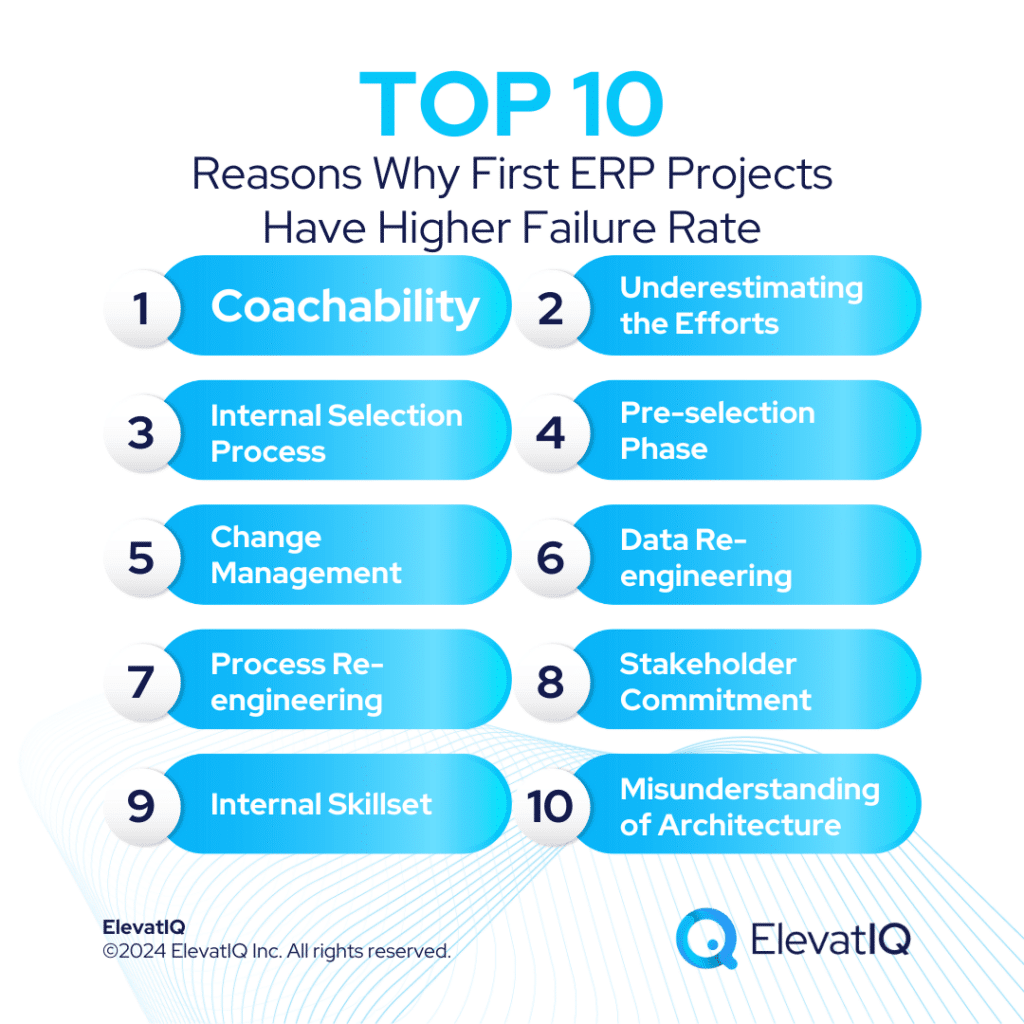

Top 10 Reasons Why First ERP Implementation Projects Fail

The first-time ERP implementation project is like getting married for the first time. Over 50% of them are likely to end up in failure. Most savvy executives who have gone through multiple implementations share that it might take up to 6 implementations – to get tangible business results from ERP projects. But, unfortunately, just like marriages, by the time they are on their 4th or 5th, they would have retired. Or they would rather not touch ERP implementations again because of the previous nightmares.

Regardless of how hard you try, you will have challenges with your first marriage (or ERP implementation). The challenges exist mostly in the misalignment of expectations, how you envisioned your life (your expectations from technology) versus your partner’s expectations of life (your ERP vendors’ expectations of your data and processes). Also, just like marriages, the issues with ERP implementations aren’t very logical or technical. Most of them are likely to be highly irrational, emotional – and, at times, strange.

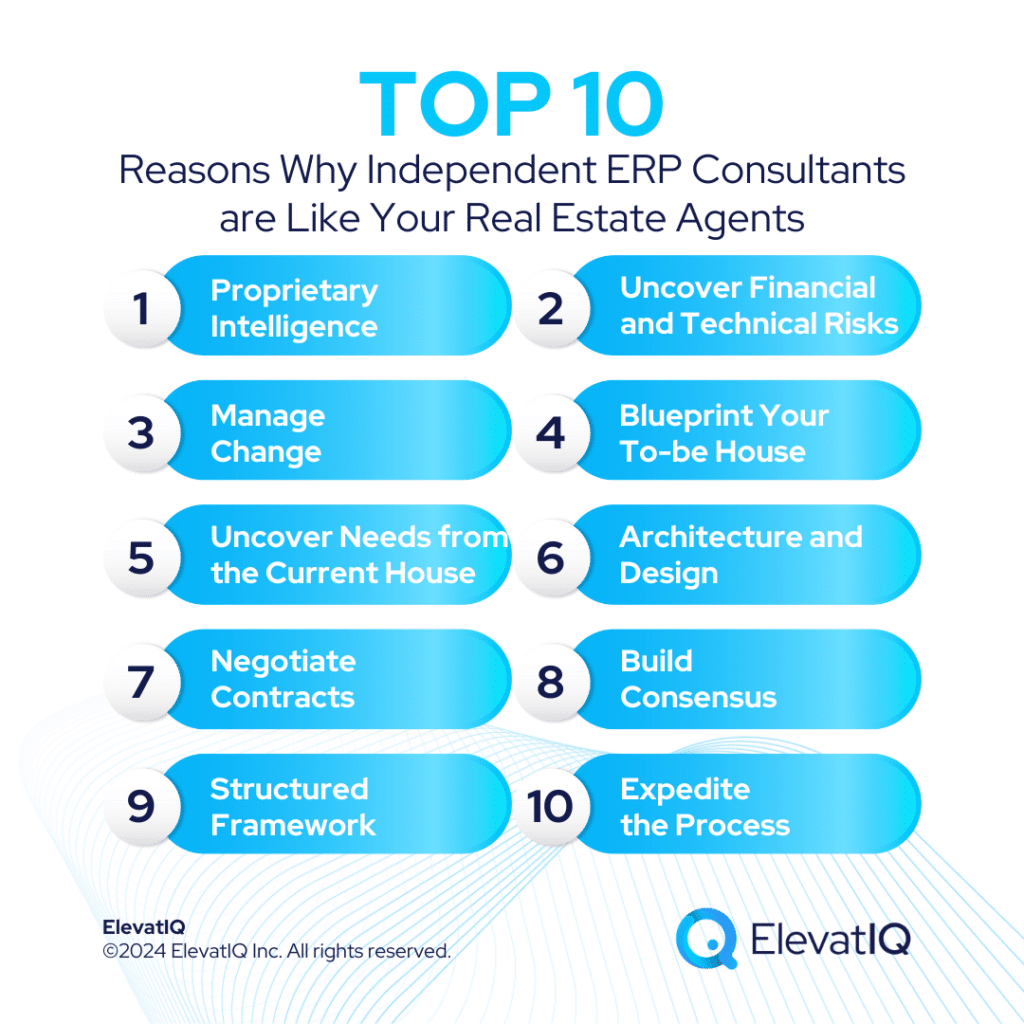

There is only one way to save your first marriage (or ERP project): to marry someone who has been married at least once (hire very seasoned consultants with several years of implementation experience). Or do a ton of research before tying the knot (pre-selection phase). Most importantly, be mentally and financially prepared for the possibility of surprises. And you need to be super open-minded to be successful. So, what are the core reasons why the first ERP implementations fail?

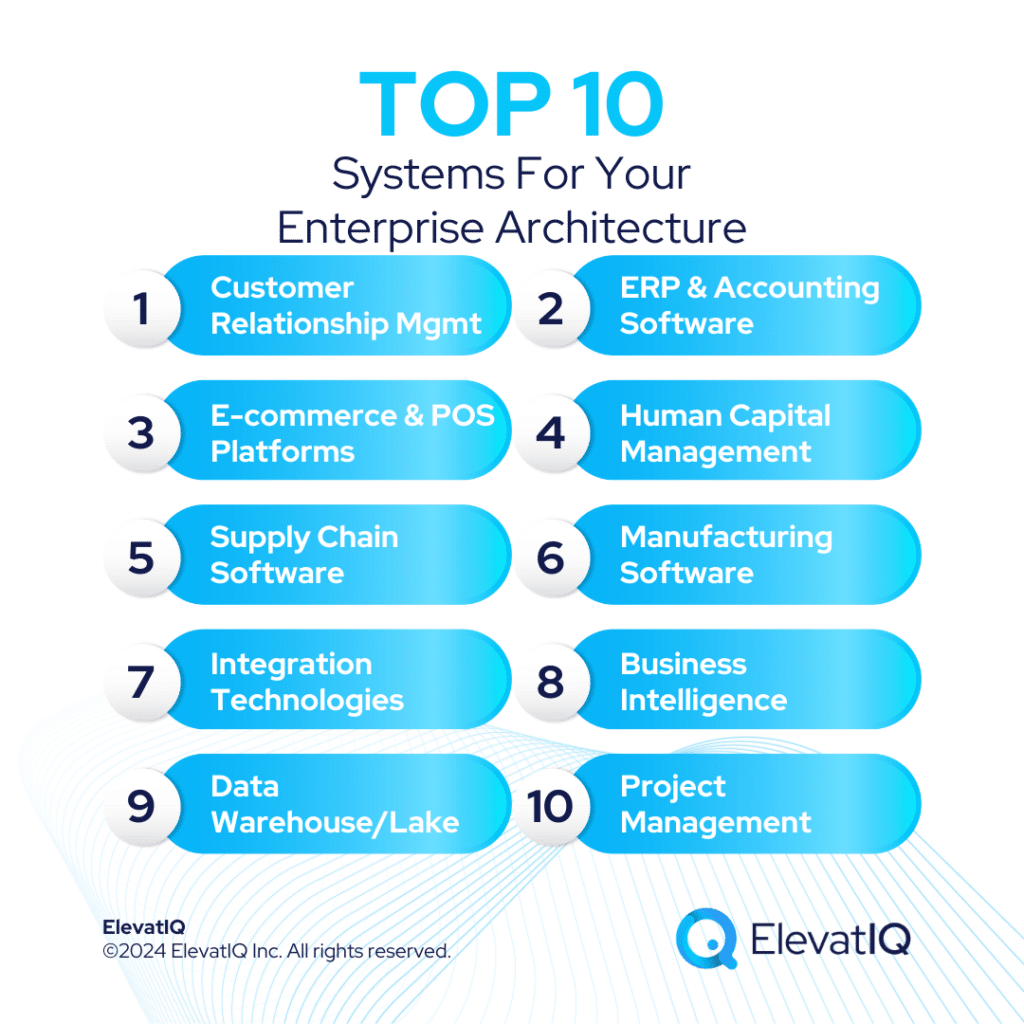

10. Misunderstanding of Architecture.

Architecture is like a blueprint for your house. Regardless of how small a house might be, architecture is still critical. The newer technologies and SAAS platforms are likely to mislead you into thinking that the technology is plug-and-play. Not true!

Issues:

- Thinking that Architecture is Not Important for Smaller Companies. A misunderstanding that APIs are supposed to integrate magically. Not to mention a belief that pre-baked integrations can cover any use cases.

- Ignoring the Interests of the Technical Teams Completely. Believing that technical folks can figure out any requirements thrown their way.

- Misassumption that Technology is about Plug-and-Play. A belief that any number of SaaS apps can be meshed together to form an ERP. And an assumption that the only thing you need to integrate two or more apps is the credentials.

Recommendations:

- Don’t Ignore the Architecture. Have well-articulated business specifications, followed by technical. Also, vet pre-baked integrations with your use cases.

- Ignoring the Interests of the Technical Teams Completely. Don’t ignore the technical perspective. Additionally, pay close attention to technical teams, as not listening might result in withdrawal issues. They might code poorly to get short-term results. However, the code may not be scalable or may have downstream implications.

- Even the Plug-and-play Technologies Require an Architectural Mindset. Don’t fool yourself into thinking that “Ikea” assemblies can meet any needs. Most SMB data and processes are so ad-hoc that even the most custom furniture shop will fall short of their needs. So, streamline your business model to fit into “Ikea” assemblies or better have resources and funds for expensive “custom furniture.”

What may work for SAAS doesn’t work for ERP, and this misunderstanding is the leading reason for the failure of the first ERP implementation.

9. Internal Skillset.

Regardless of how experienced consultants you hire, the experience of your internal team is still important. The first-time ERP implementation projects fail because going through a few cycles helps relate to the process and data re-engineering needed.

Issues:

- Team Misalignment. Teams disagreeing on the design? Data ownership? Process design? Also, disagreements on how the source of authority is supported to work. In general, the more inexperienced the team, the more misalignment.

- Lack of Experience with Similar Initiatives. No prior experience with similar initiatives? In fact, only experience as a user. Generally, only a few implementations are under their belt to be informed of the decision-making. The more limited the experience with similar initiatives, the more likely it is to fail the implementation.

- Power Struggle. Are teams not willing to give up on favorite processes or tools that might have a downstream impact? Few users too powerful and dragging the architecture in their direction? The more the power struggles, the higher the chances of failure.

Recommendations:

- Aligning Teams Require Cross-functional Visibility. Break those “walls” and increase visibility. Coach teams on cross-functional processes. So they can visualize the implications for other teams because of their decisions.

- Hire Experienced Team Members. Pair interns with experienced resources. But have experienced resources who are going to be making policy decisions.

- When Technology Falls Short, Compensation Wins. Don’t underestimate the power of compensation. When technology falls short, compensation wins. Align compensation with the right KPIs, with a tangible impact on the top and bottom lines. Trace back and identify the root cause of the barrier to hitting those KPIs.

First-time implementors are likely to have inexperienced resources, but their data and processes require a lot more work. And that is the reason why first-time ERP implementation projects fail.

8. Stakeholder Commitment.

Most teams implementing an ERP for the first time are controlled significantly by founders. Due to the nature of how they started their business, it’s very hard for them to learn the art of delegation and collaboration, especially if they might not have as much experience working in larger corporations or teams.

Issues:

- Considering the Initiatives as IT Project. Thinking that the ERP project is all about technology. A belief that technology is the solution for any process or data-related issues.

- Not Able to Balance How Much to Get Involved. Monopolizing the conversation. Not setting the right communication framework to have a clear engagement model of when to get involved and when to back off.

- Not Able to Build Consensus Among Teams. There is not enough leadership experience to dig through details and help teams make decisions. Not enough experience going through similar projects to help teams make decisions.

Recommendations:

- Don’t Take Hand-Off Approach with Cross-functional Initiatives. Don’t execute the ERP projects in a hands-off fashion. Stay engaged, and ask clarifying questions. But don’t push, or they are likely to withdraw because of your power position.

- Build Processes and Reporting Structure That Allow You to Have the Right Involvement. Make sure to let consultants set the framework. Save your commentary only for mission-critical issues; otherwise, listen and learn. Report, but don’t recommend it unless you are absolutely sure.

- They Haven’t Seen it. They Can’t See It. So They Can’t Agree. Show Them to Build Consensus. Help consultants champion their ideas. Understand the underlying reasons for disconnect, propose solutions, and maybe draw visuals to help build consensus.

The first-time ERP implementation projects fail because of the founders’ lack of experience working with knowledge workers. It’s a skill set that takes a long time to master.

7. Process Re-engineering.

90% of the smaller businesses feel that their businesses are unique, while only less than 1% when you talk to larger enterprises. The challenge is not the unique nature of their processes. But their lack of experience in standardizing their process.

Issues:

- Not Documenting the Processes. Processes so ad-hoc that you can’t even draw them? Not enough appreciation of how documentation will help with the implementation? Not calling documentation the tangible work.

- Not Documenting the Right Amount of Details. A bunch of flow charts but not enough meaning for the technical teams to use? Leaving assumptions with processes that processes are subject to interpretation?

- Not Willing to Change Proprietary Processes. So, are you married to proprietary processes to be blindsided by them? Nonnegotiable position on the proprietary process and ignoring consultants’ position completely?

Recommendations:

- First Time Implementors Especially Struggle to Draw the Processes. Firm up the understanding of your processes by drawing them.

- Not Enough Subject-matter Expertise to Provide the Right Details All Stakeholders Need. Hire experts with ERP implementation experience to draw the processes. Change management consultants with the same credentials as the ERP implementation teams or consultants, who can balance both perspectives of the business users, also of the technical teams.

- Analyze the Cost of Keeping Proprietary Processes and Tools in the Architecture. Build detailed functional and technical specs to analyze the cost of keeping the proprietary processes.

With limited experience seeing several organizations and their processes, first-time founders can’t differentiate when the process is broken vs. where it’s truly unique. This misunderstanding leads to ERP implementation failure.

6. Data Re-engineering.

It takes a long time to master data modeling that drives business results from ERP systems. The incompatible datasets cause process over-engineering and customizations, leading to ERP implementation issues.

Issues:

- No Experience with Data Modeling. No experience formalizing SKUs, BOMs, customers, and vendors compliant with the ERP dictionary.

- Not Able to Connect the Dots About Why Even Trivial Data Decisions Could Fire Back. Divisibility and modeling of the UoMs and SKUs. Using invoice objects to make decisions for warranty. Shipment line items are used as the sales order line items in the backend system. Decisions as trivial as this have the potential to kill your entire implementation.

- Not Understanding How the Source of Authority Works in Various Enterprise Datasets. No real experience with enterprise design or integration patterns?

Recommendations:

- Take Baby Steps in Modeling Your Data. Don’t go hard on yourself if you don’t understand how the modeling would impact your core processes. Be ready to fail your first implementation. The ERP data modeling is more than 20-dimensional. It takes years to master.

- Try to Research As Much As Possible and Try to Compare Your Data Model with Other Industries. Try to visualize how other industries have modeled their SKUs and BOMs and be truly curious in probing into their model. Compare as many industries as possible and try to learn.

- Map Out the Data Flow at the Field Level Across System Boundaries. Map data at the field level. The more mapping you do, the clearer the data modeling will become.

The loose data model of systems such as QuickBooks or Excel has a tendency to promote bad data hygiene, misleading founders on data hierarchies and relationships, leading to ERP implementation issues.

5. Change Management.

Most first-time ERP implementors struggle to visualize the impact of technical decisions on the business processes, leading to ERP implementation issues.

Issues:

- Firing the Change Management Company Right After Selection. We do not understand that defining change is not the end of the change management process. It’s the start. Not appreciating the value of change management.

- Hiring the Change Management Company Without Subject Matter Expertise. I do not understand the difference between different change management consultants. Not able to vet the expertise of the change management company.

- Not Able to Make Personnel or Compensation Changes to Drive the Right Behavior. Thinking that technology is the solution to all problems. Don’t have control over personnel or compensation changes.

Recommendations:

- Change Management Requires Consistent Monitoring and Pivoting During the Implementation Phase. Have the change management company involved during the implementation phase. Hire ERP selection companies that are willing to manage the ERP implementation. Don’t hire companies that are not willing to be held accountable for the success of the implementation.

- Subject Matter Expertise Matter Even For Change Management Companies. Don’t hire change management companies specializing in other fields. Hire change management companies with related experience.

- Be Ready to Solve Issues by Making Personnel and Compensation Changes. Involve stakeholders that have the clout to make personnel or compensation changes. Don’t rely completely on technology to drive change.

Most first-time ERP implementation projects struggle with change management or in hiring the right experts, leading to implementation issues.

4. Pre-selection Phase.

The percentage of companies engaging directly with the technology vendors is much higher among the companies implementing an ERP for the first time. More seasoned companies, on the other hand, with a couple of implementations under their belt, will most certainly have a pre-selection phase, sometimes as long as a couple of years.

Issues:

- Thinking that Pre-selection is the Sunk Cost. Underappreciating the value of the pre-selection phase. Taking a binary approach to ERP selection. Following the boilerplate checklist for the selection process.

- Not Involving Users During the Design Phase. Not building the as-is and to-be workflows and involving users during the design phase.

- Can’t Decide How Much to Invest in the Pre-selection Phase. Not able to decide the value of a selection phase. And how much discovery needs to be performed in the selection phase.

Recommendations:

- The pre-selection Phase is not Optional. Don’t shoot yourself in the foot by not having a pre-selection phase. Engaging directly with the technology vendors (OEMs or resellers) with a limited budget of less than $50K results in ERP projects not even going live. As well as a pure waste of money.

- Involve Users from Day One During the Pre-selection Phase. Make sure users agree to change the processes and have clear visibility into the cross-functional implications. Build a language that they have agreed on for as-is processes and replicate the to-be processes using the same.

- The More You Invest in the Pre-selection Phase, the Shorter would be the Implementation Phase. Have a shorter implementation phase by incorporating a pre-selection phase. Spend roughly the same but much easier transition and adoption without the risk of a failed implementation.

First-time implementors don’t appreciate the efforts involved in ERP implementation and want to take shortcuts with the discovery, leading to implementation issues.

3. Internal Selection Process

Selecting an ERP requires mapping data and process models to the new ERP, performing gap analysis, and estimating transaction volume. And not to mention saving you from legal troubles by helping you with cryptic software contracts.

Issues:

- Hiring interns to lead the selection process. Misunderstanding that ERP selection is all about researching a bunch of web pages and copying and pasting boilerplate requirements.

- Following the traditional selection process. A belief that the traditional selection process of looking at the demos will lead to a successful ERP selection and adopted solution.

- Trusting an ERP reseller or a freelancer for the ERP selection guidance. A misunderstanding that a reseller and freelancers can provide unbiased recommendations without preferential- or incentive bias.

Recommendations:

- Don’t risk a million-dollar disaster by letting an intern lead the selection process. Don’t waste your money with interns as the work they might do in 6 months in designing processes that a professional ERP selection consultant might finish in weeks. And save your ERP implementation.

- Don’t let the traditional selection process fool you into an ERP system that might never work for your business. Don’t trust the traditional selection process, as you are at a disadvantage because of their information parity. Hire an industry insider on your side!

- Hire a professional ERP selection consultant who is living this on a daily basis. Hire professional independent ERP consultants who can save you tons of money and get you discounts by comparing quotes and saving with unused software that you will never get from a reseller as they are losing their own commission.

The internal resources don’t have enough resources under their belt to run a selection that will lead to a successful ERP implementation.

2. Underestimating the Efforts

First-time implementors underestimate the efforts involved with an ERP implementation. They will intentionally look for shortcuts and discounts and understaff their internal resources in the hope of saving money. But they end up paying a lot more, including the risk as big as losing their investments completely.

Issues:

- Fixated on the Budget. Don’t have enough experience managing large projects. Negligent on the basic project management equation that changing budget means a reduction in scope or quality.

- Looking for Shortcuts. A misbelief that there is an easier way of doing ERP implementation projects. An attitude to ignore the warnings of consultants.

- Custom Software is the Answer to all Problems. A “binary” thinking that if ERP solutions are expensive and difficult and maybe custom-built solutions will be cheaper.

Recommendations:

- Budget Drives Quality. Try to understand the deeper implications of where the vendors are likely to cut corners if you reduce the budget. Be competitive while hiring vendors.

- Shortcuts Don’t Exist. Don’t be a kid who gets lured by candy, as there is no easy way of implementing an ERP. Be realistic to avoid a nightmare.

- Creating Custom Software is Way Harder than Documenting Your Processes. Don’t be fooled by the idea that custom software will be any easier than ERP. Try to document all your processes first, as that would be the first step in building custom software. Pat yourself on the back if you can document everything within a year.

First-time implementors have a tendency to underestimate the efforts involved with an ERP implementation, leading to ERP implementation disasters.

1. Coachability

Coachability is one of the biggest factors why first-time implementors fail their ERP implementations because of their limited experience working with consultants.

Issues:

- Not Listening to the Consultants. Being completely ignorant about consultants’ advice. Making decisions with knee-jerk reactions without understanding the implications on the business.

- Not Willing to Provide the Right Details for Consultants to Work. Unwilling to provide the details to the consultants as they assume that the consultants are supposed to feed them cooked meals as they are getting paid.

- Not Doing the Homework Required to be Successful. Ignoring the tasks assigned and not learning during the training or testing workshops.

Recommendations:

- Be a Good Student. Let them coach you. Be patient while working with them as they try to teach you multiple languages, all at the same time. It takes time, and you are the only one who can do it.

- Not providing them with the right details will only fire them back. Understand that if you don’t provide enough details, they are likely to build something that you may not want. Know that they have nothing to lose.

- Don’t Ignore the Homework or Testing to Avoid Issues Post-implementation. Understand that ERP implementations require a lot more practice to hit the ground running from day one. Follow homework religiously if you want to avoid any issues post-implementation.

Working with knowledge workers is a skill that takes years to master. The first-time implementors struggle to understand how to work with them, facing ERP implementation issues.

Final Words

Some people have chosen to lead their lives without getting married, given the horror stories. And it’s their choice of life. But marriage (or ERP implementation) is a test of your ability to build rapport with other teammates. Your ability to lead and grow an organization.

What is critical with these two is to understand and appreciate the process. As in life, there are no shortcuts. Your tendency to look for shortcuts will only make your journey more challenging. So, if this is your first time, try to understand the “ERP” psychology rather than complaining that ERPs (or marriages) don’t work.