Last Updated on April 10, 2025 by Shrestha Dash

In the company’s words, the Rootstock Spring ’25 Release is designed to “make ERP more agile, intelligent, and adaptable to the evolving needs of manufacturers.” As ERP vendors globally move toward cloud-native, AI-enhanced architectures, the Rootstock Spring ’25 Release underscores the company’s strategy to stay ahead by offering composable, intelligent, and manufacturing-focused ERP solutions.

Breakdown of Rootstock Spring ’25 Release

Why Rootstock is Redefining ERP Now

The manufacturing sector faces unprecedented challenges, including supply chain disruptions, inflationary pressures, shifting customer demands, and the need for greater operational agility. Legacy ERP systems often struggle to support manufacturers’ rapidly evolving needs, creating a demand for more flexible, composable, and AI-driven platforms.

Several industry-wide trends have made this transformation necessary:

- AI and Predictive Analytics: Manufacturers increasingly demand ERP systems that can anticipate disruptions, forecast demand accurately, and optimize operations without manual intervention.

- Composable and Modular Architectures: Rather than one-size-fits-all ERP systems, companies prefer modular platforms that can be tailored to specific needs.

- Cloud-first Strategies: Cloud-native ERPs offer scalability, better integration, and faster innovation compared to traditional on-premise solutions.

- User Experience Modernization: ERP users today expect the same level of usability, responsiveness, and personalization as consumer apps.

Rootstock’s move with the Rootstock Spring ’25 Release aligns directly with these broader shifts, reinforcing its positioning as a cloud ERP leader for manufacturers.

What’s New in Rootstock Spring ’25 Release

The Rootstock Spring ’25 Release introduces significant updates across usability, AI capabilities, supply chain management, financial controls, and CRM-ERP integration.

Key Enhancements Include:

- Modernized User Interface: A more intuitive, streamlined UI improves navigation, task completion, and visibility into operations.

- AIRS-Driven Quick Orders: By analyzing customer history and common buying patterns, AIRS recommends products, enabling sales teams to anticipate a customer’s needs and build orders faster and with greater accuracy.

- Enhanced Demand Planning Tools: Manufacturers can now build more accurate forecasts, simulate different demand scenarios, and adjust production plans proactively.

- Supply Chain Resilience Features: Tools for better risk assessment, supplier evaluation, and disruption response have been added.

- Sales Order Processing Grid: A new grid-based user experience for order management enables faster, easier entry and processing of customer orders.

- Expanded Financial Management Capabilities: Improved VAT management, AR controls, and automated compliance reporting.

Pain Points Addressed:

- Eliminating complex, slow ERP workflows

- Breaking down silos between ERP and CRM

- Enabling proactive, AI-driven management decisions

- Supporting fast reaction to market or supply disruptions

Compared to its previous versions, the Rootstock Spring ’25 Release marks a much stronger pivot towards intelligence, automation, and real-time adaptability.

Rootstock’s Approach to Emerging Tech

Rootstock’s technology strategy is centered on three pillars:

- Salesforce Platform Leverage: Building entirely on Salesforce ensures scalability, extensibility, and access to a robust partner ecosystem.

- AI and Automation: By integrating Salesforce Einstein AI, Rootstock allows users to benefit from predictive modeling, risk scoring, and automated recommendations directly within ERP workflows.

- Composable Architecture: Rootstock’s flexible modules allow customers to add, remove, or upgrade components without disruptive migrations.

Other notable tech advancements in the Rootstock Spring ’25 Release:

- Configurable workflows for easier customization without heavy coding

- Predictive analytics embedded into dashboards and reports

- Grid-based UX design to enhance usability for operational users

How Rootstock Stacks Up

In a market dominated by SAP S/4HANA, Oracle NetSuite, Infor CloudSuite, and Acumatica, Rootstock is carving a niche by being:

- Manufacturing-specific rather than industry-agnostic

- Salesforce-native offering tighter CRM-ERP integration

- More agile and composable compared to monolithic ERP suites

Competitive Advantages:

- Faster time-to-value, especially for Salesforce customers

- Deep manufacturing domain expertise

- Stronger alignment with cloud-native and composable ERP trends

Potential Gaps:

- May face challenges scaling to extremely large, complex enterprises

- Needs to continuously prove value against broader ecosystems like Microsoft Dynamics 365

The Rootstock Spring ’25 Release further solidifies these advantages, giving manufacturers a compelling reason to consider a Salesforce-native ERP.

Who Benefits and How?

Target Customers:

- Mid-sized discrete and custom manufacturers

- Engineer-to-order (ETO) and make-to-order businesses

- Manufacturers seeking faster digital transformation

Expected Value Outcomes:

- Improved operational agility and faster decision-making

- Enhanced visibility across sales, production, inventory, and finance

- Scalable growth without system re-architecture

While detailed case studies were not disclosed at launch, Rootstock has indicated that early adopters of the Rootstock Spring ’25 Release reported 20–30% faster sales order processing times and higher forecast accuracy rates during pilot programs.

Shifting the ERP Landscape?

The Rootstock Spring ’25 Release positions Rootstock to:

- Expand its footprint into new verticals within manufacturing

- Appeal to Salesforce-first enterprises seeking an integrated solution

- Influence ERP buying decisions in 2025 and beyond, especially among companies prioritizing agility and AI enablement

This launch could especially resonate with manufacturers looking to avoid the complexity and heavy overhead associated with Tier 1 ERP implementations.

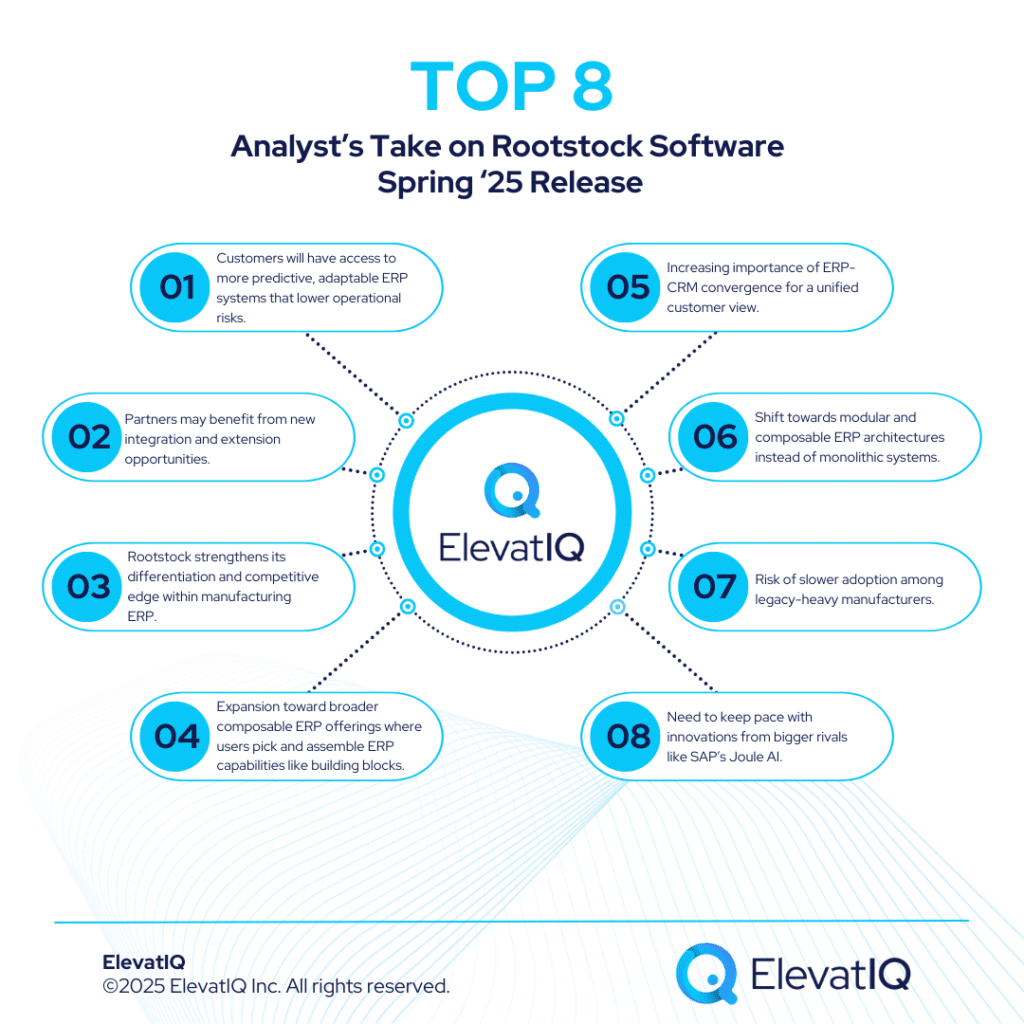

Analyst’s Take on Rootstock Spring ‘25 Release

Impact on Stakeholders:

- Rootstock strengthens its differentiation and competitive edge within manufacturing ERP.

- Customers will have access to more predictive, adaptable ERP systems that lower operational risks.

- Partners may benefit from new integration and extension opportunities.

Future Predictions:

- Further AI-driven automation and possibly autonomous ERP functionalities (like self-correcting supply chain modules)

- Expansion toward broader composable ERP offerings where users pick and assemble ERP capabilities like building blocks

- Continued enhancement of industry-specific cloud solutions

Industry Trends Observed:

- Increasing importance of ERP-CRM convergence for a unified customer view

- Shift towards modular and composable ERP architectures instead of monolithic systems

- Emphasis on supply chain resilience and agility as key ERP value propositions

Possible Challenges:

- Risk of slower adoption among legacy-heavy manufacturers

- Need to keep pace with innovations from bigger rivals like SAP’s Joule AI

- Convincing non-Salesforce customers to adopt a Salesforce-based ERP platform

The success of the Rootstock Spring ’25 Release could very well hinge on how effectively these challenges are addressed.