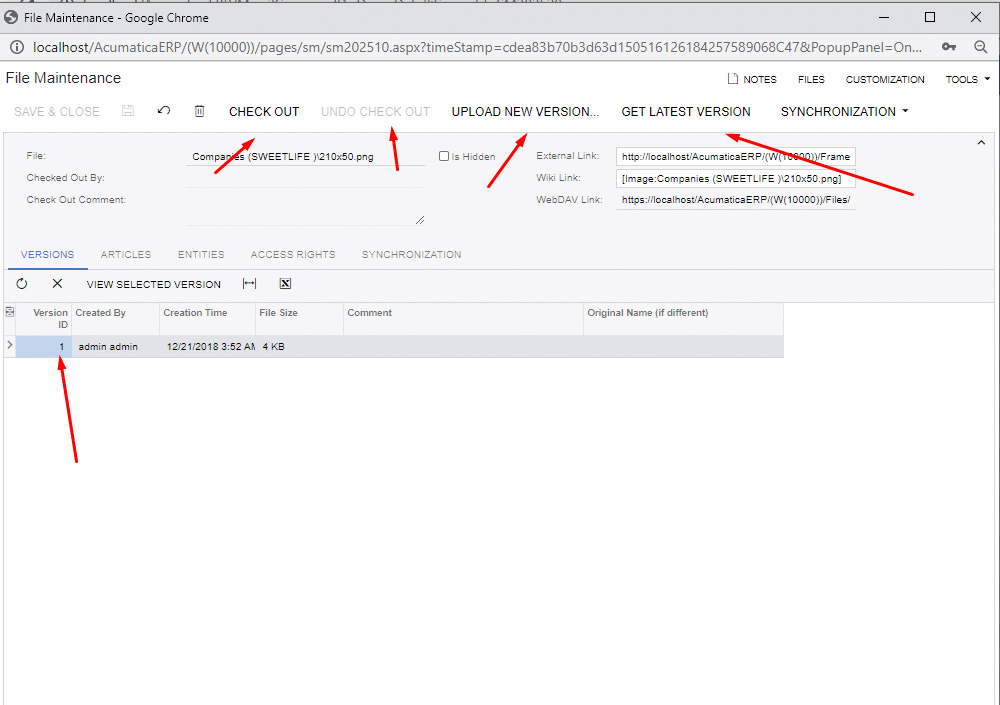

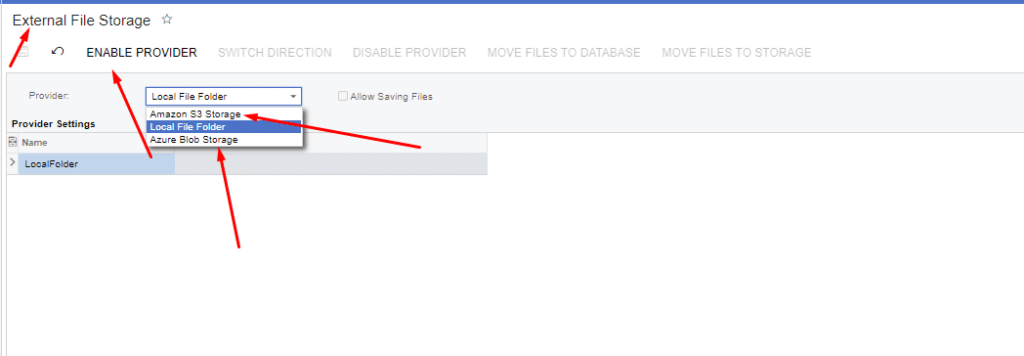

Acumatica is an excellent choice for companies transitioning from smaller ERP or MRP systems. However, businesses without experienced CFOs, operations executives, or controllers skilled in process and data translation for ERP systems may face challenges. Founder-led companies, in particular, might find implementation demanding due to the need for expertise in translating manual processes. Adapting to Acumatica’s structured data model—with its intricate business rules for enhanced financial control—can be a hurdle for those unfamiliar with such systems.

Acumatica’s versatility makes it a strong choice for businesses with diverse operations. But how does it compare to more mature ERP systems in terms of advanced features like dimensional inventory and global localization? While its cloud-native design and marketplace extensions offer flexibility, can they fully bridge the gaps in deeper operational capabilities? With competition from AI-first systems and dominant players like NetSuite and Sage Intacct, will Acumatica’s recent Professional Services edition be enough to gain market share? Download the full Top ERP Systems in 2025 Report now to see where Acumatica stands among the top ERP solutions.

8. IFS

Like other upper mid-market ERP solutions such as Infor LN, QAD, and Sage X3, IFS offers extensive functionality, particularly suited for companies with asset-intensive and field service operations. Uniquely positioned in the market, IFS appeals to enterprises seeking mature, industry-specific capabilities—reducing the need for extensive customization compared to vanilla ERP systems like SAP or Oracle. It serves as a strong alternative in the upper mid-market space, offering both best-of-breed asset management and field service capabilities, as well as a comprehensive ERP solution tailored for asset-centric industries, including telecom, energy, construction, MRO, airlines, and IT field services.

IFS’s complex data model and advanced asset scheduling make it a strong fit for upper-mid-market companies, but does its need for experienced internal teams and external advisors pose a challenge for growing enterprises? With its cloud-native architecture and global multi-entity capabilities, is it the best choice for businesses nearing the $1 billion revenue mark? As IFS expands in North America and invests in AI-driven acquisitions, will its unclear generative AI roadmap impact its competitive edge against other top ERP solutions? Download the full Top ERP Systems in 2025 Report now to see how IFS compares in this year’s rankings.

7. Epicor Kinetic

Epicor Kinetic is the company’s flagship solution. It excels in supporting manufacturing companies with structured processes. Its unique data model and BOM structure are key. It also has strong planning for dimensional inventory. This makes it ideal for industries like metal, fasteners, and fabrication. It works well for aerospace, automotive, and medical device manufacturers. Epicor Kinetic supports complex planning across various business models. These include manufacturing, distribution, and construction. Its advanced features manage WBS-centric processes. This allows efficient management of large programs with centralized cost tracking.

Epicor Kinetic is designed for companies beyond basic transactional processing. It offers a sophisticated data model. This model surpasses entry-level ERP systems like Acumatica and NetSuite. It targets businesses needing advanced manufacturing capabilities like MRP, allocation, and scheduling. Successful implementation requires deep expertise in process and data coding. It’s less suitable for founder-led companies without experienced executives. The rigid revision model can be challenging. Companies with poor SKU and BOM structures may face issues. Strong internal capabilities and advisory support are crucial.

Epicor Kinetic has evolved with modern cloud capabilities and a familiar Microsoft Dynamics-style interface, but do its financial management tools still lag behind competitors? With recent acquisitions enhancing field service, S&OP, and PIM, has Epicor truly differentiated itself, or does its suite-centric approach blend in with other ERP vendors? Its generative AI announcements are among the most exciting in the space, but will it outpace competitors in delivering AI-driven innovations? Download the full Top ERP Systems in 2025 Report now to see where Epicor Kinetic stands in this year’s rankings.

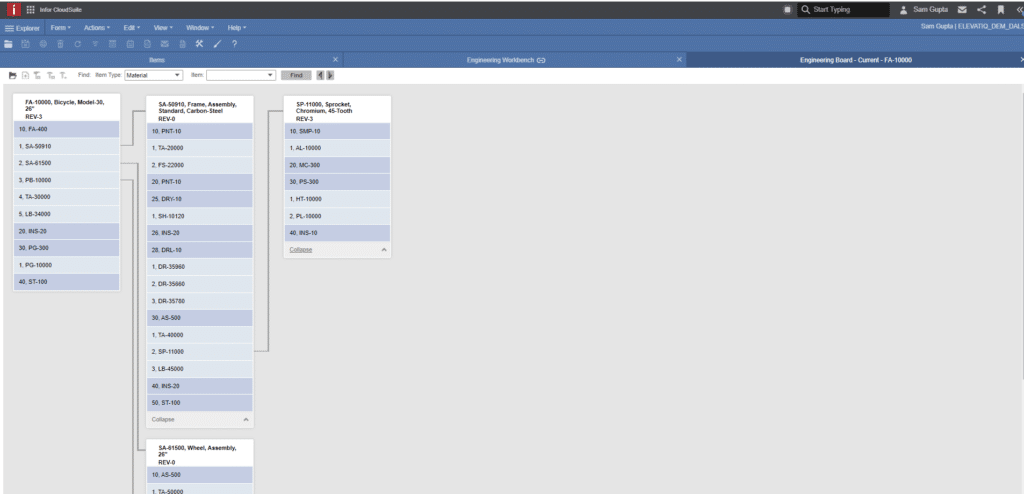

6. Infor CloudSuite LN/M3

Infor LN and M3 are Infor’s flagship solutions. They cater to distinct micro-verticals across industries. Both are built on the Infor OS platform. They share similar suite capabilities. These solutions are well-established in the upper mid-market. They target companies with $250 million to $750 million in revenue. They are for businesses outgrowing entry-level ERPs like Acumatica, Infor CSI, or NetSuite. Infor LN and M3 offer mature capabilities for complex manufacturing and distribution. They provide a suite experience similar to SAP and Oracle. Key features include PLM, WMS, WFM, BI, and a supply chain collaboration platform.

Infor LN is designed for discrete manufacturing sectors, including automotive, aerospace, and high-tech industries. In contrast, Infor M3 specializes in process and apparel manufacturing, serving industries like fashion, food & beverage, and chemicals. Both solutions excel in supporting advanced global operations, particularly for multinational companies seeking cost synergies across regions. Their native capabilities effectively address global trade and compliance requirements, making them a strong choice for international business operations.

Infor LN and M3 serve enterprise companies well in a two-tier ERP strategy. But does their limited industry focus restrict growth opportunities for businesses pursuing diversification or M&A? With a complex data model and BOM structure requiring significant expertise, are the operational efficiencies worth the investment? As Infor shifts toward a platform-driven approach rather than major functional advancements, can it stay competitive in an evolving ERP landscape? Download the full Top ERP Systems in 2025 Report now to see where Infor LN and M3 rank among the top ERP solutions.

5. Microsoft Dynamics 365 Business Central

Microsoft Dynamics 365 Business Central, designed for SMBs, is a natural choice for companies transitioning from smaller ERP, MRP, and accounting systems such as QuickBooks, Microsoft GP, Odoo, Katana, or Fulcrum. Competing with NetSuite, Sage Intacct, and Acumatica, Business Central offers a robust ecosystem with numerous industry-specific add-ons. However, successfully leveraging this ecosystem requires expertise in evaluating unproven code from VARs and ISVs. A solid approach of system architecture is essential to prevent conflicts between plugins and ensure unpainful implementation.

Business Central is particularly well-suited for companies with diversified global operations looking to consolidate all entities into a single database. This is useful for streamlined reconciliation and tracking. While add-ons can extend its functionality for complex industrial operations, its core design aligns best with industries such as non-profits, the public sector, FMCG, and F&B distribution. It is also a strong fit for light assembly manufacturing, telecommunications, media, technology, energy, and utilities.

Business Central’s strong consulting ecosystem and global adoption make it a popular choice, but is it the right fit for companies needing more advanced operational capabilities beyond financial reporting? As Microsoft leads AI-driven innovation, how will Business Central’s alignment with this strategy shape its future compared to other ERP solutions? With many vendors still refining their AI approaches, will Business Central’s stability give it a competitive edge? Download the full Top ERP Systems in 2025 Report now to see where Microsoft Dynamics 365 Business Central ranks this year.

4. Oracle ERP Cloud

Oracle ERP Cloud remains a top choice for large enterprises across diverse industries, including media, telecommunications, construction, energy, oil and gas, and healthcare (following the acquisition of Cerner). It is particularly well-suited for organizations with strong internal IT expertise and a need to integrate various proprietary and third-party software systems, such as patient claims management or utility billing solutions.

Oracle ERP Cloud is an ideal solution for global companies using it as their corporate financial ledger while maintaining other systems at the subsidiary level. Its robust financial capabilities support organizations requiring ledger-level security and hierarchical financial reporting. They might require this whether by line of business, function, or fund. Additionally, it offers seamless integration with a powerful HCM suite and a natively embedded EPM solution.

Oracle ERP Cloud is a strong choice for financial services and insurance, but does its limited success in product-centric industries make it less viable for manufacturing and supply chain-heavy businesses? With many enterprises using it primarily as a corporate ledger, does it provide enough operational depth at the subsidiary level? As competitors like Microsoft and SAP push AI-first strategies, can Oracle ERP Cloud maintain its leadership without a clear roadmap for innovation? Download the full Top ERP Systems in 2025 Report now to see how Oracle ERP Cloud ranks this year.

3. Microsoft Dynamics 365 Apps

Microsoft Dynamics 365, now referred to by various names for different industries—such as Supply Chain Management or Project Operations—has become one of the most in-demand ERP solutions for upper mid-market and large enterprises. While Microsoft doesn’t disclose specific revenue figures for its Dynamics portfolio, estimates suggest that the business unit generates several billion dollars in revenue, significantly smaller than SAP but notably larger than many smaller ERP vendors.

Microsoft Dynamics 365 is particularly well-suited for large global organizations, especially in regions where niche ERP solutions are less prevalent, such as Eastern Europe, South America, or Australia. These regions present unique localization challenges that require tailored solutions to meet specific country- and province-level compliance needs. In many cases, organizations deploy Microsoft Dynamics 365 primarily for accounting and financial reporting, while relying on specialized operational systems for subsidiary-level functions.

Microsoft Dynamics 365’s vast consulting ecosystem and strong ISV marketplace give it a unique edge. But does the complexity of navigating these add-ons lead to higher implementation risks? With unqualified ISVs and VARs contributing to a higher failure rate, how can businesses ensure a successful deployment? As Microsoft prioritizes AI-driven innovation, will Dynamics 365 regain momentum despite facing stronger competition this year? Download the full Top ERP Systems in 2025 Report now to see where Microsoft Dynamics 365 ranks in this year’s analysis.

2. SAP S/4 HANA

SAP S/4HANA continues to be the top choice for large enterprises. The large enterprises with global operations and extensive localization needs across multiple continents, with Oracle being its primary competitor. While alternatives like Unit4, IFS, or Deltek may handle the demands of larger enterprises, they often fall short in delivering the robust global compliance and transactional capabilities that SAP S/4HANA excels at. Additionally, SAP S/4HANA stands out for its superior transactional workload handling capabilities, as well as outstanding traceability for large, complex organizations.

SAP S/4HANA is also an ideal choice for companies seeking a best-of-breed architecture tailored to specific functional needs. This architecture allows for operational cores on isolated sub-ledgers, which is particularly crucial for large distribution and 3PL companies managing complex WMS networks. Companies with intricate HCM operations and stringent compliance requirements may need to integrate best-of-breed systems. Moreover, SAP S/4HANA offers the essential capabilities for enterprises requiring sophisticated eCommerce platforms, including features like CDP and CPQ. Its flexibility and enterprise-grade architecture make it a standout solution for diverse operational needs.

SAP’s impressive growth in 2024, fueled by strategic acquisitions and a strong AI strategy, has positioned it as a leading ERP contender, but will its focus on core ERP workflows give it a lasting competitive edge over customer-centric solutions? With initiatives like RISE and GROW targeting the mid-market, can SAP successfully expand beyond its traditional enterprise stronghold? As it aligns with Databricks and enhances adoption rates, will SAP’s momentum continue? Download the full Top ERP Systems in 2025 Report now to see where SAP S/4HANA ranks this year.

1. NetSuite

Securing the top position, NetSuite remains the leading ERP solution. It is recognized for its broad industry success, robust ecosystem, credible marketplace add-ons, and comprehensive functionality. While not as complex as competitors like SAP S/4HANA or Microsoft Dynamics 365 F&O, NetSuite excels in supporting diverse business models, including omnichannel operations, matrix/dimensional inventory, and subscription-based models.

Despite its versatility, NetSuite may not be the best fit for industrial distributors and manufacturers due to limitations in pricing and item master capabilities. However, it performs exceptionally well in lighter manufacturing and consumer-centric industries such as health and beauty, fashion, apparel, and CPG. Its strong financial capabilities, coupled with an integrated HCM solution, also make it a preferred choice for service-centric industries, including smaller banks, credit unions, financial services, non-profits, as well as the technology and media sectors.

NetSuite’s top ranking is backed by its product quality. But how can businesses avoid the common pitfalls of over-customization and integration issues that lead to implementation failures? With no clear AI-first roadmap and limited portfolio momentum, does NetSuite risk falling behind its competitors in the long term? As it enters the field service vertical to compete with Acumatica, will NetSuite’s strategic direction be enough to maintain its position? Or will it be overshadowed by newer market challengers? Download the full Top ERP Systems in 2025 Report now to see where NetSuite ranks this year.

Conclusion

Choosing the right ERP system can be a daunting task due to the many factors to consider. When it comes to critical digital transformation initiatives, where the stakes are high and job security could be affected, it’s important not to base your decision on popularity alone. While systems like SAP may carry a strong reputation, relying on this alone can be a risky strategy.

Instead, adopt a more structured approach to ERP selection by carefully assessing solutions that are tailored to your specific industry or market segment. This thoughtful, strategic process will increase the chances of finding an ERP system that truly meets your organization’s unique needs and long-term goals.