NetSuite vs SAP S/4 HANA ERP Independent Review 2024

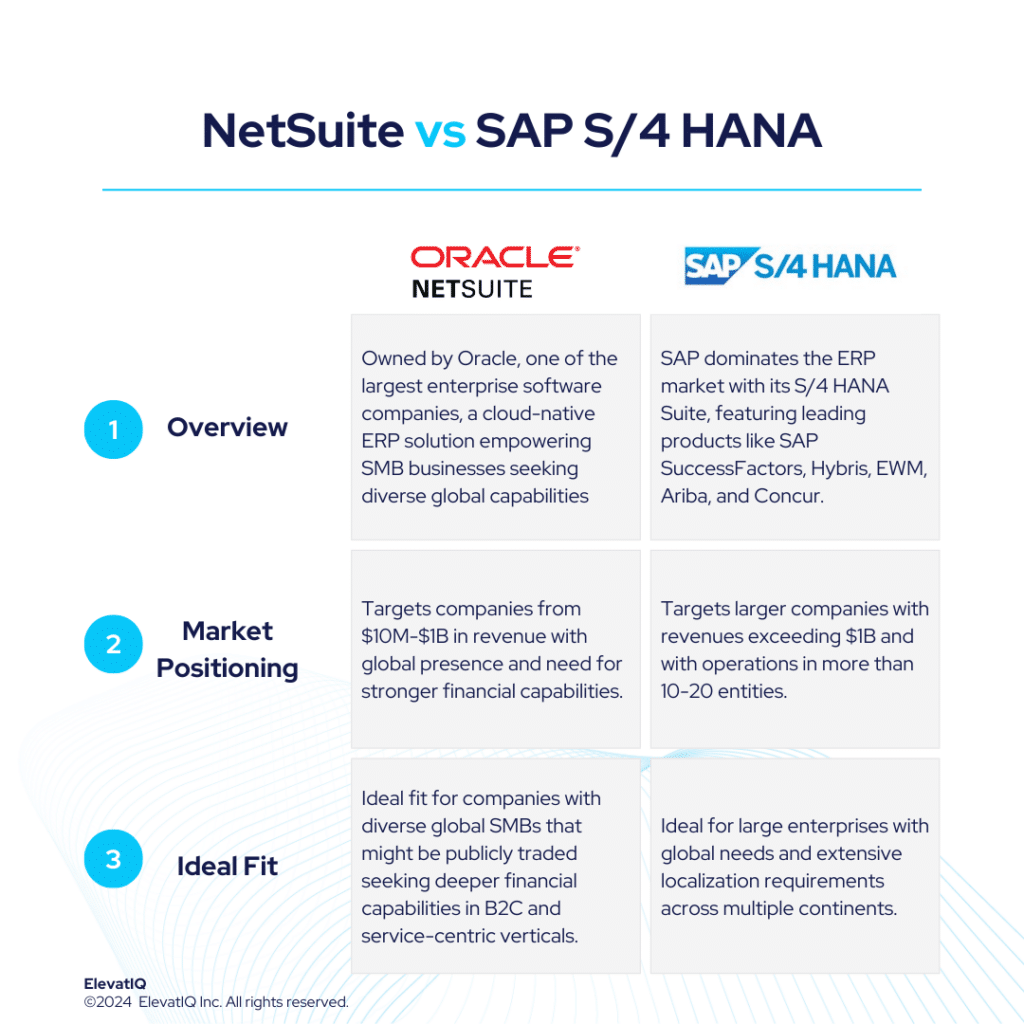

SAP maintains its dominance in the ERP market particularly due to its large market share, driven by the significantly larger deals in the enterprise space compared to the mid-market. The architecture of the S/4 HANA Suite, preferred by enterprise-grade companies, also includes leading products like SAP SuccessFactors for HCM, SAP Hybris for Commerce, SAP EWM for WMS, Ariba for P2P, and Concur for T&E.

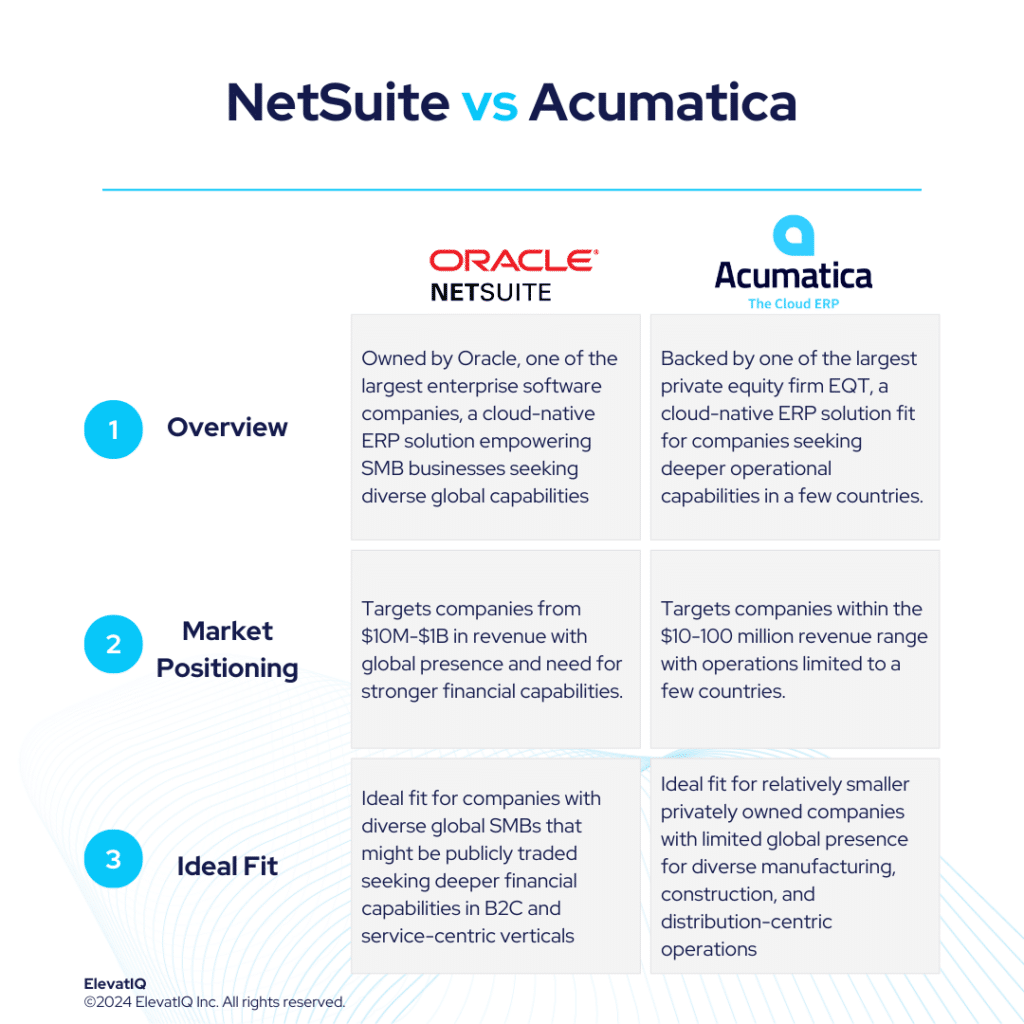

On the other hand, NetSuite caters well to globally spread small to mid-market companies seeking robust financial capabilities with localization in numerous countries. It offers solutions tailored to specific business models. SAP S/4 HANA is often the top choice for enterprise companies due to their high transaction volume, stringent governance, and traceability requirements, particularly for product-centric enterprises needing mature capabilities like MRP and allocation.

Conversely, NetSuite is suitable for a diverse range of companies, including service-centric, distribution-centric, commerce-centric, and B2C organizations. While SAP S/4 HANA excels for companies operating in multiple countries, NetSuite performs well across various industries but may lack depth for industrial distributors and manufacturers, focusing more on lighter manufacturing and consumerized products like health and beauty, fashion, apparel, and CPG. For those deciding between NetSuite and SAP S/4 HANA, this comparison offers vital insights for their ERP selection project. Therefore, let’s explore further.

| NetSuite | SAP S/4 HANA | |

| Started in | 1998 | Pioneers of ERP |

| Ownership by | Oracle in 2016 | SAP |

| No. of customers | 37,000+ | 28000+ |

What is NetSuite?

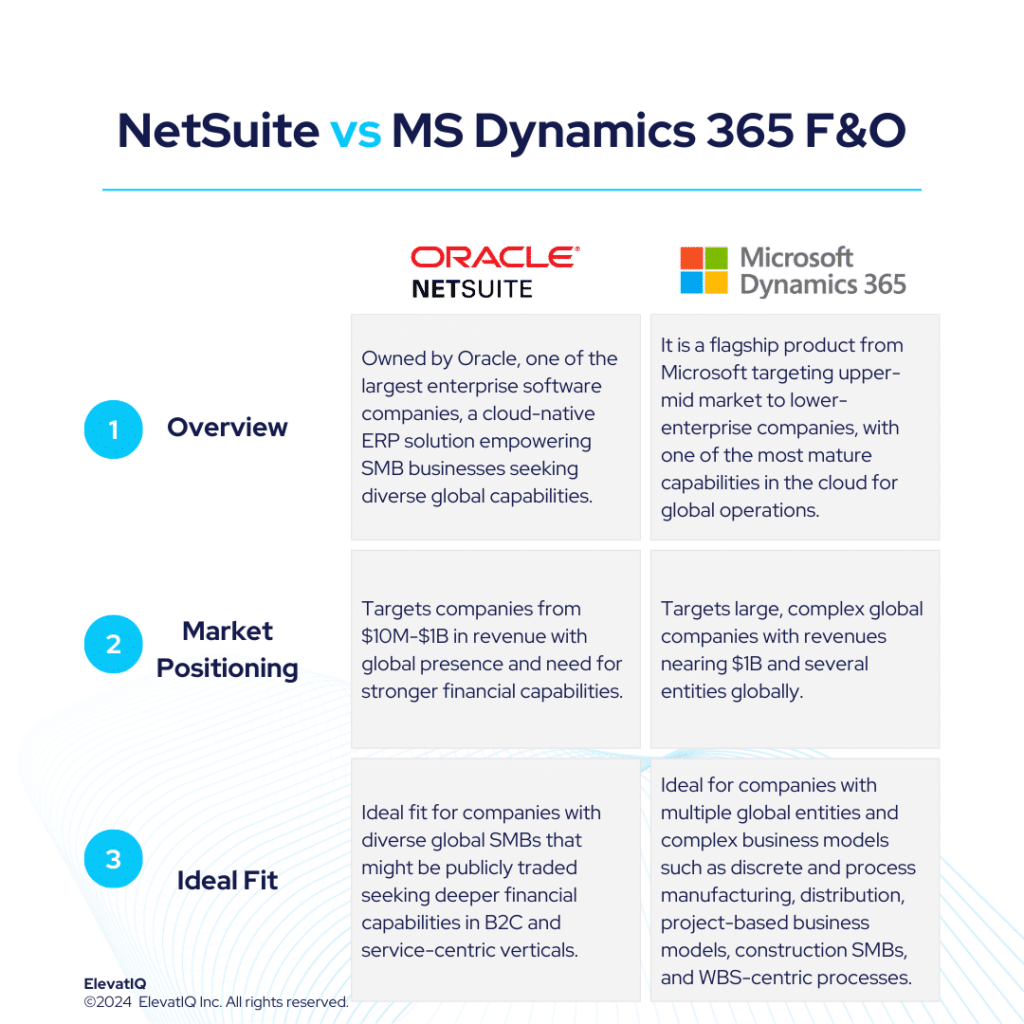

NetSuite stands out as the leading ERP solution, particularly driven by its success for diverse industries seeking stronger financial capabilities over the operational, robust ecosystem, credible marketplace add-ons, and comprehensive functionality. Not as complex as some competitors like SAP S/4 HANA and Microsoft F&O, NetSuite excels in supporting diverse business models, including omnichannel architecture, matrix/dimensional inventory, and subscription-based models.

While NetSuite excels across industries, it may not be the ideal choice for industrial distributors and manufacturers due to limitations in pricing and item master capabilities. Its strength lies in supporting lighter manufacturing and consumerized products like health and beauty, fashion, apparel, and CPG. With robust financial capabilities and an integrated HCM solution, NetSuite is well-suited for service-centric industries, including smaller banks, credit unions, financial services, non-profit organizations, as well as the technology and media sectors. While NetSuite remains the top-ranked solution due to its product quality, there might be challenges with over-customization and integration issues, leading to implementation failures. Working with NetSuite demands thorough vetting of their solution and architecture.

What Is SAP S/4 HANA?

SAP S/4 HANA remains the top choice particularly for large enterprises with global needs and extensive localization requirements across multiple continents. Also, in this league, its primary rival is Oracle. While alternatives like Unit4, IFS, or Deltek might handle the workload for larger enterprises, they often lack the robust global compliance and transactional capabilities that SAP S/4 HANA offers. Additionally, SAP S/4 HANA excels in providing superior transactional workflow capabilities that are purpose-built to streamline traceability for large and complex organizations.

Moreover, SAP S/4 HANA is an ideal choice for companies seeking a best-of-breed architecture tailored to the needs of specific functions. This architecture allows for operational cores on different ledgers, which is also crucial for larger distribution and 3PL companies managing complex WMS networks. Companies with intricate HCM operations and stringent compliance requirements may particularly find it necessary to integrate a best-of-breed system.

Additionally, for enterprises requiring sophisticated eCommerce platforms with components like CDP or CPQ, SAP S/4 HANA provides the essential capabilities. The flexibility and enterprise-grade best-of-breed architecture make SAP S/4 HANA a standout solution, particularly for such diverse operational needs. The cloud version may also require additional third-party add-ons, similar to NetSuite. Nevertheless, organizations opting for the on-prem version can access superior capabilities, potentially outperforming other ERP systems.

NetSuite vs SAP S/4 HANA Comparison

Navigating the choice between NetSuite vs SAP S/4 HANA is a significant decision for businesses particularly looking for operational efficiency and strategic alignment. Thus, this section delves into the comprehensive comparison of NetSuite vs SAP S/4 HANA across various critical dimensions.

| NetSuite | SAP S/4 HANA | |

| Global Operational Capabilities | Natively localized in over 100 countries, although its enterprise-grade capabilities might not match SAP S/4 HANA’s. | Offers deeper multi-entity capabilities compared to NetSuite. |

| Diverse Capabilities | Supports diverse business models across multiple countries, but operational richness might not be as extensive. | It is tailored for large, public-centric product organizations, particularly with intricate product models and demanding MRP runs. |

| Best-of-breed Capabilities | Contains pre-integrated components like HCM and FP&A, though the maturity of these components may vary. | Pre-integrates leading software like SAP Commerce Cloud, Hybris, Concur, and SuccessFactors. |

| Last-mile Capabilities | Limited last-mile capabilities for industries like manufacturing, necessitating add-ons for comprehensive functionality. | Limited pre-baked capabilities for micro-industries, requiring development or add-ons. |

| Operational Functionalities | Focuses on seamless CRM integration, suitable for businesses not opting for third-party solutions. | Does not provide out-of-the-box integration with A&D-specific PLMs, configurators, and CPQ systems. |

| Integration Capabilities | User feedback has concerns about perceived depth. | Suits MRP-driven companies needing enterprise-grade capabilities, aiming to consolidate entities within a single database. |

| Manufacturing Capabilities | Suitable for light manufacturing, limited mature capabilities such as allocation and Kanban. | Supports complex manufacturing operations and product models, possibly limited to industry-specific manufacturing functionalities. |

| Pricing Model | Named-user based | FUE (Full Use Equivalent) |

| Key Modules | 1. Financial Management 2. Accounting 3. Global Business Management 4. Inventory Management 5. Order Management 6. Supply Chain Management 7. Warehouse Management 8. Procurement 9. CRM | 1. Financial Management 2. Sales 3. Procurement 4. Manufacturing Management 5. Supply Chain Management 6. Professional Services Automation 7. CRM |

NetSuite vs SAP S/4 HANA Feature Comparison

Both platforms offer a plethora of features and functionalities designed to streamline business operations and enhance efficiency. In this feature comparison, we delve into particularly the distinct capabilities of NetSuite vs SAP S/4 HANA across various critical dimensions, providing insights to aid businesses in making informed decisions regarding their ERP selection. Thus, this section discusses features under each of the following modules, particularly financial management and supply chain management.

Financial Management Comparison

In this section, we are discussing a detailed comparison of the financial management capabilities particularly offered by NetSuite vs SAP S/4 HANA. By examining their respective strengths and functionalities, particularly in managing financial processes. Businesses can therefore gain valuable insights to determine the best-suited ERP solution for their financial management needs.

| NetSuite | SAP S/4 HANA | ||

| Financial Management | General Ledger | Supports complex general ledgers including public reporting requirements of several countries | Can support the needs of even the most complex financial organizations with more than ten ledger rollups at the country level and conversions. |

| Accounts Receivable and Accounts Payable | Automates and streamlines invoice delivery, payment processing, and collections management as well as accounts payable processes. | Supports global collaboration of customers and vendors, including shared service model. | |

| Cash Flow Management | Provides visibility to optimize cash flows, monitor bank accounts, and manage liquidity. | Complex treasury capabilities with the support for global operations, including maintaining treasury KPIs, workflows, and processes for dedicated treasury departments. | |

| Tax Management | Manages domestic and global tax, generates detailed reports, and analyzes transactions real-time. | Has built-in support for taxes of over 100 countries. | |

| Close Management | Automates inefficient manual tasks, such as journal entries, account reconciliations, variance analysis, and intercompany transactions. | SAP S/4 HANA’s close management capabilities are designed for very large and complex global organizations with enterprise-grade capabilities. |

Supply Chain Management Comparison

In this comparison, we explore and analyze the supply chain management capabilities of NetSuite vs SAP S/4 HANA, shedding light particularly on their respective strengths and weaknesses.

| NetSuite | SAP S/4 HANA | ||

| Supply Chain Management | Warehouse Management | Provides the ability to optimize day-to-day warehouse operations, eliminate manual processes and minimize handling costs. | Can support embedded or standalone architectural patterns along with complex business models such as 3PL or warehouse value-added services for third-party logistics. |

| Inventory Management | Automates inventory management processes with multi-location fulfilment, cycle counting, replenishment, traceability and item visibility. | Robust inventory management capabilities accommodating many different business models and inventory types of complex, global organizations. | |

| Procurement | Streamlines procurement processes with source management, purchase management, vendor management and invoice processing. | Enterprise-grade procurement capabilities for large complex global organizations, publicly traded or privately owned. | |

| Supply Chain Planning | Provides the ability to analyze demand, determine replenishment requirements, add stock and create orders according to an up-to-date supply plan. | Compared to NetSuite, SAP S/4 HANA’s supply chain capabilities are enterprise-grade, with capabilities to support planning for diverse business models and product mixes. | |

| Supply Chain Execution | Optimizes all supply chain assets, controls costs at each step. | Enterprise-grade strategies for global supply chain workloads with the best-of-breed WMS and TMS solutions pre-integrated with capabilities to support various architectural patterns for diverse business types. |

Pros of NetSuite vs SAP S/4 HANA

When evaluating ERP solutions, understanding the distinct advantages of NetSuite vs SAP S/4 HANA is crucial. In this section, we are particularly exploring the strengths of NetSuite vs SAP S/4 HANA across various dimensions. Thus, shedding light on their respective capabilities and functionalities.

| NetSuite | SAP S/4 HANA |

| Provides richer financial capabilities over operational, with leaner operational layers. | It is an ideal solution as the corporate financial ledger for large companies with multiple layers of financial hierarchies operating in multiple countries. |

| Ideal for SMBs operating in different countries. | The item master, product model, and warehouse architecture can accommodate the needs of most business models. |

| The data model is B2C friendly, supporting integration with B2C channels. | Because of the power of HANA, SAP S/4 HANA can process very complex MRP runs with product models containing millions of serial numbers and SKUs, making it much faster than most ERP systems. |

| Ideal for eCommerce-centric SMBs because of the ecosystem and the integration operations available for eCommerce-centric companies. | Ideal fit for complex operations with its transactional maps capabilities built with the products, making debugging complex financial enterprises easier. |

Cons of NetSuite vs SAP S/4 HANA

Just like recognizing strengths is important, it’s also crucial to weigh the specific drawbacks of NetSuite vs SAP S/4 HANA. Therefore, in this section, we will delve into the limitations and challenges associated with NetSuite vs SAP S/4 HANA across various operational and financial dimensions.

| NetSuite | SAP S/4 HANA |

| Not a great value for companies operating only in a few countries as they can get richer operational capabilities with other richer focused solutions. | The controls provided as part of the product may feel unnecessary and overwhelming for smaller companies. |

| May struggle with transactional workload requirements of companies over $1B and the ones that might be acquiring 10-20 entities every year. | The data model is overwhelming for smaller organizations outgrowing QuickBooks or smaller ERP systems. |

| Not ideal for startups with simpler operating models. They might find audit-centric and deep financial capabilities over-bloated. | Overbloated financial control processes, such as compliance, allocation, and approval flows, are only necessary for large organizations. |

| Named-user-based pricing requires allocating fixed costs, even for seasonal workers or external users accessing the subset of data such as customer or vendor portals. | Despite advanced financial traceability and technical capabilities, the functional capabilities are not as rich as with its on-prem version. |

| Not fit for companies seeking OEM-owned integration with core operational systems such as CAD or PLM. | While SAP S/4 HANA has one of the best best-of-breed solutions, they might not be as pre-integrated as other solutions. |

| The last-mile capabilities required for manufacturing or industrial distribution are extremely limited. | In industries where it might not be the most frequently installed as an operational solution, the other solutions are likely to have deeper last-mile capabilities. |

Conclusion

In conclusion, the comparison between NetSuite vs SAP S/4 HANA offers valuable insights for businesses navigating the complex landscape of ERP selection. While SAP S/4 HANA retains its dominance in the ERP market, particularly for large enterprises with extensive global needs and compliance requirements, NetSuite emerges as a strong contender for small to mid-market companies seeking robust financial capabilities and operational versatility. SAP S/4 HANA also excels in offering mature capabilities tailored to specific functions, making it an ideal choice for product-centric enterprises and companies operating in multiple countries. Conversely, NetSuite stands out for its flexibility across diverse business models, although it may lack depth in certain operational areas such as industrial distribution and manufacturing.

Ultimately, the choice between NetSuite vs SAP S/4 HANA particularly depends on the unique requirements and strategic objectives of each organization. Therefore, by carefully considering the strengths and limitations outlined in this comparison, businesses can make informed decisions that align with their long-term goals and drive efficiency in today’s dynamic market landscape. Also, seeking assistance from an independent ERP consultant can significantly aid the decision-making process, offering specialized advice and direction tailored to the specific needs of the business.